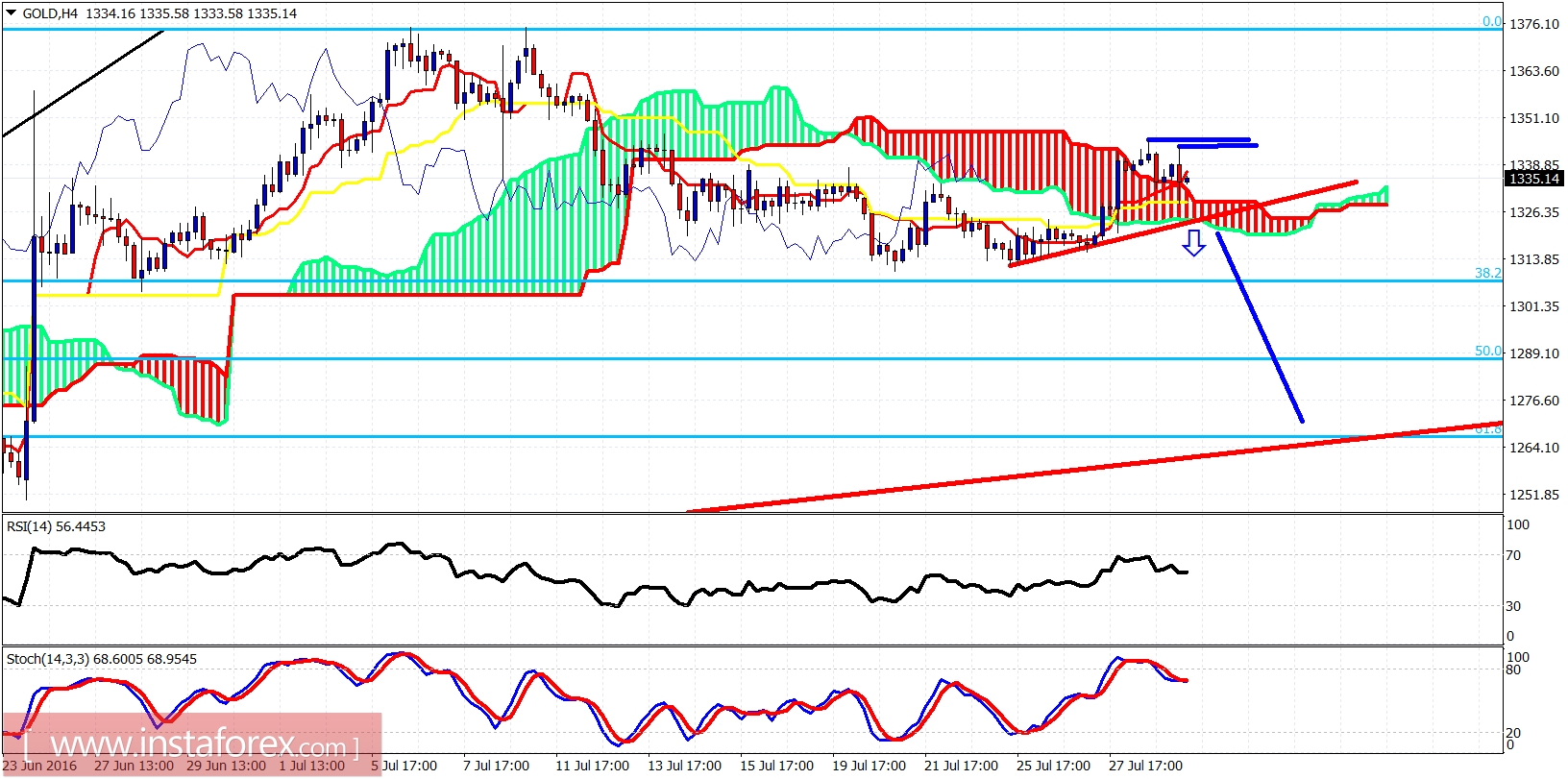

Gold price is showing signs of reversal from our target area of $1,350. Bears need to break below $1,320 for the bearish scenario to play out. Expecting gold to push lower towards $1,250-70.

Red line -support trend line

Gold price is trading above the Ichimoku cloud. Short-term support is at $1,328 and resistance is at $1,345. A break below $1,325 will be a bearish sign as price will be breaking below the cloud and the red trend line support. Next target will be 61.8% Fibonacci retracement of the rise from $1,200.

