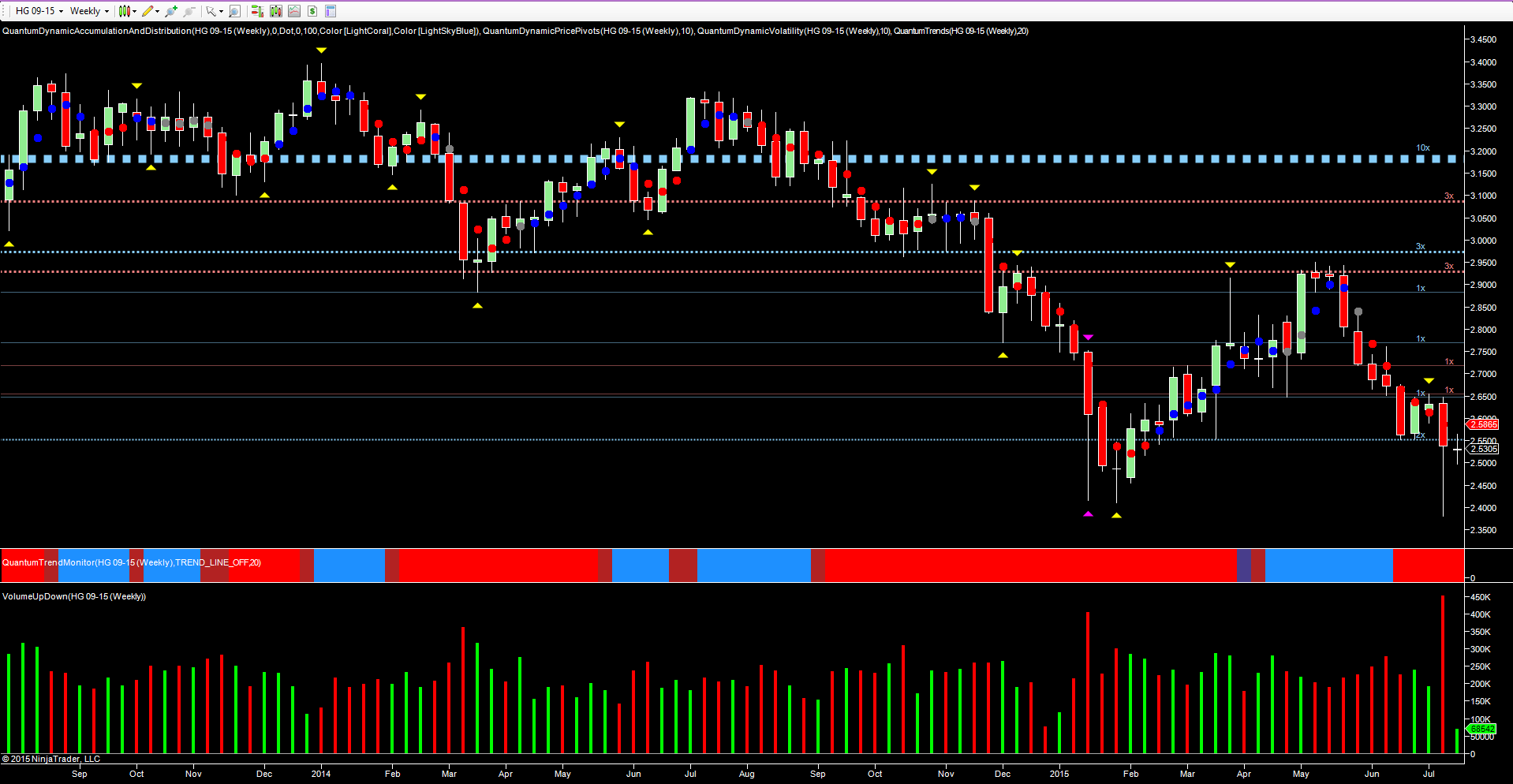

When studying any chart in whatever timeframe it can often be difficult to interpret the price action, particularly when a market has been in a congestion phase. A classic but simple example is the two bar reversal, where overlaying one candle on other often creates the classic hammer or shooting star, which are often the precursor of a change in trend. The weekly chart for copper is a classic example, and one which reveals much about the current market condition for the base commodity, particularly when considering the associated volume.

