Key Points:

- Further upsides look likely from a technical perspective.

- Upsides largely contingent on a near-term breakout.

- Upside constraint of channel could be tested in the medium-term.

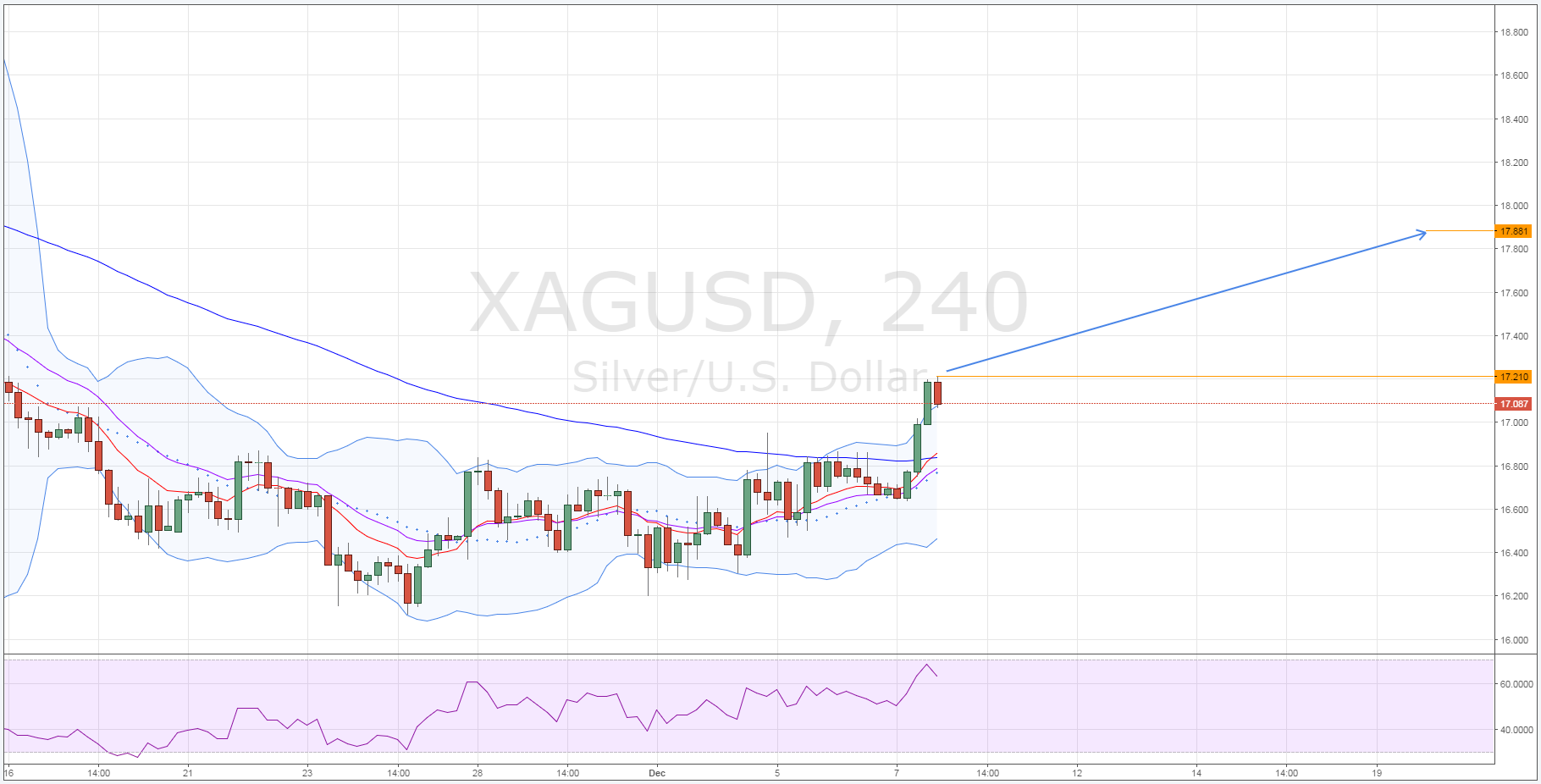

Silver could be about to make a serious attempt at testing the upside constraint of its bearish channel. Yesterday’s rather bullish session has seen the metal soar towards a robust zone of resistance that, if broken, could lead to a short ranging phase and subsequent push towards the boundaries of the channel. As a result, it’s worth taking a look at some of the technical forces currently in play which could see this outcome eventuate.

Firstly, as demonstrated below, a fairly well-defined bearish channel has been gripping silver prices for some time now. Notably, the metal has recently put some distance between itself and the downside constraint of said channel which now begs the question, where will silver move to next? Contrary to the outcome already suggested, the most obvious move for silver prices would be another near-term slip. Indeed, respecting resistance around the 38.2% Fibonacci level would be in line with the highly bearish EMA bias evident on the daily chart.

Fortunately for the silver bulls, the technical evidence reveals there may be an alternate, if slightly less obvious, forecast for the metal. Starting on the daily chart, the Parabolic SAR has recently transitioned from a bearish bias to a bullish one which will be adding some momentum to the silver rally. Additionally, RSI remains firmly neutral which indicates that, even given the strong surge seen last session, the metal is in little danger of becoming overbought.

Zooming into a shorter time frame, both the Parabolic SAR and RSI indicators are similarly inclined which bodes well for continued bullishness moving ahead. Furthermore, on the H4 chart, the EMA bias is actually now highly in favour of continuing the uptrend as is evidenced by the imminent moving average crossover. Moreover, the metal has closed above the upper Bollinger band which will likewise be encouraging further buying pressure.

Combined, it is expected that these forces push silver above the 17.209 level and up to the 61.8% Fibonacci retracement. After doing this, the metal should cool off again and range between the two Fibonacci levels until reaching the upside constraint of the channel. At this point, there are two likely options, either a breakout to the upside or a reversal and move back to the downside constraint. Unfortunately, it is presently too early to call what will occur and we will need more technical and fundamental cues as the metal draws nearer to this crucial point.