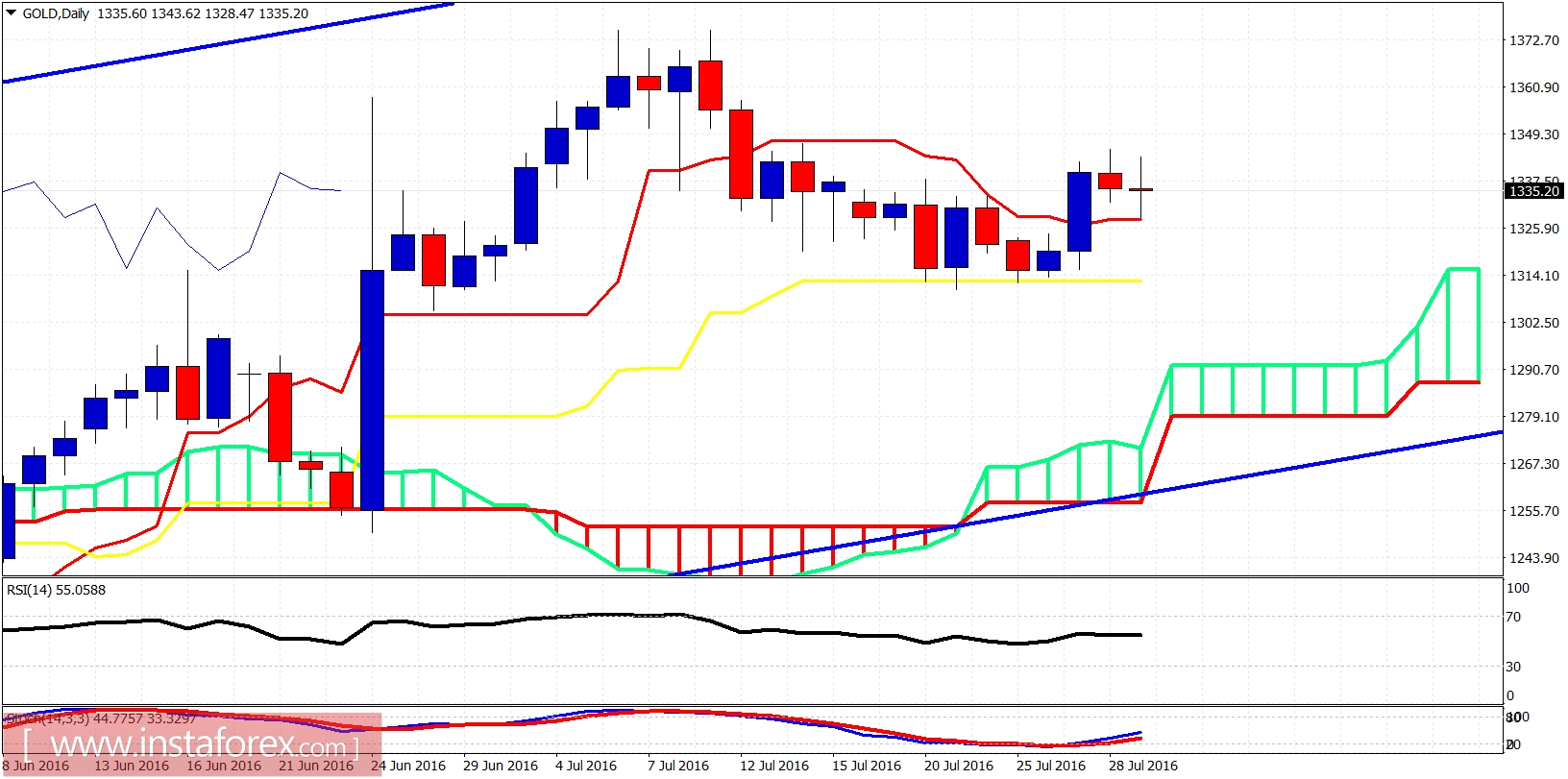

The daily candle is holding above the daily tenkan-sen (red line indicator) at $1,327. A daily close below that level will push price towards the daily kijun-sen (yellow line indicator) at $1,314. The most probable outcome is a push towards the daily cloud support near $1,290 at least. A break and weekly close above $1,350 will increase the chances of making a new high above $1,375 next week.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.