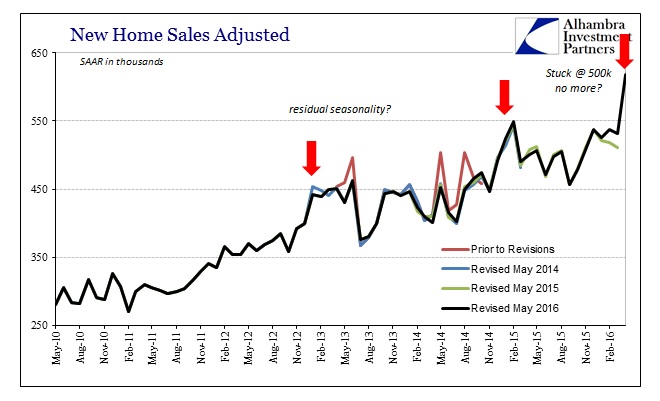

New home sales surged in April to 619k SAAR. That was the highest rate, by far, since January 2008 more than eight years ago. It was also the biggest monthly gain in twenty-four years, which either suggests home sales are more than rebounding or casts doubt upon the quality of the data. Economists left no uncertainty as to which way they are leaning:

Consumers are taking the leap and buying the biggest of big ticket items of their lives and this speaks to confidence. The Federal Reserve can raise rates at their June meeting without fear the economy is going to slow, said Chris Rupkey, chief economist at MUFG Union Bank in New York. Reuters

Though the overall article contained the obligatory credentialed optimism full of such glowing sentiment, it did also include a small cautionary note about the data itself. Admitting both how this one month spike was out of place and that its signal foundation wasn’t actually home sales at all, the implications argue maybe toward more reasonable skepticism.

New home sales increased broadly, with the exception of the Midwest. April’s increase, however, probably exaggerates the housing market strength given that homebuilders confidence has stagnated since rising in January.

New home sales are extremely volatile month-to-month and preliminary figures are subject to large revisions because they are mostly drawn from building permits data.

These are not the estimated count of actual new home sale but rather a stochastic process to estimate that number based on other inputs of related factors. That means we have to rely on both the statistics as well as those factors (which are also statistical estimations). Even with the latest benchmark revisions, the seasonally-adjusted SAAR’s for the past few years during the overall economic slowdown period have started to exhibit what others have called in the GDP context “residual seasonality.” In other words, it has become a regular occurrence that new home sales figures jump significantly around year-end (the exception being 2014).

It doesn’t necessarily mean that home sales are not rising, even at regular intervals, only that we might want to be careful before extrapolating an unknown quantity into “without fear the economy is going to grow.” This has been a consistent ritual, as noted yesterday about the uneven trajectory of PMI’s. It seems that the non-recessionary pattern of the slowdown has led to not just overheating extrapolations of dubious data but even perhaps curious exaggerations within the data itself.

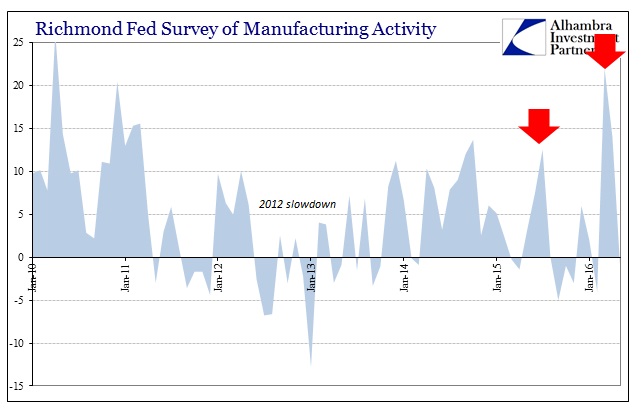

The April jump in new home sales clearly stands out, but it is not alone in that position. Earlier today, the Richmond Fed reported that its manufacturing survey index (PMI) “unexpectedly” dropped back below zero (seasonally adjusted). That wasn’t something anticipated because only two months before the index had surged by the largest amount in its history, from -4 in February to +22 in March. Now back to -1 again?

In the context of PMI’s and the uneven slowdown, the answer is relatively simple to figure. As I have written constantly, there has been a tendency to exaggerate the difference between the start to the year and the months that followed; going from really bad to just plain bad isn’t the same thing as an actual rebound. PMI’s, however, can’t compute the difference; they are yes/no questions. If a lot more respondents responded that business was “better” in March than February then the index shoots up because there is no depth to the effort; it doesn’t even attempt to answer “how much better.”

