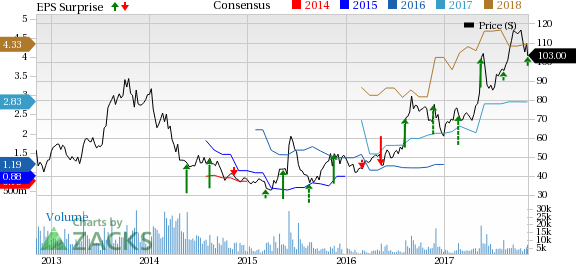

SINA Corporation’s (NASDAQ:SINA) third-quarter 2017 non-GAAP earnings of 77 cents per share surged 37.5% from the year-ago quarter to beat the Zacks Consensus Estimate of 73 cents.

Net revenues grew 61.2% to $443.1 million and beat the Zacks Consensus Estimate of $409.8 million. Non-GAAP net revenues grew 62% to $440.5 million.

Notably, SINA’s shares have gained 69.4% year to date, substantially outperforming the industry’s gain of 55%.

Quarter Details

Advertising revenues moved up 56% year over year to $364 million, driven by the momentum in the Weibo segment. Non-advertising (non GAAP) revenues increased 98% year over year to $76.6 million.

Revenues from Weibo (NASDAQ:WB) business surged 80.9% year over year to $320 million. Monthly active users increased 26.6% year over year to $376 million, driven by an increasing number of mobile users. At the end of the quarter, daily active users went up to 165 million, up 25% from the year-ago quarter.

Weibo non-ad revenues grew a whopping 114.2% to $43.2 million, mainly attributable to the hike in membership fees and live broadcasting business. Weibo's ad and marketing revenues grew 76.7% to $276.8 million in the reported quarter.

Portal advertising revenues were up 9.5% year over year to $87.4 million. Portal non-advertising revenues increased 88.9% to $39.8 million on the back of the progress made in online payment business.

Non-GAAP operating income was $140 million, which surged 157% year over year. Non-GAAP operating margin was 33% compared with 21% in the year-ago quarter.

Balance Sheet and Cash Flow

SINA exited the quarter with cash & cash equivalents (including short-term investments & restricted cash) of $2.6 billion compared with $2.4 billion as of Jun 30, 2017.

Cash provided by operating activities in the quarter was $188.1 million. Capital expenditure was $7.3 million.

Our Take

Strong performance of SINA’s Weibo platform continues to be a key growth driver. Advertising as well as non-advertising revenues continue to be driven by the momentum of the Weibo segment.

SINA’s popular mobile portal and service offerings are enabling the company to capitalize on the growing mobile market. Rise in user engagement on SINA news app is a positive.

Moreover, we believe that SINA will benefit from growth potential of e-commerce, e-banking and online payment markets in China. We expect the company’s growing online payment business to drive non-Weibo revenues further.

The company’s live broadcasting business is also helping it to generate significant revenues. Triple-digit year-over-year growth in sectors like entertainment and luxurious brand bode well for the company.

We also believe that Weibo’s monetization ability will continue to be a major driving factor for SINA amid intensifying competition from the likes of Sohu.com Inc. (NASDAQ:SOHU) and NetEase (NASDAQ:NTES) in the video and brand advertising market.

However, the company’s business is likely to be impacted by soft macroeconomic conditions in China. Increasing marketing spend on SINA news app and continuing investments in other verticals like Internet banking and insurance will weigh on margins.

Currently, SINA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Sina Corporation (SINA): Free Stock Analysis Report

NetEase, Inc. (NTES): Free Stock Analysis Report

Weibo Corporation (WB): Free Stock Analysis Report

Sohu.com Inc. (SOHU): Free Stock Analysis Report

Original post

Zacks Investment Research