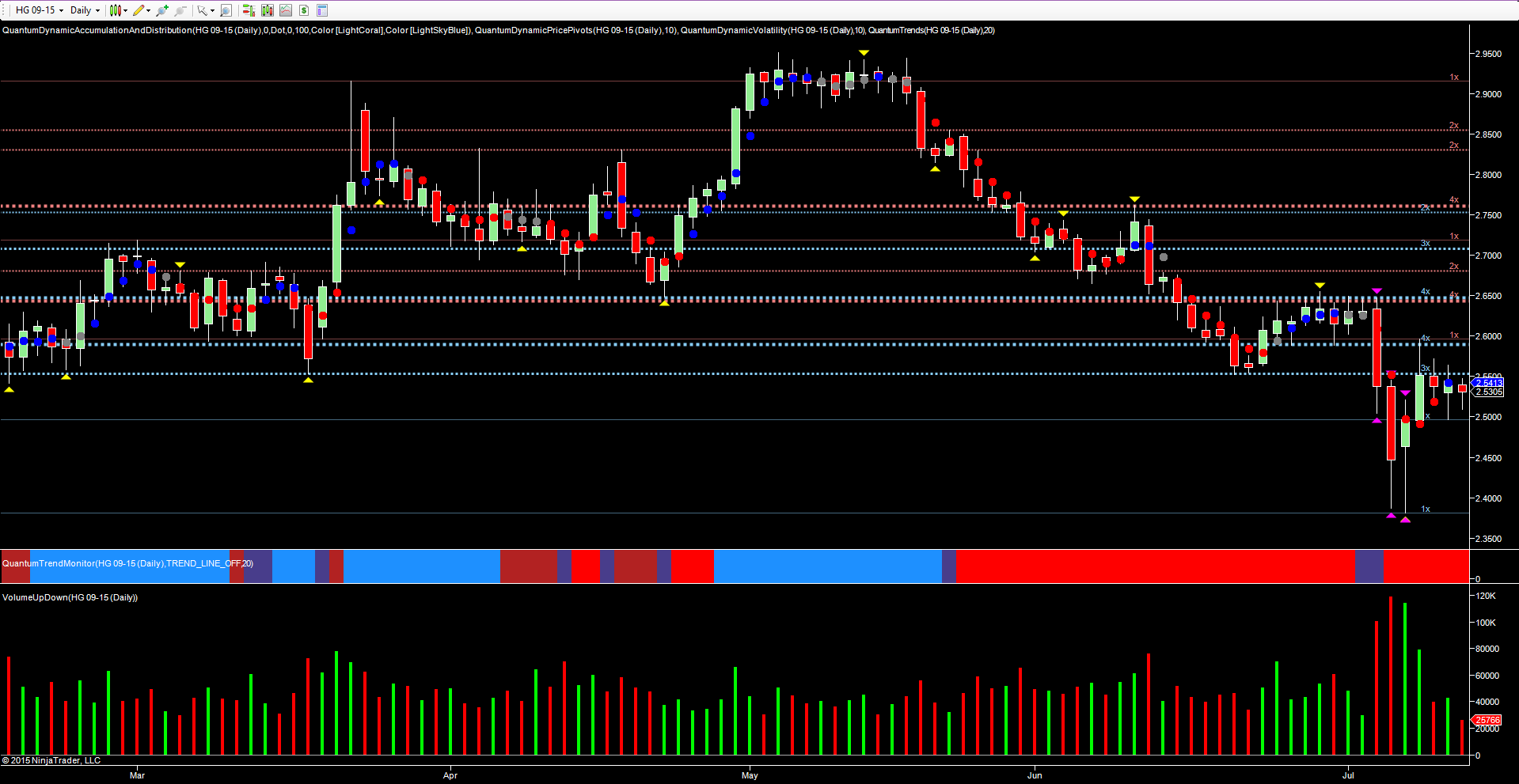

Over the last two weeks on the daily chart, the price action has been volatile to say the least, with three of these candles triggering the volatility indicator. Each of these has been accompanied with ultra high volume as the market tested the $2.38 per lb price region as defined with the blue dotted line, before recovering off the lows on each occasion. Since then, we have seen the market trade in a tight range and trade between $2.49 per lb to the downside and $2.55 per lb to the upside. So what were we to make of this price action, and it is the weekly chart that has given us a valuable insight and perspective on this slower timeframe.

Here we can see last week’s price action clearly defined. The deep wick to the lower body of the candle confirms the buying, which is now entering the market, while the extreme volume confirms this unequivocally, and creating a classic example of stopping volume on this timeframe. Stopping volume is the precursor to a reversal and represents the phase of price action when the big operators are moving into the market to buy, and often the prelude to a buying climax. This is the period at which the insiders are buying, when everyone else is selling, and the stopping volume is the first signal these operators are putting the brakes on the market. A falling market has momentum, and just like an oil tanker under full speed, will take several miles to stop once the engines are switched off.

The market is much the same, and taking the momentum out of the market takes both time and effort, which is reflected in the associated volumes. There is also often a degree of overrun, as indeed we saw in the earlier example in January this year. Last week’s price action is now looking like a repeat performance and as such as we can expect to see copper prices rise from this level in due course, once the selling pressure has been completely absorbed. This may take a few weeks, but once complete and the remaining sellers mopped up, then the big operators will be ready to take the market higher once again, with any low volume test then confirming.

Charts are from NinjaTrader and the trading indicators from Quantum Trading.