It's like Halloween is arriving early this year. By that I mean it just keeps getting scarier and scarier. My guess is that every speculator on the planet is long silver/short gold or outright long silver.

That of course is an exaggeration, but I am not exaggerating when I categorically state that the silver market is a train wreck just waiting to happen. As I have said before, and will say so again – I would rather miss any more upside in this market than get long now, not with a trade so lopsidedly jammed with speculators on the long side. I will leave that for the daredevils and others who like driving the stagecoach as close to the edge of the mountain pass road as they possibly can.

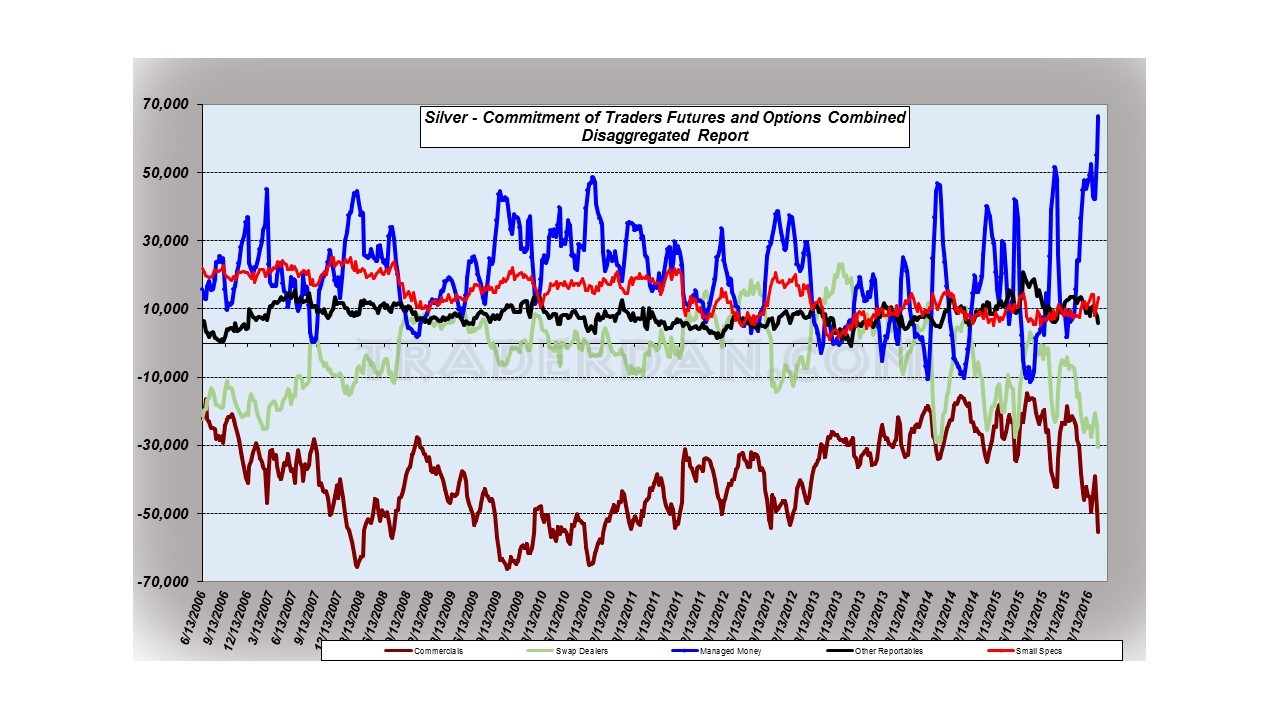

Look at this baby and marvel:

Tell me we do not have a buying frenzy taking place in the silver market! I suppose it can keep going higher and the specs can keep piling on more and more longs but when it breaks, it is going to be ugly – unless you are short and then it will be a thing of beauty to behold a mass exodus of hapless specs who ended up buying the top in this thing.

