Warren Buffett’s most famous quote has to be: “Be fearful when others are greedy and greedy when others are fearful.” But how do we know when others are fearful or greedy?

I’ve written about margin debt as the Index Of The Volume Of Speculation, but there’s another indicator that can be useful in this regard and, like margin debt, it’s another real money indicator rather than just a survey of investor opinion. That is the Rydex Ratio, or the measure of Rydex traders’ assets in bear funds and money-market funds relative to their assets in bull funds and sector funds.

Just Watch

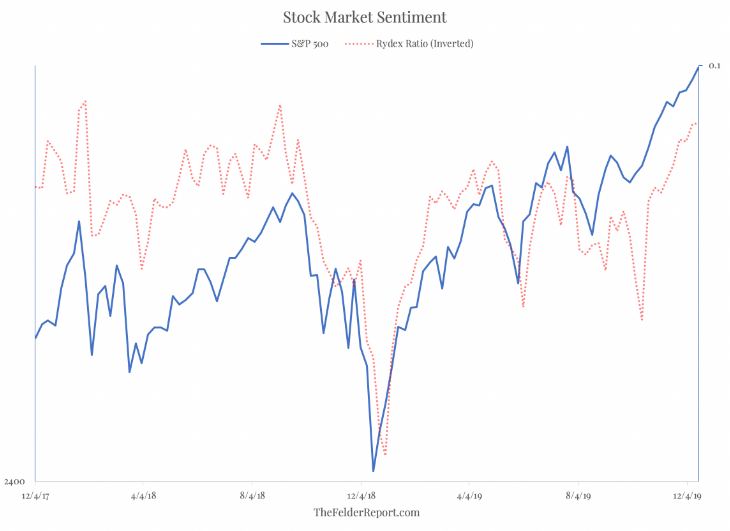

There are a few different ways to use this ratio but the simplest is to just observe the overall level of the ratio. In the chart below, the ratio is inverted so that it corresponds better with the level of the S&P 500 Index. Currently, Rydex traders are about as bullish as they were in early 2018 – just prior to the Volmageddon selloff – and again in the fall of 2018, which preceded that year's fourth quarter waterfall decline.

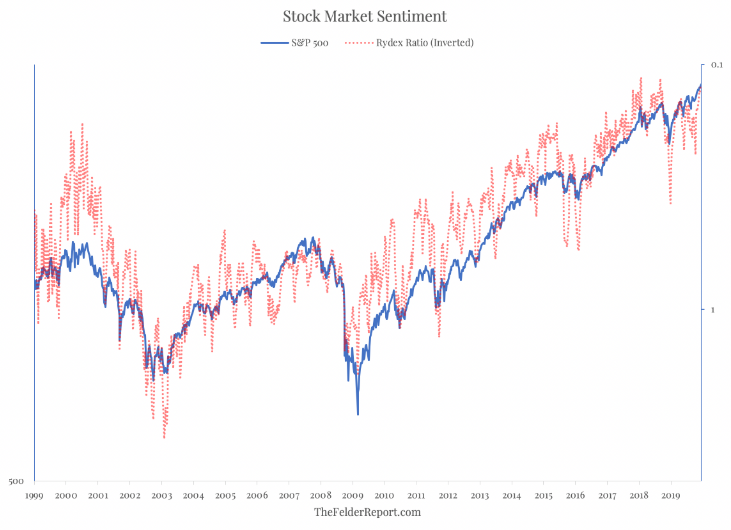

But when you zoom out even further it becomes apparent just how greedy these traders have now become. Even at the peak of the dot-com mania, from late-1999 into early-2000, they weren’t as aggressively positioned as they are today.

So, from both a short-term and long-term perspective, it’s pretty clear investors have become greedy – and to a fairly rare degree. For this reason, it may be wise to “be fearful” right now when it comes to overall equity exposure.