Market Overview: S&P 500 Emini Futures

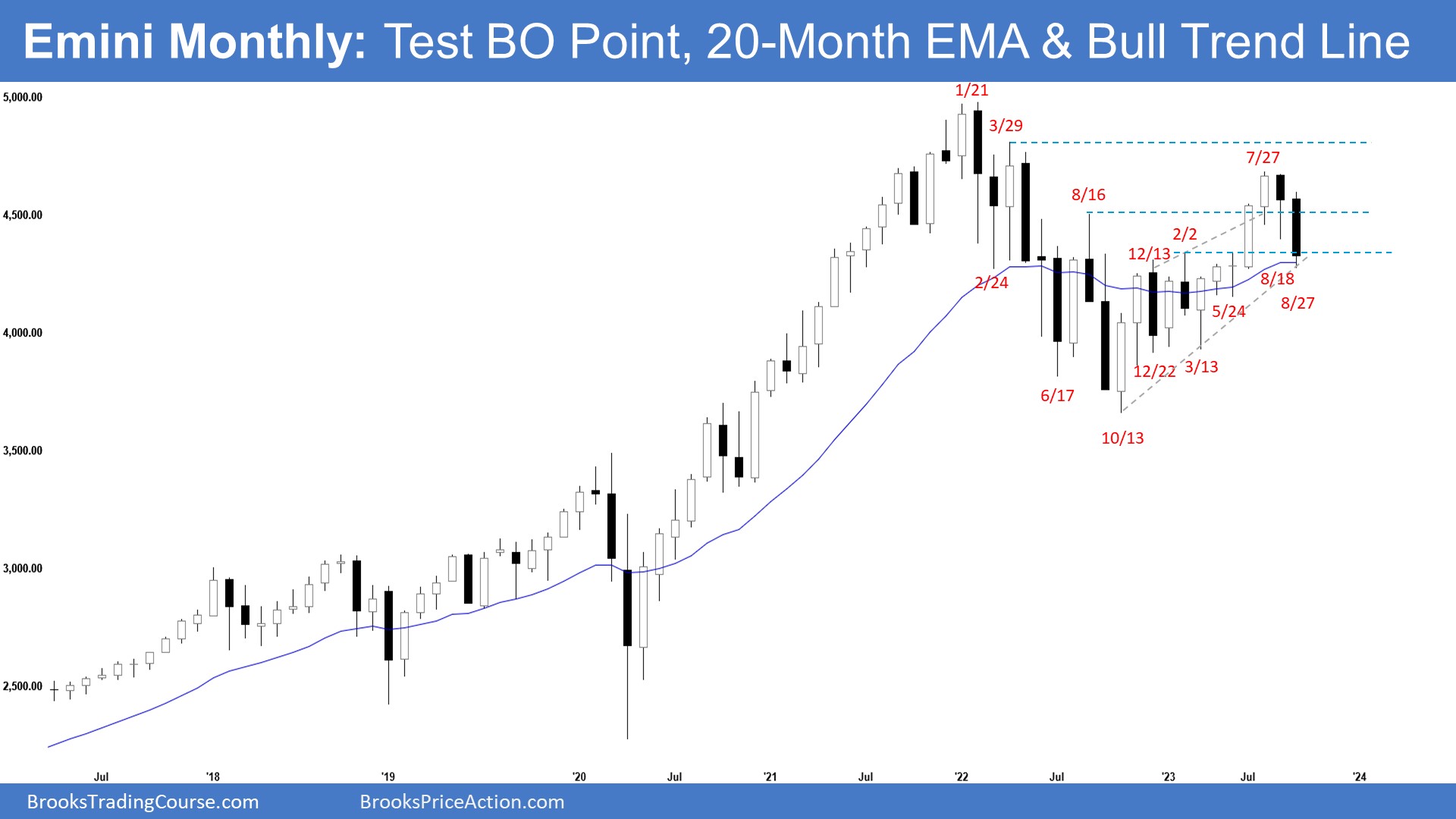

The monthly S&P 500 Emini Futures chart formed an Emini pullback within a broad bull channel testing the 20-month exponential moving average and the bull trend line. The bulls see the market as still being in a broad bull channel and want a reversal to retest the July 27 high. The bears got the first pair of consecutive bear bars since last year (Sept 2022). They will need to create more follow-through selling closing far below the 20-month EMA to increase the odds of a reversal down.

S&P500 Emini Futures

- The September monthly Emini candlestick was a big bear bar closing near its low.

- Last month, we said until the bears can create strong bear bars with follow-through selling, odds slightly favor the market to still be in Always In Long.

- The bears managed to get follow-through selling in September testing the 20-month EMA.

- They see the prior rally (Jul 27) as a retest of the all-time high and want a reversal from a lower high major trend reversal.

- September was the first pair of consecutive bear bars since last year (Sept 2022).

- The bears will need to create more follow-through selling closing far below the 20-month EMA to increase the odds of a reversal down.

- Previously, the bulls managed to create a tight bull channel from March to July.

- That increases the odds of at least a small second leg sideways to up after the current pullback.

- They see the pullback in August and September simply as a test of the Feb 2 breakout point, the 20-month EMA and the bull trend line.

- The bulls want the 20-month EMA to hold as support. They see the current move simply as a deep pullback within a broad bull channel.

- They want a retest of the July 27 high followed by a breakout and a test of the all-time high.

- Since September’s candlestick was a bear bar closing near its low, it is a sell signal bar for October.

- The Emini may still trade at least a little lower.

