Gold is retreating as dollar strengthens with higher expectations of a rate hike in June. Rising inflation and new home sales in April point to improved economic growth in the second quarter, providing support for a rate hike soon rather than later. Will gold continue falling?

Gold price has gained 14.23% since the start of 2016 as global market turmoil derailed Federal Reserve’s plans for monetary policy tightening outlined in December policy statement. Investment demand for gold increased as global equities slumped and the dollar weakened making gold cheaper for users of other currencies. At their March FOMC meeting central bank policy makers projected two interest rate hikes this year instead of four predicted in December, contributing to further weakening of dollar and boosting gold demand. However recently Federal Reserve officials stated their support for a rate hike as early as in June following positive economic data. Thus consumer price index rose 1.1% year over year in April from 0.9% in March, with core inflation slipping 0.1% to 2.1%. The better than expected inflation report followed a 1.3% on month growth in retail sales in March after an upwardly revised 0.3% decline in previous month. A 16.6% surge in single-family homes in April to a more than eight-year high was another sign of improved economic growth in the second quarter, providing support for a rate hike in June. Gold has been declining since the start of May after gaining 5.6% in April as the US dollar index gained 2.6% since the start of May with central bank official stating their preference for a June rate hike if incoming data indicate improving economic growth. Rising durable goods orders report yesterday indicated investment picked up in April, boding well for second quarter growth and adding to recent bearish developments for gold like a fall in China's gold imports in April from a three-month high in the previous month. Today the second reading of Q1 US GDP will be released at 16:30 CET and upward revision to 0.9% from 0.5% is expected. A negative surprise in the reading, which is not very likely, will be bullish for gold. Later at 18:30 CET Fed chief Janet Yellen will speak at Harvard University and likely bullish comments of the central bank head are certain to add to bearish pressure on gold.

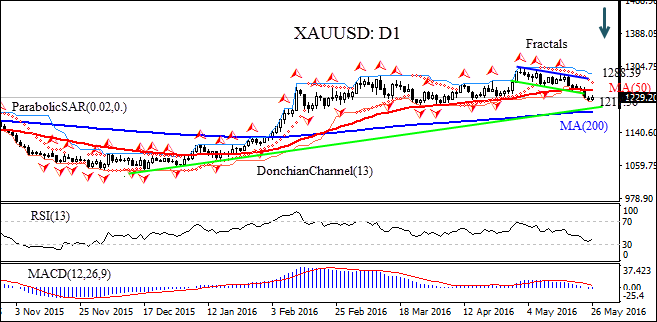

On the daily timeframe XAUUSD: D1 had been trending upward since the beginning of 2016. It has been correcting downward since the start of May. The price has broken below the downward channel it had been trading the past three weeks as well as below the 50-day moving average MA(50) after hitting 15-month high at $1304.34 on May 2. It is approaching the support line of the uptrend. The Parabolic indicator gives a sell signal. The Donchian channel is tilted lower indicating downtrend. The RSI oscillator is near the oversold zone and is edging upward. The MACD indicator is below the signal line and zero level, which is a bearish signal. We believe the downward momentum will continue after the price closes below the lower Donchian bound at $1217.56, which may serve as a point of entry. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at $1288.39. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus we are changing the probable profit/loss ratio to the breakeven level. If the price meets the $1288.39 stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position Sell Sell stop below 1217.56 Stop loss above 1288.39