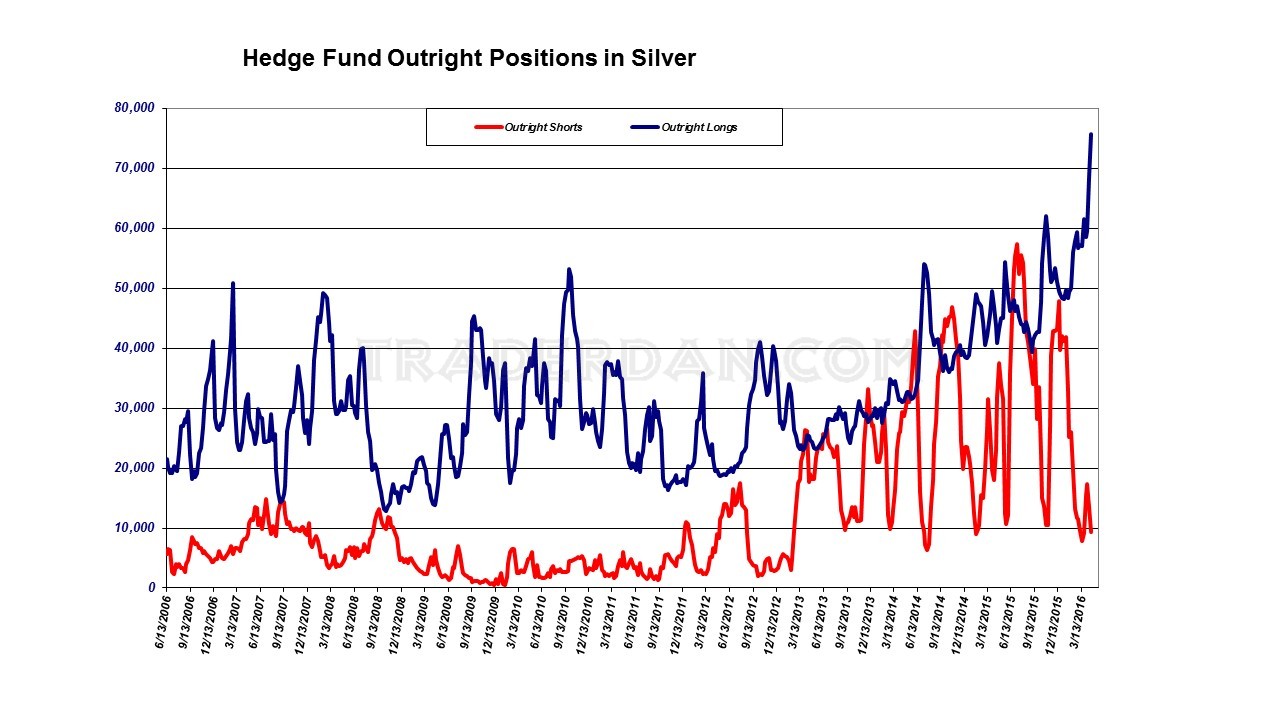

Here is a look at the hedge fund outrights:

Yet another all time record high!

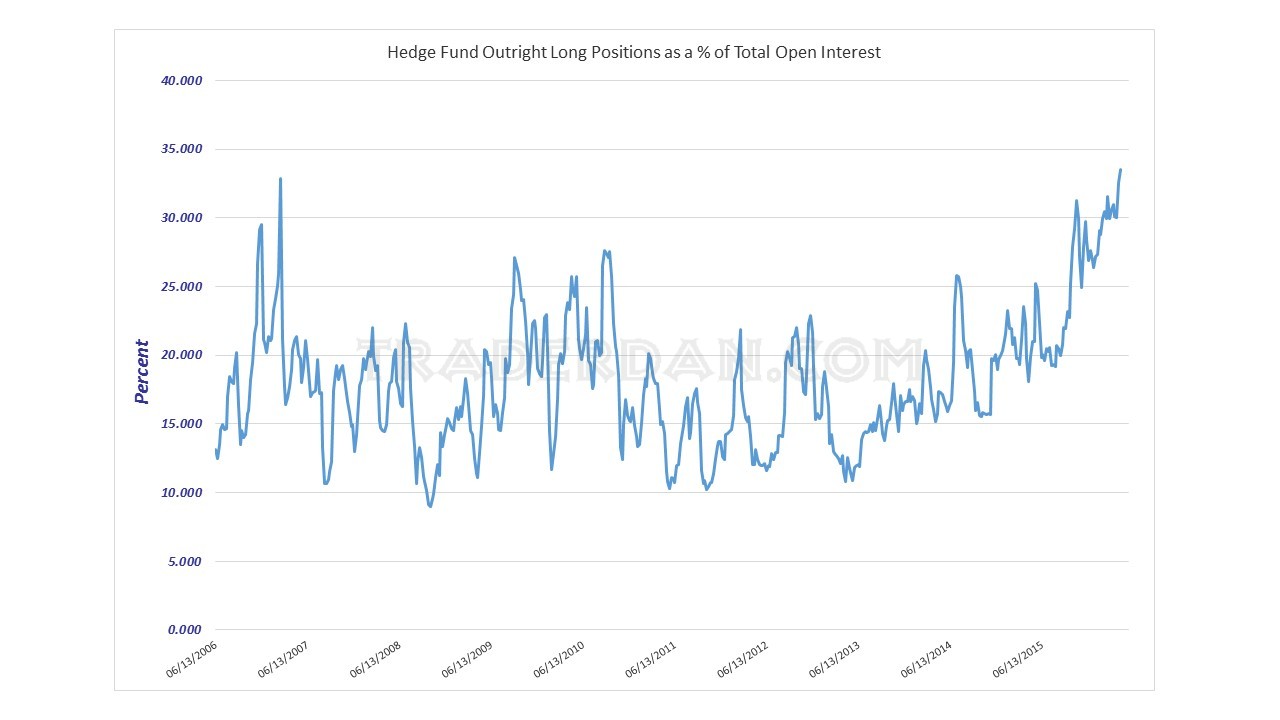

Even when viewed as a percentage of the total open interest, which allows us to compensate for the increase in open interest, we still are at a record, all-time high.

