Below is a summary of my post-CPI tweets. You can (and should!) follow me @inflation_guy or sign up for email updates to my occasional articles here.

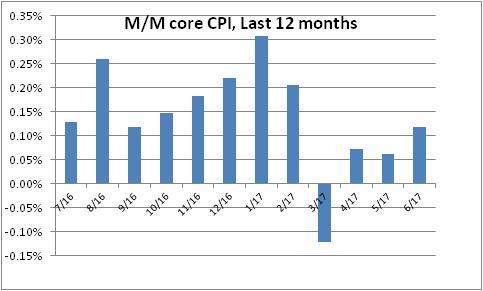

- quick CPI review: last 3 months have been -0.12%, +0.07%, and +0.06% on core CPI – that is, basically flat.

- three months before that were 0.22%, 0.31%, and 0.21%. Basically a 3% annualized rate. Which of these is “right”?

- Market has become convinced something around the current 1.75% average is “right.” But we’ve had big misses both sides.

- Consensus for Friday is for 0.2% on core, 1.7% y/y, but that’s a very narrow range. Basically 0.15% m/m gets both of those.

- If we get 0.16%, then y/y should round up to 1.8% y/y. If we get 0.14%, then m/m rounds down to 0.1%.

- Of course, recent months have shown us something wildly different is possible!

- core CPI 0.119%, again below consensus…y/y drops to 1.71%.

- This is closer to the summer lull we’ve seen recently. But still low. Here are the last 12 months of core CPI.

- That chart is weird, looks like there was a dramatic effect in March that’s wearing off. But it’s actually been a series of one-offs.

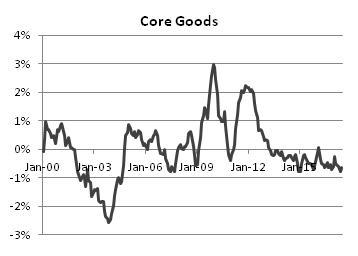

- Core services at 2.5% y/y, down from 2.6% (and down from 3.1% as recently as Feb). Core goods -0.6%, up from -0.8%.

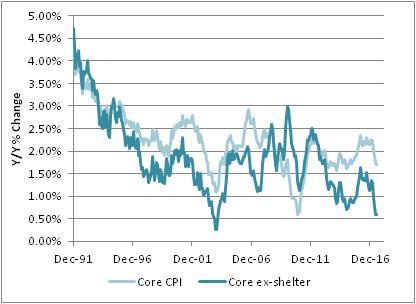

- Core CPI ex-shelter was basically unchanged at 0.6% y/y, matching 13-year lows.

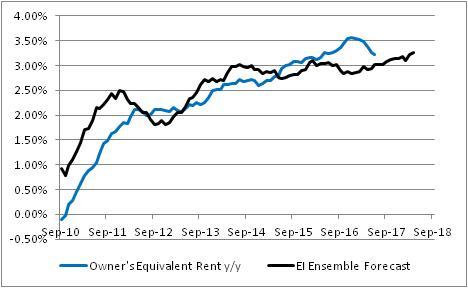

- Owners Equiv Rent was +3.23% y/y, Primary Rents 3.86% vs 3.85%. So the low print isn’t main part of housing.

- But housing overall – the major subgroup – decelerated to 3.02% from 3.12%. So that deceleration is elsewhere.

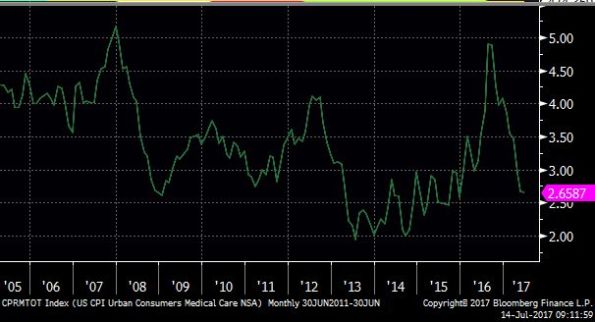

- Medical Care CPI was unchanged at 2.66% y/y.

- Pharma inflation 3.31% from 3.34%. Professional Services 0.58% from 1.0%. But hospital services 5.65% from 4.95%.

- This chart is physician’s services. I’m really curious about this.

- An optimist could say ‘this is b/c high deductibles under O-care force consumers to negotiate aggressively with doctors.”