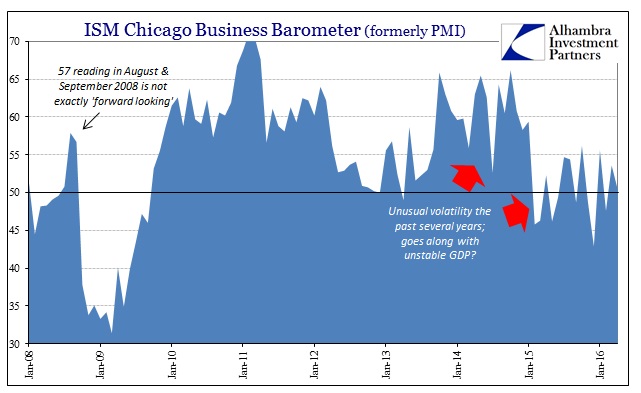

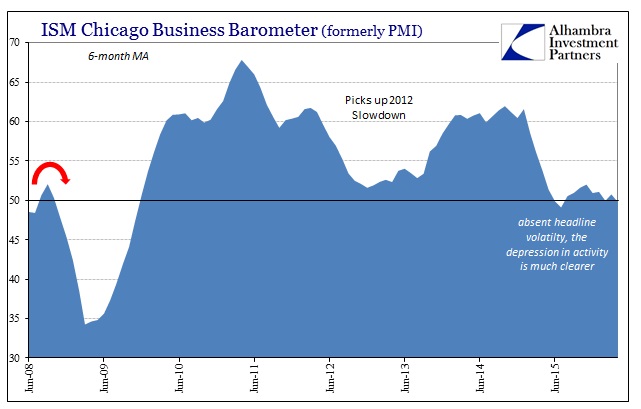

We have witnessed similar behavior in other data series, as well, including other PMI’s. The ISM Chicago Business Barometer found itself in similar confounding fashion around the same general time frame. After sinking to a new cycle low (by far) in December at 42.9, the index jumped in January unbelievably to 55.6; only to fall to 47.6 in February before jumping yet again to 53.6 in March. April’s 50.4 was right about the 6-month average.