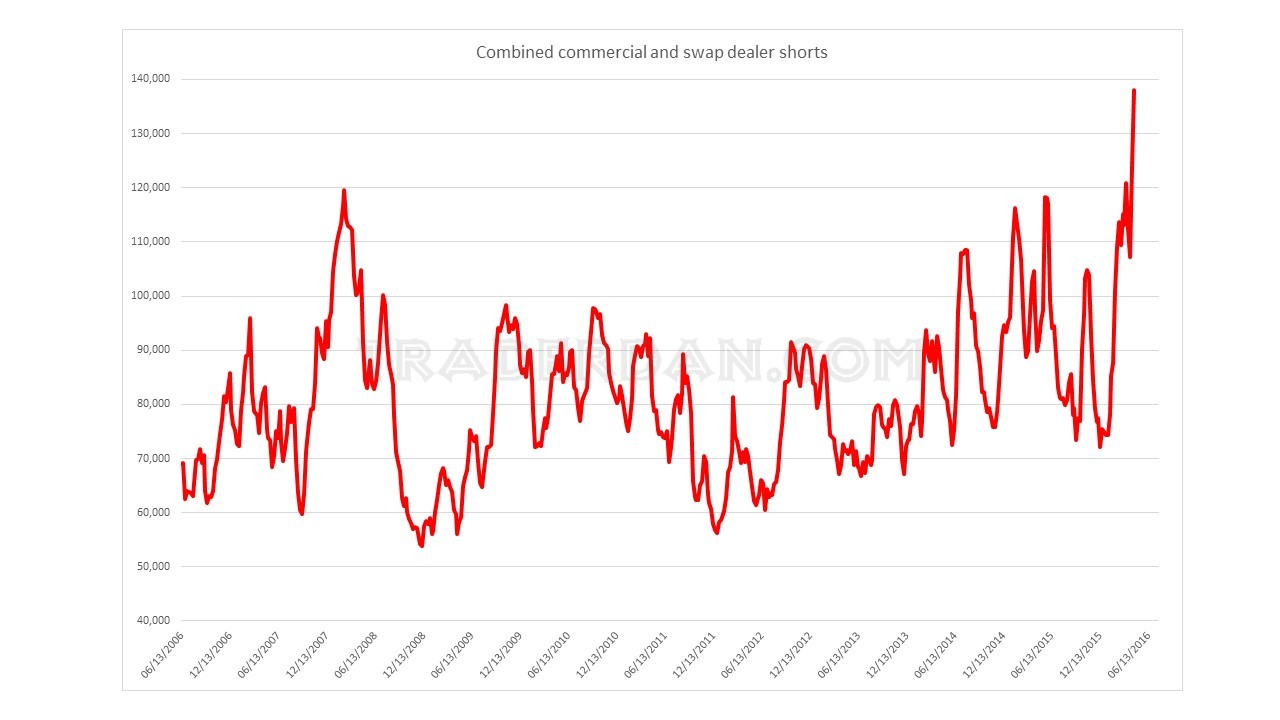

Not impressed enough yet? Try this one on for size:

Commercial interests and Swap Dealers have been more than happy to offload silver into the hands of speculators at these prices.

In looking at the actual daily price chart we can see the metal’s upside progress stymied at $17.75 – $17.50.

If I were long this market, and I am not, I would get some downside protection through the use of options at the very least.

So far, the hedge funds have hung quite tough in here; however, that push to $17.75 which failed, looks an awful lot like an interim blow off top. The huge surge in volume would seem to confirm that. We do need a push below $16.75 to convince some die hard bulls however. If that levels gives way next week, we will see some of them start coming out.

It will be up to the bulls to prove that they can muscle this thing away from that level and reclaim the initiative. That would require at the very least a push through $17.35-$17.40.

We’ll see what we get this coming week. For now, if you are long this market, best stay nimble and don’t close your eyes for too long or you are liable to be surprised, unpleasantly, when you re-open them. In all seriousness, stay alert and do not grow complacent – not with all that potential selling firepower sitting out there from longs.

Think about how many of them were already chasing it up near $17.50 this week only to watch the price melt down from that level within 60 minutes after getting long. Talk about a rude awakening to the horrors of trading silver.

This market is both a heart-breaker and an account destroyer. It is still the play thing of the funds and will always be just that.

By the way, notice that both silver and the beans broke lower together on Friday.