The silver market can be rather confusing for a lot of traders, but there is hope that it’s not too hard to understand as it bounces around on technical patterns on the chart.

Source: Blackwell Trader (Silver, D1)

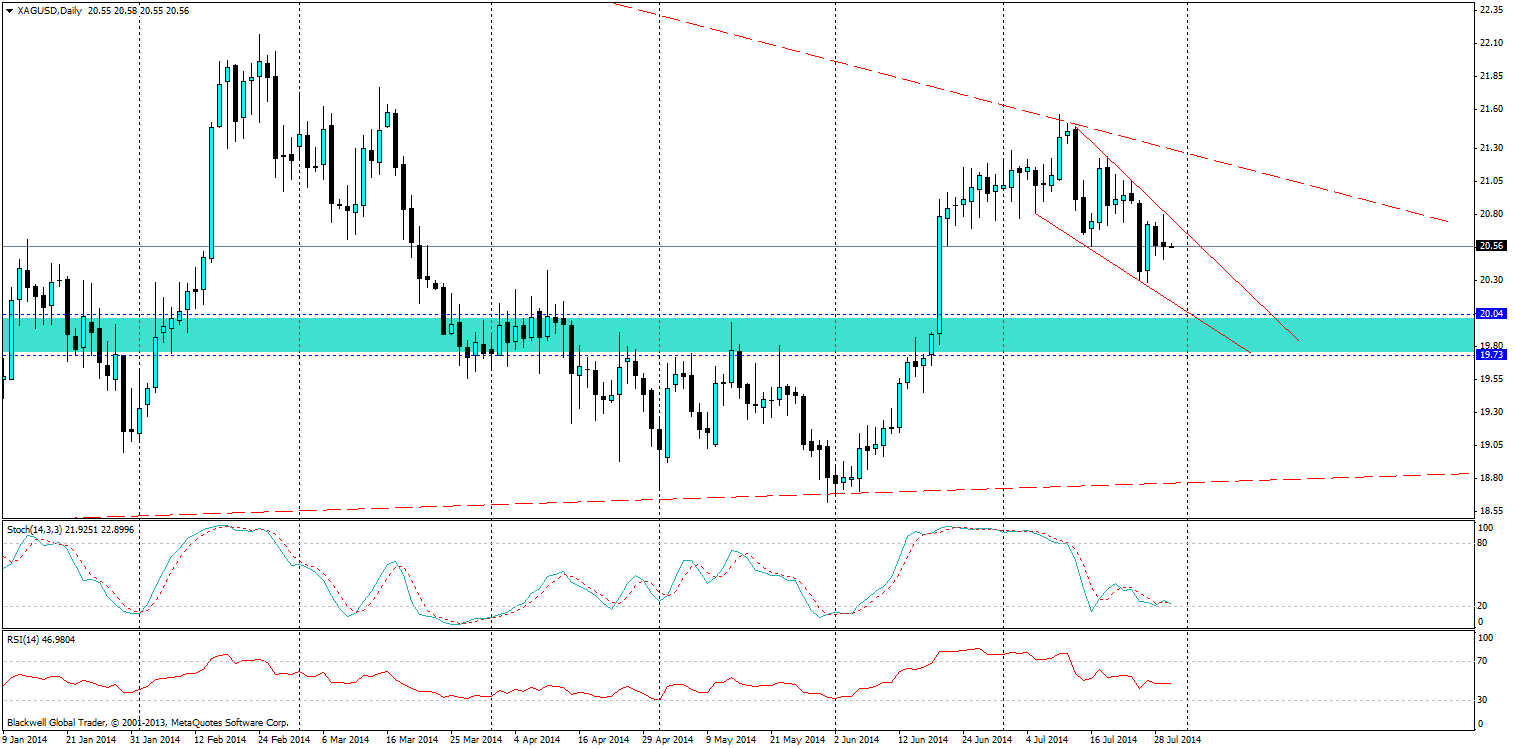

After a strong touch on the bearish trend line silver has looked to range back downwards in a descending wedge, and that’s not surprising given that markets are starting to look up at the U.S dollar. All forecasts this week are expected to show positive results for the U.S economy, whether that is actually true remains to be seen. But, it’s a positive sign when forecasters are looking forward with some optimism.

So with a descending wedge, it generally means that we will see a bullish breakout higher at some point. Currently the market is at 20.57 and further lows look very much possible. I am targeting the 20.04-19.73 area which has shown in the past to be a turning point with high volume and liquidity in the market. Traders will be looking to target this area as well.

Movements lower though could struggle if U.S. data is weaker than expected, however, the current trend line will likely trap movements higher in the event of weaker U.S. data.

Overall, bearish sentiment remains in the short term until we get below the present 20.00 dollar an ounce mark, and strong U.S. data will help extend this push lower. A strong non-farm reading might even push it completely into the range we are targeting and in turn help provide a breakout of the present descending wedge.