- Traders will see if the bears can create more follow-through selling closing below the 20-month EMA.

- Or will the market trade slightly below the 20-month EMA but reverse to close above it by the end of the month?

- For now, until the bears can create consecutive strong bear bars trading far below the 20-month EMA, odds slightly favor the market to still be in Always In Long.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

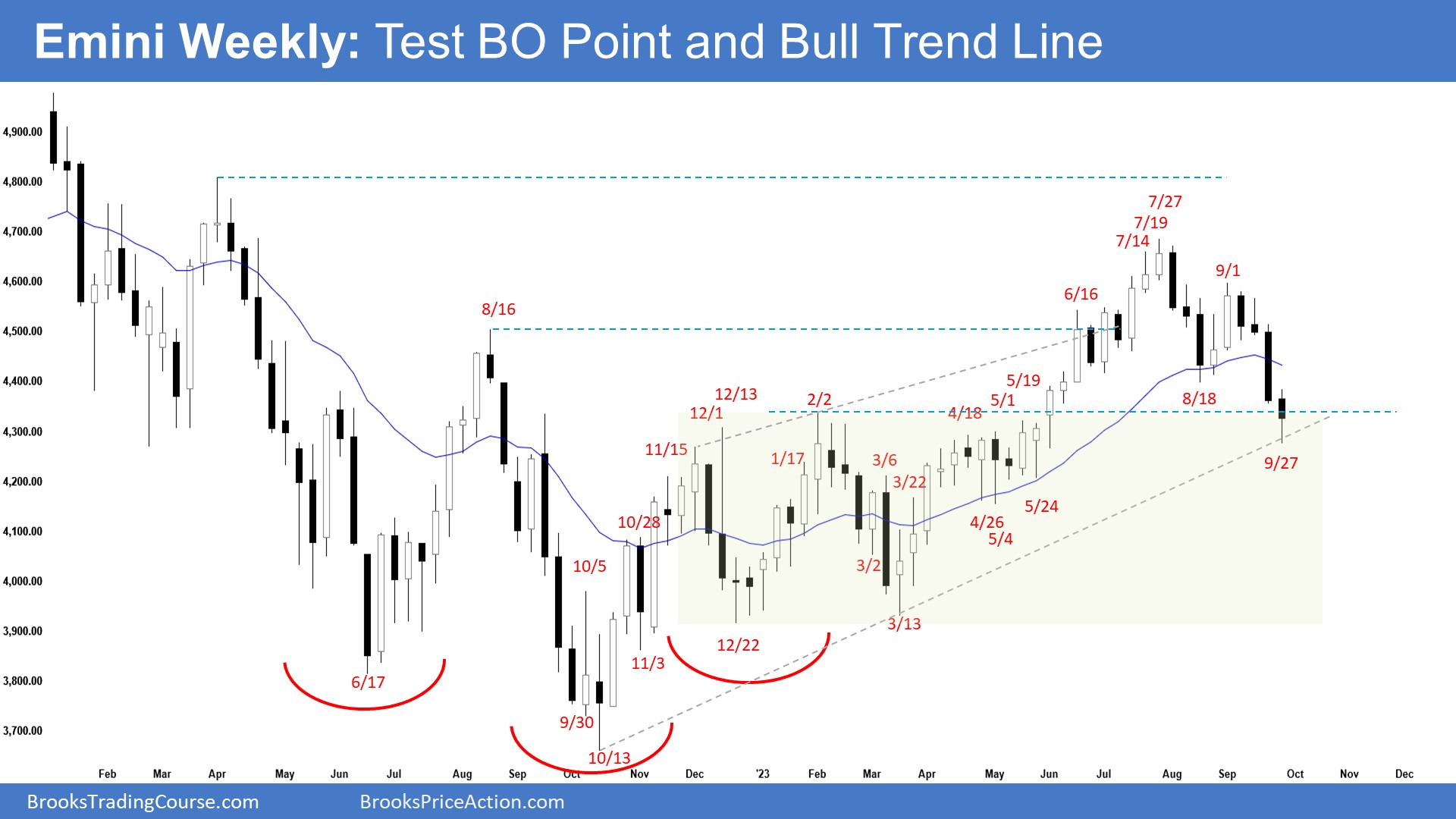

- This week’s Emini candlestick was a bear bar with a long tail below.

- Last week, we said that odds slightly favor the Emini to trade at least a little lower and traders will see if the bears can create follow-through selling or will the market trade slightly lower but reverse up with a long tail below or a bull body.

- This week traded lower but reversed to close with a long tail below, closing around the middle of the candlestick.

- Previously, the bulls got a strong trend up (from March) in a tight bull channel.

- The bulls hope to get a retest of the July 27 high from a double bottom bull flag (Aug 18 and Sept 27).

- They want the Emini to reverse back above the 20-week exponential moving average.

- They see the current move down simply as a deep pullback within a broad bull channel.

- The bears got a two-legged pullback testing the breakout point (Feb 2) and the bull trend line.

- They got follow-through selling this week and a consecutive bear bar below the 20-week EMA.

- They want a strong breakout below the bull trend line with follow-through selling.

- If there is a pullback (bounce), they want another leg down to complete the wedge pattern with the first 2 legs being August 18 and September 27.

- Since this week’s candlestick was a bear bar with a long tail below, it is a sell signal bar for next week albeit weaker.

- Traders will see if the bears can continue creating follow-through selling or will the market stall around the current levels.

- For now, while the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

- However, if the bears continue to get consecutive bear bars closing near their lows, that will increase the odds of a reversal down.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.