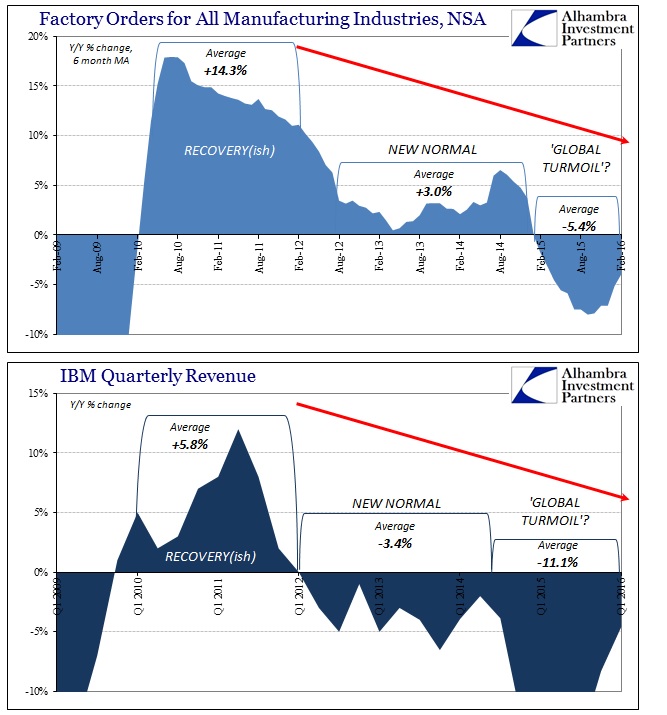

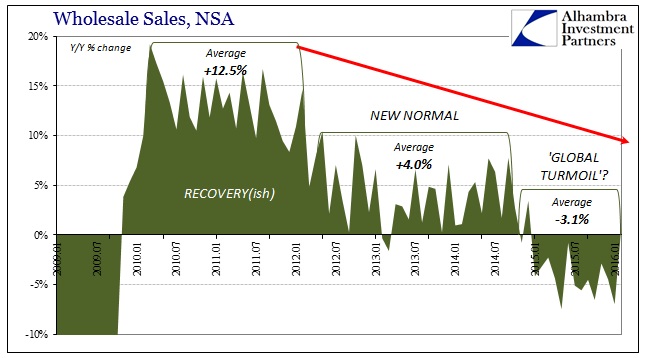

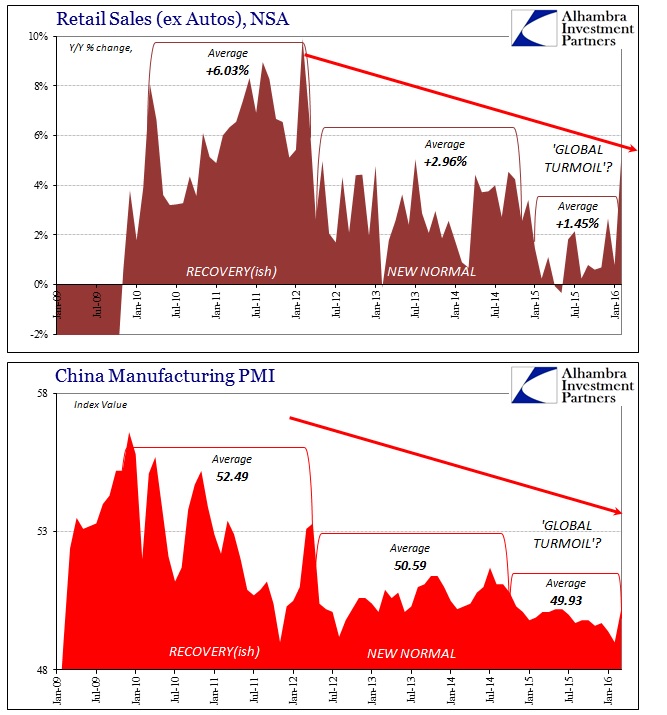

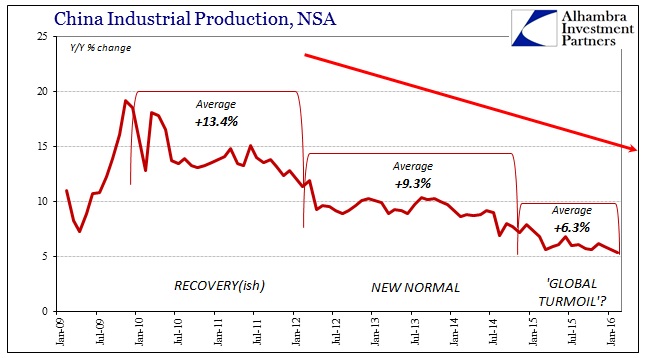

What is clear, however, is that volatility seems to have increased since the start of the rising dollar kicked off the contraction portion of the slowdown. Because these economic segments are not behaving exactly like recessions of the past there seems to be an indeterminate amount of confusion about exactly what is going on. In PMI’s especially, it leads to these sorts of drastic swings in emotional description about what individual participants might be seeing while overall adding very little in individual monthly readings to the total economic picture. The monthly variation might seem to violently transition from despair to hope and back again but the smoothing averages leave less doubt about the overall trend or state:

The slowdown really slowed down at the start of 2015; and likely hasn’t moved out of that position.

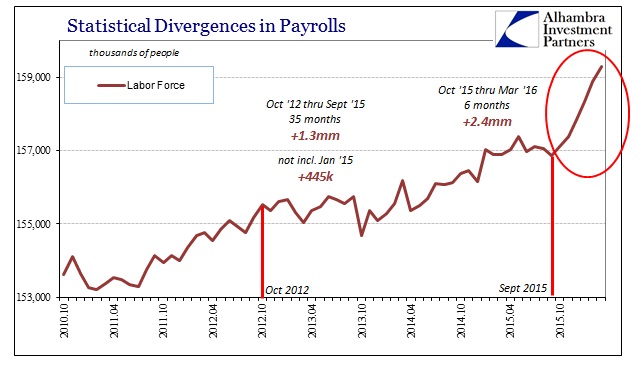

While it is much easier to explain the unnatural “instincts” of PMI’s under these slowdown conditions, swaying only to varying degrees of getting worse, it can still account for greater statistical emphasis in accounts where this “should” not occur (like new home sales). I think the most prominent example is the BLS payroll numbers since last October, particularly in the Household Survey of the labor force. The estimates suggest an historic rush of formerly ambivalent potential workers to suddenly look for work just as the economy took an even more deeply negative turn alongside “global turmoil.” The result is like new home sales where the stochastic process claims a surge that nobody can actually find in reality.

While the government has reported that the labor force has grown by more than two million workers over the past six months, Funk said he isn’t seeing that in his business, with the number of people he has available to fill jobs down from last year.

Tom Gimbel, chief executive officer of Chicago-based staffing company LaSalle Network, is seeing some people come off the sidelines and resume working. But it’s more a trickle than a torrent, he said, adding, “I think it’s running pretty dry.”

When you understand that these economic data pieces are really stochastic processes, the fact of interjected subjectivity is no longer a mystery. I believe it starts with the overall economic condition since we haven’t seen anything like this in recorded economic history. We started with a stunted recovery that quickly gave way to a multi-year slowdown that passed not into renewed vigor (as all prior slowdowns had) but only greater and more uneven slowing (and in many places outright contraction, but not of the recessionary “V” pattern). These statistical measures were never designed for these conditions, which means straight away that “season” adjustments have to work “harder” to smooth out all that doesn’t fit with the expected historical pattern.

It is entirely possible that new home sales rose sharply in April, though I would be far more suspicious about it than most economists. Likewise, it is possible that there has been a rush into the labor force, but that one I believe far, far less because corroboration (lack of) is much more direct (wages and especially spending, as in “manufacturing recession”) and widely available. As for the PMI’s, this contraction part of the slowdown really consists of violent mood swings related to the drastic differences in the “dollar” system (and its effects on everything from asset prices to the actual flow of goods via available credit money) from one month to the next.

People are usually bored by numbing repetition, excited by something very new and different, but the economy wasn’t supposed to be included in all that. It’s certainly another blow to orthodox economics which had claimed knowing all that was ever worth knowing. I have no doubt at all that an entirely new “business cycle” format was never included in any stochastic subset as it would amount to the economic equivalent of the mother of all “tail events”; meaning that we truly live in fundamentally interesting times that mainstream processes and commentary keeps trying to shepherd back (inappropriately) toward “normal.”