Investors are hoping a strong January is just the start to a strong recovery for stock prices. Particularly, tech stock prices.

Last year's selloff hit the sector particularly hard as a slowing economy and inflation are strong headwinds for growth stocks. Investors hope these headwinds slow, or go away in 2023.

Today, we look at the chart of an important stock market index to see what may be brewing over the coming months.

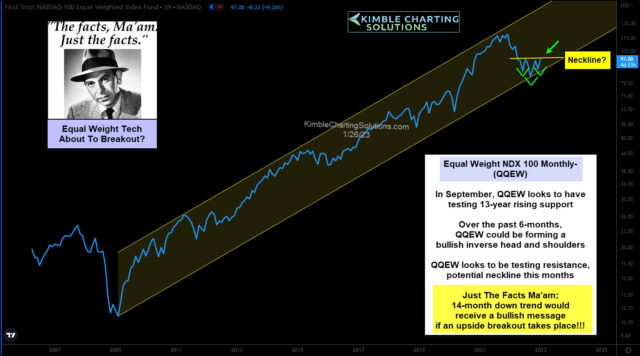

Below is a long-term monthly line chart of the First Trust NASDAQ-100 Equal Weighted Index Fund (NASDAQ:QQEW). We can see that despite the vicious selloff, QQEW held its rising 13-year price channel support.

The stair-step bounce that has ensued has helped to form a very bullish stock market pattern: an inverse head and shoulders. Currently, price is testing the neckline of this pattern, which comes into play as resistance.

This will turn bullish if a breakout takes place here.

A tech breakout would also send a bullish message to the broader market and economy. Stay tuned.