[This blog post is an excerpt from a TSI commentary published within the past two weeks]

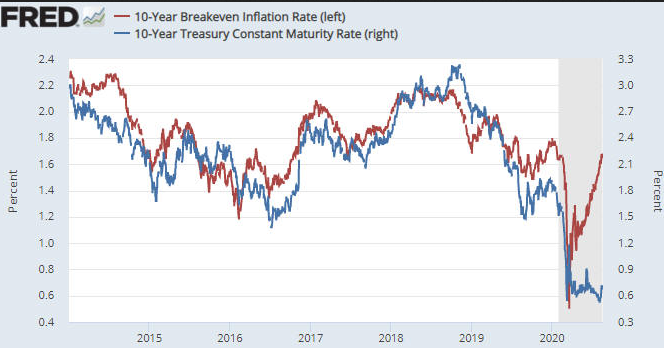

Many analysts downplay the Fed’s influence on bond yields, but we don’t think it’s possible to explain the following chart without reference to the massive yield-suppressing boot of the Fed. The chart compares the 10-year T-Note yield with the 10-Year Breakeven Rate, a measure of the market’s inflation (CPI) expectations. The Breakeven Rate is calculated by subtracting the Treasury Inflation Protected Security (TIPS) yield from the associated nominal yield.

The chart reveals that the 10-year T-Note yield generally moves in the same direction as the 10-Year Breakeven Rate. This is hardly surprising, given that the expected “inflation” rate is usually the most important determinant of the long-term interest rate. In particular, a higher expected “inflation” rate usually will result in a higher long-term interest rate. However, something very strange has happened since March of 2020. Since that time there has been a large rise in the expected CPI while the nominal 10-year yield has drifted sideways near its all-time low.

As far as we can tell, there are only two ways that the sort of divergence witnessed over the past five months between inflation expectations and nominal bond yields could come about.

One way is capital flight from outside the US to the perceived safety of the US Treasury market that overrides other effects on bond prices/yields. This is what happened during 2011-2012, which is the only other time that a substantial rise in inflation expectations coincided with flat or declining nominal US bond yields. In 2011-2012, capital flight to the US was prompted by the euro-zone’s sovereign debt crisis.

Manipulation by the Fed is the other way that the divergence could arise.

Over the past five months there has been no evidence of capital flight to the US. Therefore, it’s clear that the Fed has maintained sufficient pressure to prevent the nominal 10-year bond yield from responding in the normal way to a large rise in the bond market’s inflation expectations. Not without ramifications, though.

A large rise in the expected “inflation” rate in parallel with a flat nominal interest rate equates to a large decline in the ‘real’ interest rate. In this case, it equates to the ‘real’ US 10-year interest rate moving well into negative territory. This has put irresistible downward pressure on the USD and irresistible upward pressure on the prices of most things that are priced in dollars, including gold, equities, commodities and houses. It has even put upward pressure on the price of labour, despite the highest unemployment rate since the 1930s.

At the moment the Fed undoubtedly is pleased with its handiwork. The rise in the gold price to new all-time highs could be viewed as a rebuke, but these days no one in the world of central banking cares about the gold price. Central bankers do, however, care about the stock market, and the Fed’s governors will be patting themselves on the back for having helped the S&P 500 Index fully retrace its February-March crash. They also will be pleased that the CPI is rising in spite of the deflationary pressures resulting from the lockdowns. After all, the concerns they have expressed over the years about insufficient “inflation” make it clear that the last thing they want is for your cost of living to go down*.

However, the Fed is ‘playing with fire.’ Putting aside the long-term negative economic consequences of the mal-investment caused by the Fed’s money pumping and interest-rate suppression, if the Fed continues to prevent bond yields from reflecting rising inflation expectations then the steady shift currently underway towards hard assets and anything else that offers protection against currency depreciation will become a stampede. And once that happens, the sort of central bank action that would be required to restore confidence would crash both the stock market and the economy.

If the Fed continues along its current path then an out-of-control rise in prices won’t be an issue to be dealt with in the distant future. It possibly will become an issue before the end of this year and very likely will become an issue by the middle of next year.

*Nobody with common-sense can figure out why.