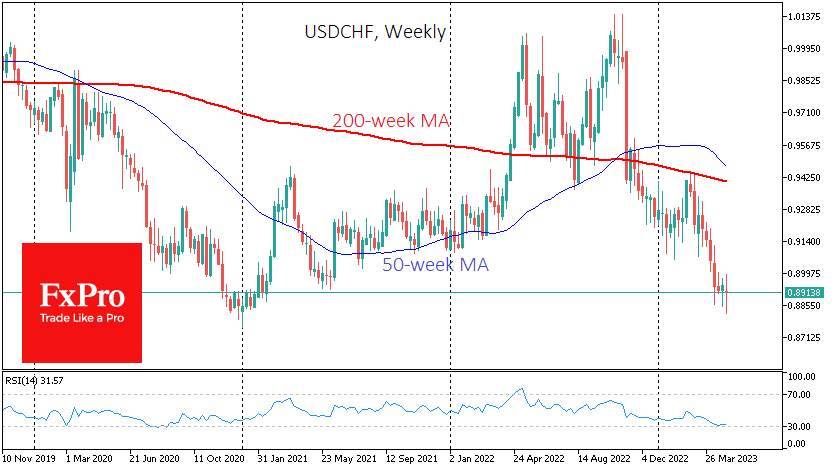

The Swiss franc declined, losing about 1% to 0.8920 after a fresh batch of macroeconomic data. The unemployment rate remains at 1.9%, a historic low. But at the same time, inflation is surprising, falling short of forecasts.

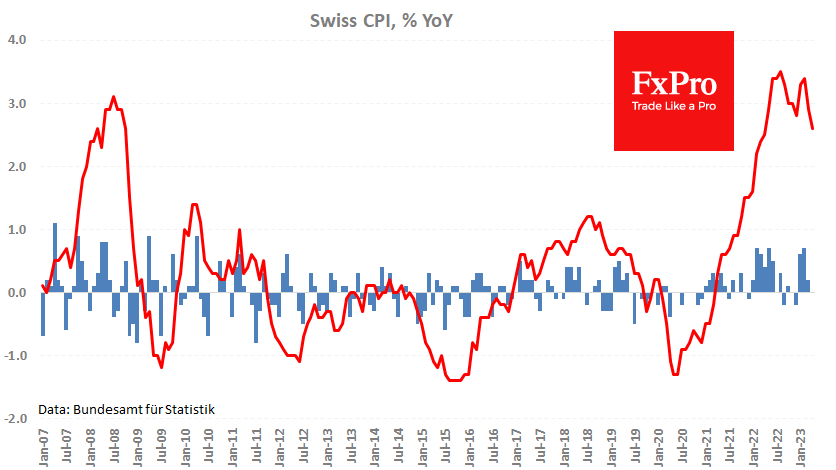

The consumer price index was virtually unchanged over the past month, and the annual inflation rate fell from 2.9% to 2.6%, while economists, on average, expected growth of 0.2% m/m and 2.8% y/y, respectively. The current inflation rate is the lowest in the last 11 months and very close to the SNB target.

The latter fact has spurred speculation that the country's central bank will refrain from further tightening policy after raising rates by 225 points in the current monetary cycle. However, the head of SNB Jordan is in a hurry to moderate these expectations, not ruling out further rate hikes.

Switzerland's significantly lower inflation is mainly due to the performance of the franc, which is now close to the same levels from which it began its decline against the dollar in early 2021. For comparison, the EURUSD is now 10% lower; at the worst point, it exceeded 22%.

The franc's strengthening accelerated in March, apparently due to the problems of US banks, which caused steady demand for safe havens such as Switzerland. However, having slipped below 0.8900, USDCHF was close to the levels from which the SNB turned the pair to growth over the past 11 years.

It is hard to believe that this time the exchange rate will be reversed again by the intervention of the Central Bank since this would contradict the primary policy course. But over the years, support has been formed in this area, which will take a lot of work to pass.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Swiss Franc Is Losing Ground Due to Low Inflation

Published 05/05/2023, 07:16 AM

Updated 03/21/2024, 07:45 AM

Swiss Franc Is Losing Ground Due to Low Inflation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.