Mobile and wireless software developer Smith Micro Software (NASDAQ:SMSI) shares have been recovering. Shares are grinding back towards pre-pandemic levels towards a potential triple top which would blunt its performance against the benchmark S&P 500 index. The rollout of 5G will enhance revenue growth as its popular apps like SafePath and ViewSpot get more integrated with popular carriers. The approval and distribution of COVID-19 vaccines is accelerating the return to normalcy, at least the new normal which has been the galvanization of family dynamics. COVID has inadvertently strengthened the family unit out of necessity from stay-in-shelter mandates. Evidence of this can be found with the abundance of “family meal deals” and the surge in demand for single-family homes. Prudent investors can wait for opportunistic pullback price levels to gain exposure on reversions to monthly rising support levels.

Q3 FY 2020 Earnings Release

On Nov. 4, 2020, SMSI released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) profit of $0.04 or non-GAAP income of $1.8 million. Revenues grew to $12.6 million versus $11.8 million for Q3 2019, a 7% year-over-year (YoY) increase. SafePath revenues grew 30% YoY to $6.8 million. However, the Company expects SafePath revenues to drop (-7%) to -12%) based on current trends in Q4 2020 due to the merger of Sprint and T-Mobile (NASDAQ:TMUS) and the potential transition of Sprint subscribers to T-Mobile suite of voice products, which could also integrate SafePath app. ViewSpot revenues are expected to grow 10% to 15% in Q4 2020 due to the integration of the product by DISH Network (NASDAQ:DISH) in its acquisition of Boost Mobile. The Company ended the quarter with total cash and cash equivalents of $25.9 million.

Conference Call Takeaways

Smith Micro CEO, Bill Smith, addressed key catalysts heading into 2021, “We continue to focus on the deployment of a number of new carrier customers for both SafePath and ViewSpot. Our efforts are all proceeding forward with the full support of these new customers.” The drop on year-over-year (YoY) net income was the heavier investment in marketing and research and development expenses to “staff a growing number of customer deployments.” The Company plans to recruit an additional 12 to 15 employees in Q4 2020, in addition to the 70 to 80 people hired in 2020. CEO Smith summed it up, “while the global economic impact of COVID-19 and the merger of our largest customer has tempered short term growth, the company remains profitable, our sales pipeline is healthy and our products are in demand.”

COVID Galvanized the Family Dynamics Trend

The pandemic has shifted lifestyles in many ways. Aside from the acceleration of trends relating to the migration to digital, ecommerce and remote workflows, it has also galvanized the family dynamic. For many, this is the silver lining of the pandemic that forced so many families to hunker down together and perhaps galvanize relationships out of necessity from stay-at-home mandates. Prudent fast food and restaurant establishments identified this trend early and monetized it by creating “family” dinner packs, specials and meals for off-premise dining. The dine-in trend that has caused home products and kitchenware company shares to skyrocket are further evidence, as well the record demand for single-family homes. Contact tracing is also becoming more accepted by the masses despite initially appearing “intrusive”. These two elements are the undercurrents that can impact Smith Micro’s core product offerings that can be further enhanced by the rollout of 5G to enhance its internet of things (IoT) products.

Safepath7

Smith Micro’s flagship product is SafePath, a family GPS app that enables functions like providing exact address locations of family members, ability to restrict calls to members, create safety areas and alerts, check-in and pick-me-up functions, find-ring-lock-wipe any family phone if lost or stolen. The new SafePath7 includes stronger parental controls enabling “age-based content filters, screen time limits, dead mode and the ability to schedule offline time are all features in high demand as parent everywhere seek tools to help manage screen time, block inappropriate content and improve the digital wellbeing of their children.”, according to CEO Smith. Going with the “family” theme of family phone plans, having the product bundled with new carriers is a boon to the top line, which investors are anxiously awaiting hints of new carrier deals. This will be a key catalyst heading into 2021. Prudent investors who understand this theme can watch for opportunistic pullback levels.

SMSI Opportunistic Pullback Levels

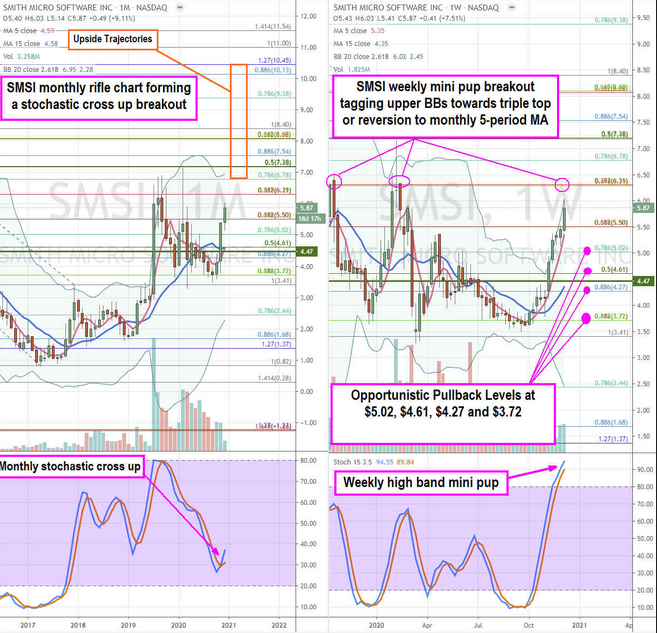

Using the rifle charts on the monthly and weekly time frames provides a broader perspective of the SMSI shares. The monthly rifle chart is reversing the multi-year downtrend as the monthly stochastic crossed back up at the 30-band after triggering the monthly market structure low (MSL) above $4.47 through the $4.61 Fibonacci (fib) level. The weekly rifle charts made a full stochastic oscillation as shares near the $6.31 potential triple top. It’s important not to chase ahead of the fib resistance test. Since investors are anticipating the announcement of new carrier wins for its products, be aware of the potential of a sell-the-news reaction. For this reason, it’s best to wait for pullbacks. If the $6.31 level rejects, then prudent investors can look for opportunistic pullback levels at the $5.02 fib, $4.61 monthly support/fib, $4.27 fib and the $3.72 fib. Upside trajectories range from the $6.78 fib up to the $10.45 fib.