- The S&P 500 is riding high on a wave of sentiment but investors should be wary.

- Less bad isn't good and now it appears as if inflation is accelerating.

- The outlook for earnings growth continues to decline and may drag the market down with it.

Equity markets have been moving higher for the last 2 months on a wave of bullish sentiment that may take the S&P 500 up another notch or 2. The problem is that this wave of sentiment is driven by a lessening of bad news, not good news, and means this is a bear market rally and not a recovery or reversal.

The information driving the market is a cooling of inflation and a slowdown in the pace of FOMC interest rate hikes. This is good news indeed, but inflation remains hot, the FOMC is on track to hike rates, and the economic pressure is building. The takeaway is that S&P 500 earnings are deteriorating, and the market should move lower.

Inflation Runs Hot In January; Fed Comes Back Into Focus

Inflation ran hot in January and not just hot; it appears to be accelerating. The consumer price index came in at 0.5%, a tenth hotter than expected and 4-tenths hotter than the previous month on increases in all categories. That is a noticeable acceleration of inflation, and it is driven by housing, energy and food (which is underpinned by energy and housing), so negative feedback loops could form again.

This means consumers can expect inflation to remain high for the foreseeable future. And the core number was hot too. Core inflation accelerated to 0.4% from the previous 0.3% and showed acceleration. The takeaway is that although the YOY figures “cooled,” the monthly figures suggest YOY comps will flatten if not higher in the near term and that could push the Fed to act more aggressively than the market is pricing in.

The worst of the inflation news was the Producer Price Index. The PPI or producer price index is a gauge of input prices and it, too, is running hot. The PPI came in above expectation on all counts and suggested the CPI will continue to see upward pressure. This means the FOMC can be counted on to continue raising rates and they may even need to do another 50 basis point hike.

The next meeting is in late March, which means another full round of inflation data is due before the committee meets. The expectation for hot inflation is already creeping into the outlook for rate hikes which is now pricing in a 15% chance of 50 basis points at the next meeting.

The peak of rates is also on the rise; the Fedwatch tool has the market pricing in the peak at 5.5% or higher and for it to remain above 5.0% until EOY 2023 at least.

It’s All About Earnings For The S&P 500

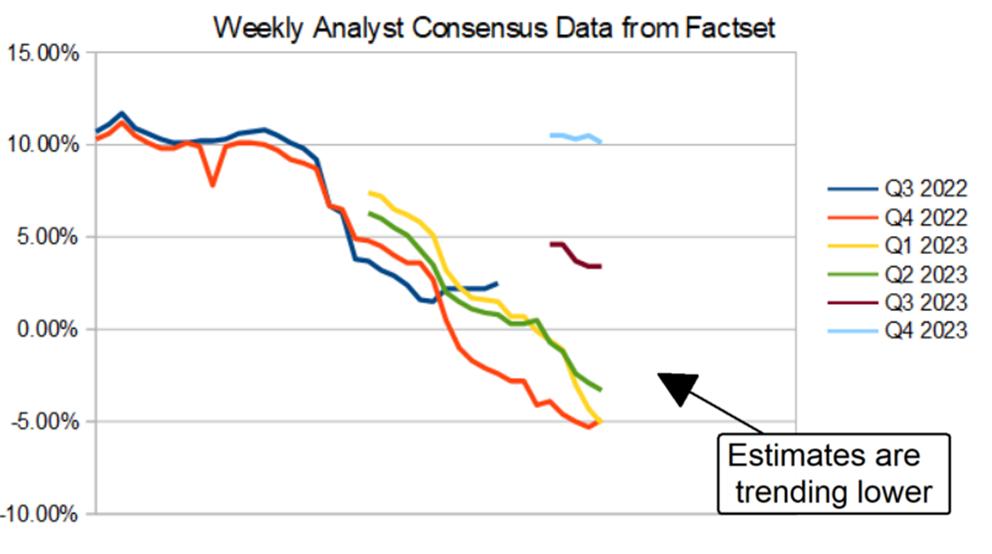

The S&P 500 Index is driven by the outlook for earnings and the outlook for earnings is deteriorating rapidly. While the Q4 season has seen the blended rate reported by Factset, begin to edge higher Q4 2022 was abysmal and the guidance was worse. The average S&P 500 company posted a 4.9% decline in YOY EPS growth and guided the market lower.

That’s what counts—the guidance. The guidance has the consensus estimates for all 4 quarters of 2023 trending lower, and the 1st half estimates are trending lower the fastest and are a dead weight hanging around the market’s neck. As it is, the FY23 consensus remains favorable for growth, but the analysts have yet to reevaluate the 2nd half estimates.

If they hold to the trend, that won’t happen until the Q2 earnings reporting season, when the odds are high that Q3 estimates will turn negative.

The S&P 500 Is Having A Hard Time With Resistance

The S&P 500 has made an excellent recovery from the 2022 lows but is now facing stiff resistance at the 4,150 to 4,300 level. The daily chart shows a potential bullish triangle that could increase the market, but the weekly chart is not so favorable. Conditions for another rally are present, but the market is overbought and trading at resistance within a bear market with the earnings outlook in decline. Any rally that forms is highly questionable.

The more likely scenario is that, even if the market does move up another notch, that resistance will be confirmed and the S&P 500 will remain range bound. In this scenario, a test of the lows near 3,500 is possible. If the outlook for the 2nd half turns negative, the odds are high that the index will set a new low before the end of the year.