Riskier currencies, including the Australian dollar and euro, were able to hold onto gains from earlier in the week during trading yesterday, as speculation that the Fed would extend its bond-buying program led to risk taking among investors. Today, attention is likely to return to the eurozone and the ongoing debt issues in Spain and Italy. Traders will want to pay attention to any announcements regarding these two countries, as they could lead to market volatility. Furthermore, the US manufacturing and housing data could help the dollar recoup some of its recent losses if they come in above forecasted levels.

Economic News

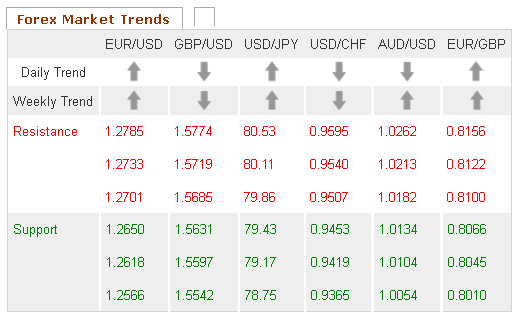

USD - Dollar Stages Moderate Recovery Vs. YenAfter falling as low as 78.78 in overnight trading, the US dollar was able to stage a moderate recovery against the yen over the course of European trading yesterday. The USD/JPY advanced close to 60 pips, eventually reaching as high as 79.36. The greenback was not as fortunate against its other main currency rivals, as speculation regarding the Fed extending its bond buying program led to risk taking in the marketplace. The AUD/USD advanced close to 40 pips over the course of the day, reaching as high as 1.0209. Meanwhile the GBP/USD gained close to 60 pips, eventually peaking at 1.5776.

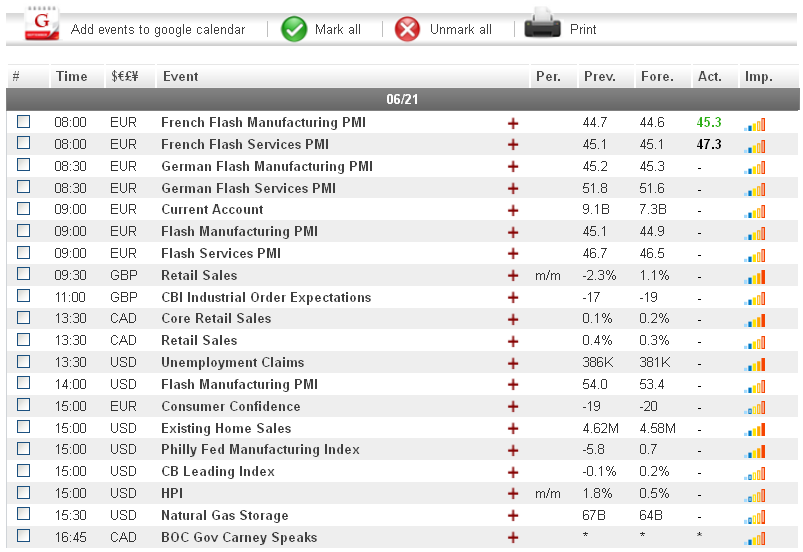

Turning to today, dollar traders will want to pay attention to the US Philly Fed Manufacturing Index and Existing Home Sales figure, both set to be released 14:00 GMT. Both figures are considered highly significant indicators of overall economic health and have the potential to generate dollar volatility. Better-than-expected data out of the US could help the greenback extend its upward movement vs. the Japanese yen. Additionally, any negative data out of the eurozone could help the dollar recover against its riskier currency rivals.

EUR - EUR Gains May End Up Being Temporary

The euro saw gains against both the US dollar and Japanese yen during European trading yesterday, as news that Greek political parties have agreed to the makeup of a new government following elections over the weekend led to an increase in risk taking. The EUR/USD gained more than 50 pips over the course of the day, eventually reaching as high as 1.2723. Meanwhile, the EUR/JPY moved up over 100 pips, eventually hitting the 101.11 mark.

Turning to today, analysts are warning that with attention shifting back to the debt problems in Spain, the euro may reverse yesterday's gains. Spanish government bond-yields recently spiked over 7%, leading to worries that Spain would soon require a much bigger bailout than originally thought. Additionally, recent German news indicates that the eurozone debt crisis may be spreading to the region's largest economy. Any further negative German indicators could result in heavy euro losses.

Gold - Gold Falls Amid Risk Taking

The price of gold fell during European trading yesterday, as investor risk taking in the marketplace caused safe haven assets to turn bearish. The precious metal fell as low as $1600 an ounce by the afternoon session, down more than $20 for the day.

Turning to today, gold may be able to recoup some of yesterday's losses, as investors shift their attention to the ongoing problems in the eurozone. With no concrete solutions to fix Spain's debt problems, combined with fears that the region's debt crisis could be spreading to Italy and Germany, investors may choose to revert their funds back to safe-haven assets, which could lead to gains for gold.

Crude Oil - Crude Oil Reverses Earlier Gains

Crude oil gave back most of its recent gains during European trading yesterday due to the investor concerns regarding a slowdown in the US economic recovery combined with a higher than expected US inventories figure. The US added 2.9 million barrels of crude to its stockpiles last week, further signaling to investors that demand in the world's largest oil consuming country is going down. As a result, the price of crude fell over $1 a barrel, eventually hitting $82.80.

Today, oil traders will want to pay attention to news out of the US, particularly the Philly Fed Manufacturing Index and Existing Home Sales figure. Any indication that the US economy is slowing down further may cause demand for oil to go down as well. As a result, the price of oil may continue its bearish trend.

Technical News

EUR/USDWhile the Williams Percent Range on the daily chart has crossed over into the overbought zone, indicating that a downward correction could occur in the near future, most other long-term technical indicators show this pair trading in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

GBP/USD

The Slow Stochastic on the daily chart has formed a bearish cross, indicating that this pair could see a downward correction in the near future. Furthermore, the Williams Percent Range on the same chart has crossed into overbought territory. Traders may want to go short in their positions for this pair.

USD/JPY

The Bollinger Bands on the weekly chart are narrowing, indicating that this pair could see a price shift in the coming days. In addition, the Slow Stochastic on the same chart has formed a bullish cross, signaling that the price shift could be upward. Opening long positions may be the wise choice for this pair.

USD/CHF

Long-term technical indicators are providing mixed signals for this pair. On the one hand, the weekly chart's MACD/OsMA appears close to forming a bearish cross. On the other hand, the daily chart's Williams Percent Range is currently in oversold territory. Traders may want to take a wait and see approach for this pair.

The Wild Card

USD/NOKThe Slow Stochastic on the daily chart has formed a bullish cross, signaling a possible upward correction. Furthermore, the Williams Percent Range on the same chart is currently close to the -90 level, lending further support to the theory of impending upward movement. Forex traders may want to open long positions for this pair.