- Pessimist: “even if that’s true, it means fewer doctors tomorrow, ergo higher prices.” & where is this effect in hospital prices?

- I don’t see anything very quirky in these numbers unlike past months. OER still converging with our model.

- If there’s “nothing unusual,” it suggests underlying core rate is something near 1.5%. But inflation always on the way to somewhere.

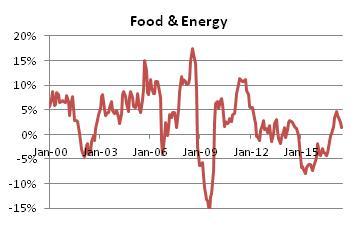

- Four-pieces breakdown: Food & Energy

- Four-pieces breakdown: Core Goods. Still bumping along, but this will turn higher as USD weakens.

- Four-pieces breakdown: Core Services less Rent of Shelter. This continues to be The Story.

- Four-pieces breakdown: Rent of Shelter – as I said, ebbing but just because it was ahead of itself. Housing isn’t about to deflate.

- As @pearkes points out, core services ex-housing largely a medical story, and that’s likely temporary. Chart for CPI medical care:

- I find it ironic: if O-care IS helping to contain health care, it’s b/c consumers negotiate harder when they don’t really have health care.

- …which would seem to run counter to the professed reason for the ACA, which was to increase coverage. Is it working b/c it’s not working?

- Enough CPI for today.

- Also, good friend just published a thriller: He’s a very engaging author if you like fiction.

It was just a few months ago that we worried about whether core inflation was about to accelerate past 3%. Then, we had a few months where some people (not me!) worried that we were suddenly plunging into deflation and core inflation was around 0%. The reality seems to be somewhere in the middle. The recent ultra-low prints are clearly the results of one-offs, but it also seems as if the ongoing upward pressures – for example, in housing – have come off the boil as well. Back when rents were surging, I was worried that our model was perhaps not capturing some other dynamic and that rents would run away to the upside; in the event, it was probably just noise.

So what is the true underlying dynamic? We have to remember that economic statistics are just experiments – samples of an unknowable distribution. And, since economic data is very noisy, it usually takes a lot of data to be able to say for sure that something has changed. Economists and other prognosticators are usually not so patient. We got a weak number, and we want to say right now that something fundamental has changed. It doesn’t work that way.

Inflation data are usually fairly stable (once you strip out food and energy), so a couple of surprising figures is often enough to signal a changing dynamic. But one curious aspect of the last year’s worth of core inflation data is that it has been very volatile – in fact close to being the most volatile in the last twenty years:

There are a couple of implications to that observation, but the key one here is that it means it’s harder to reject any particular null hypothesis when the data are all over the place.

So here’s the summary: the main contributor to lower core inflation that is difficult to shrug off completely is the abrupt plunge in medical care inflation. This also happens to be the category that is most difficult to measure, since most consumers do not directly pay for much of their health care…or, anyway, they didn’t until Obamacare led to dramatic increases in deductibles. But that change in who pays for health care makes it very difficult to disentangle what the price of health care is actually doing, as opposed to the quantity of health care consumed. Very, very difficult.

My suspicion, based on direct observation and conversations with professionals in hospital and practice management, is that there are indeed pressures to contain healthcare costs, part of which are being caused by the fact consumers are having to negotiate directly with doctors for care and part of which are the result of other institutional pressures, such as the effect of Medicare/Obamacare legislation on formulary negotiations. Does that mean Obamacare is “succeeding?” If the sole purpose of the ACA was to lower health care costs by reducing the consumption of health care – maybe it is, at least in the short run. Certainly, there is a lot of energy on the entrepreneurial side dedicated to finding ways to cut costs, and lots of inefficiencies that can be wrung out…and, if “angry consumers” is the impetus for organizations finally wringing out these inefficiencies, I suppose that’s not a bad thing.

As I said earlier, I think it’s too early and there’s too much noise to say that something fundamental has changed. Heck, a year ago I thought medical inflation was about to run away on the upside (and I wasn’t alone, as the Republican sweep of Congress attests). I am not about to be fooled in the opposite direction as easily. What I will say is that I have trouble believing that inflation in the cost of physicians’ services is going to go negative, or stay near zero for a long time. I could be wrong, but I suspect that part of the pendulum will start to swing back over the next six months.