- Upcoming US inflation report will be crucial for dollar and risk-linked assets

- Stock markets turn down as crypto civil war sparks contagion concerns

- Sterling takes a hit as risk appetite sours, US election results still unclear

Dollar eyes inflation test

Global markets are on red alert for the latest batch of US inflation data later today. Inflation is still the boogeyman for consumers, central banks, and investors alike, so this dataset has turned into the most important release in financial markets. Despite a series of rapid-fire Fed rate increases this year, there hasn’t been any serious improvement in inflation yet.

Inflation is a notoriously lagging indicator, and the structure of the US banking system has amplified this lag. Most US loans are given at fixed rates, so it takes longer before higher rates can impact economic activity, in contrast to Europe where almost all loans are at variable rates. This transmission lag allows the Fed to raise rates faster and to a higher level than the ECB, which has been a critical factor for euro/dollar.

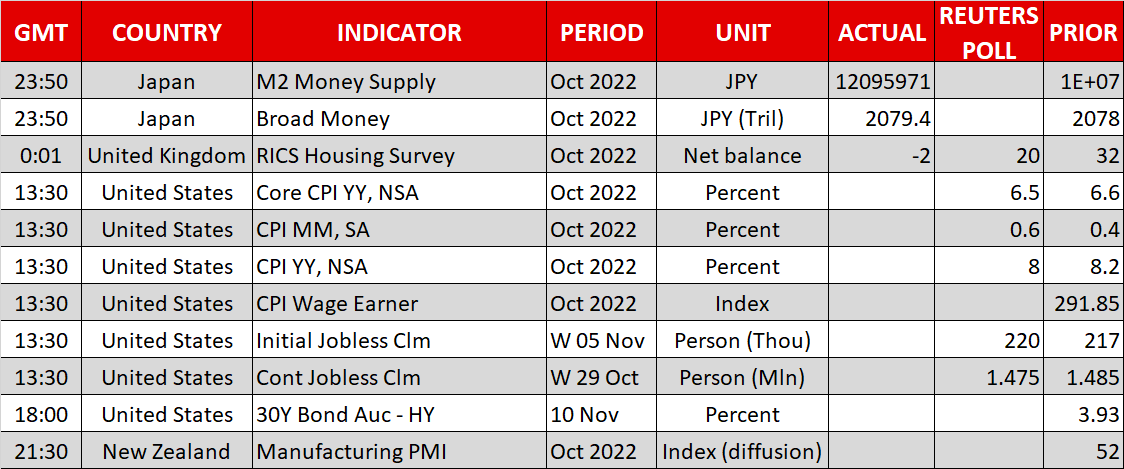

Both the headline and core CPI rates are set to have retreated in October, but not meaningfully enough to alter the Fed’s battle plans. Business surveys showed that companies raised their selling prices at the slowest pace in almost two years, while used car prices and shipping costs continued to decline, but rents likely offset some of this improvement as they play catch-up with last year’s surge in house prices.

As for the dollar, this stunning rally seems to be entering its final phase. Whether it happens this month or around year-end, there are mounting signs that inflation is losing its punch and the Fed is about to shift into lower gear. With government spending likely to roll off because of a split Congress, the market already flush with long-dollar bets, and the fundamentals of other major currencies starting to improve, the scope for further dollar gains seems limited from here.

Crypto winter hits stocks

A sense of caution returned to haunt equity markets on Wednesday, with the major indices on Wall Street losing around 2% as the ‘battle royal’ in the crypto arena sent shockwaves across riskier assets. Investors hit the panic button on news that Binance won’t move forward with its bailout of the FTX exchange after all, sinking the entire crypto space into deep uncertainty.

There are real concerns that if a high-caliber exchange like FTX collapses, that could spark a domino effect of liquidity crunches, as confidence evaporates and crypto traders rush to withdraw funds from other firms. Ironically, this is the very problem that cryptocurrencies were meant to solve in the first place. In any case, these contagion risks dealt a heavy blow to crypto prices, which spilled over into more traditional assets such as equities.

Overall, it’s still difficult to envision a trend reversal in stocks. Most leading indicators point to a recession that hasn’t started yet, valuations have not deflated enough to reflect the prospect of weaker earnings next year, and the Fed continues to drain liquidity via quantitative tightening. There’s also a risk that selling pressures intensify heading into year-end, because of tax-loss harvesting and hedge fund redemptions after such a brutal year.

FX market and midterms update

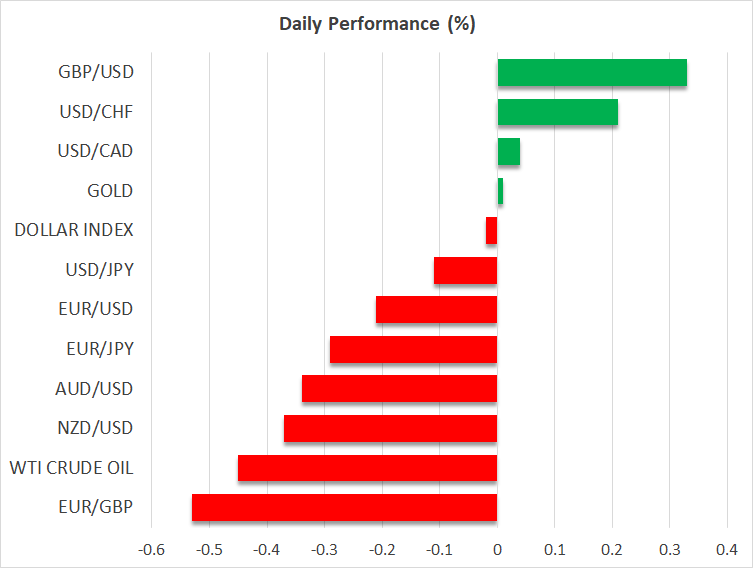

In the broader FX complex, it was a classic case of traders playing some defense. The US dollar and to a lesser extent the Japanese yen outperformed, mostly to the detriment of the British pound and commodity-sensitive currencies. With UK political nerves calming down, sterling seems to have re-established its link with risk sentiment, mirroring any swings in stock markets.

In the political sphere, the outcome of the US midterm elections isn’t clear yet. What is clear is that there wasn’t a ‘red wave’ but rather a ‘red sprinkle’ as the Republicans underperformed compared to what opinion polls suggested going in. They are still set to take control of the House but their majority will probably be slimmer than expected, while the Senate race is too close to call.

Markets didn’t react much because despite these surprises, the most likely endgame is still a divided Congress and two years of total fiscal gridlock.