Key Points:

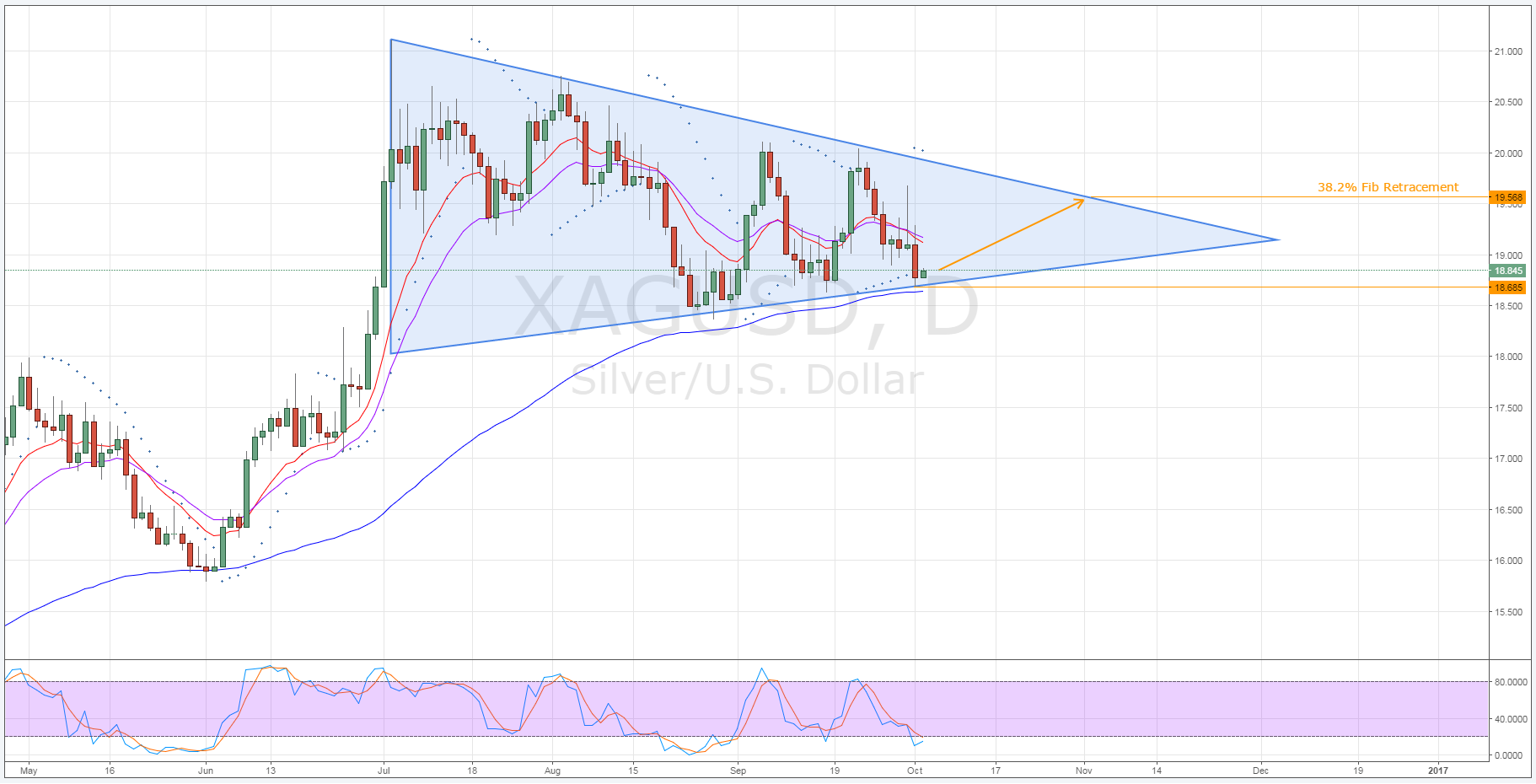

- Bullish pennant remains in play for silver.

- Stochastics have moved into oversold territory.

- 100 day EMA providing dynamic support.

Due to an ongoing consolidation phase, silver prices should make a move to the upside over the coming weeks. As a result, we could see the metal begin to seek out the 19.50 mark once again after reversing. However, any potential rally could be somewhat muted relative to the prior two surges in silver prices due to the recent switch in the Parabolic SAR reading to bearish.

Silver is expected to begin to recover primarily as a result of the bullish pennant structure which has dominated the charts since July. As demonstrated below, the metal is currently challenging the downside constraint of the pennant which indicatesthat silver prices have likely reached a point of inflection.

Further reason to suspect a reversal in the coming sessions can be found in a range of technical measures. Firstly, whilst the 12 and 20 day EMA’s are currently bearish, the 100 day average remains staunchly bullish. What’s more, this moving average is currently a source of dynamic support for silver prices which should limit downside risks moving forward.

Secondly, the current readings on the stochastic oscillator are firmly in oversold territory. As a result of these readings, selling pressure should begin to subside drastically as the bear’s influence over the metal wanes. Furthermore, the presence of the 61.8% Fibonacci retracementaround the 18.685 price will prove difficult to break through and should, therefore, encourage the bulls to re-enter the silver market.

Once a reversal has taken place, we can expect to see the metal ascend to around the 19.568 level before faltering once again. Whilst this is largely due to the upside constraint of the pennant providing substantial resistance at this point, this price also coincides with the 38.2% Fibonacci retracement.

It is also worth noting, any impending rallies could be reasonably muted relative to those previously seen. The reason for this is a result of the recent switch seen in the Parabolic SAR reading from bullish to bearish. As a consequence of the switch, buying pressure could be somewhat sluggish and it may take longer for the price hike to gather suitable momentum in the absence of some impactful fundamental results.

Ultimately, it currently looks rather improbable that silver is going to break free of its consolidation phase in the near-term. Therefore, range traders could net some decent pips over the proceeding weeks. However, whilst the technical bias is relatively robust, keep an eye on the fundamentals as they could play a role in ending this pennant prematurely.