The US is in a recession.

Quarterly earnings by publicly traded corporations have fallen for SIX straight quarters. That covers a time of 18 months.

This has never happened outside of a recession.

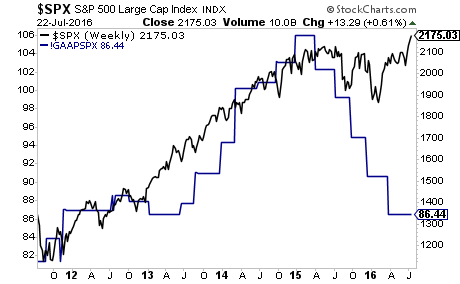

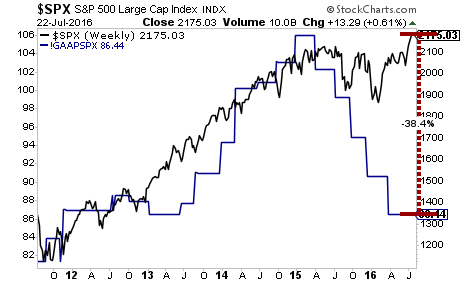

Against this economic backdrop, stocks are in “la la land” rallying to new all-time highs.

The more earnings fall while stocks move higher, the BIGGER the bubble gets.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple digit returns on invested capital every year since inception.

Beyond this, the world’s second largest economy (China) is rapidly devaluing the yuan. Back in August 20

Stock bubbles are formed when stocks detach from fundamentals. By the look of things, this hit in 2015. And is has gotten significantly worse since then.

At current levels, the S&P 500 needs to fall almost 40% to catch up with earnings.

A Crash is coming… we all know it. And smart investors are preparing their portfolios for it now before it hits.

Imagine if you’d prepared for the 2008 Crash several months ahead of time. Imagine the returns you could have seen.

I can show you how. We’re currently on an all-time record winning streak with our investments.