Consider a few HYPOTHETICAL examples of what we accept as normal:

- GDP (gross domestic profit) grew by 2.1% this past year.

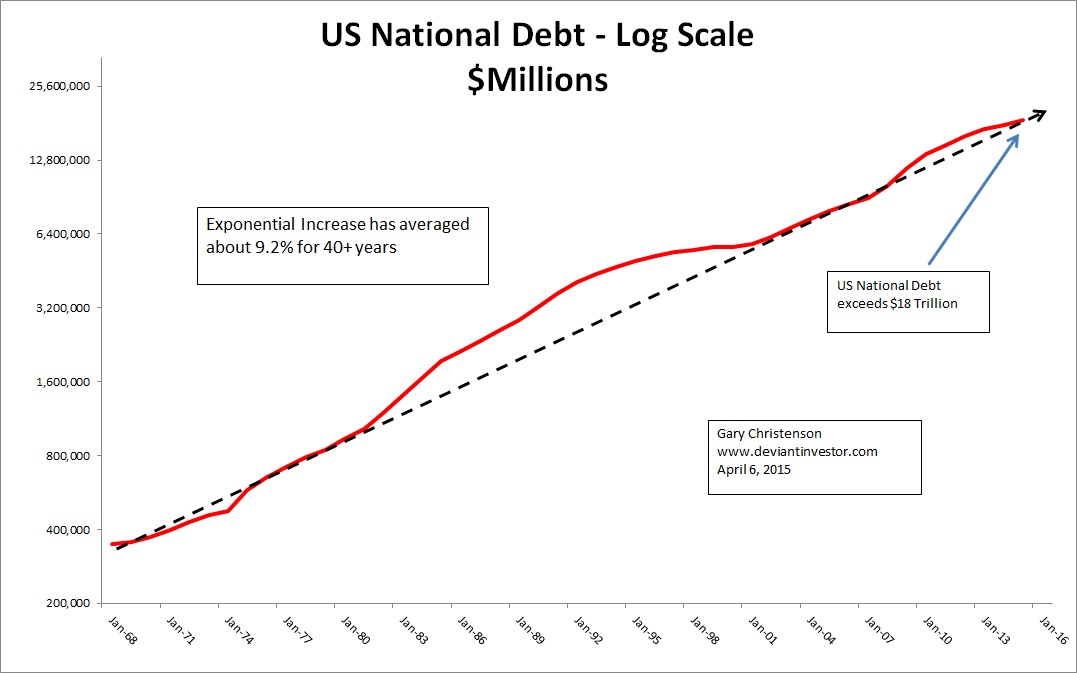

- The US National Debt increased by over 9% this past year.

- Sales at XYZ Corporation increased by 27% year-over-year.

- Spending on prescription medications increased by 22% this year.

- Population increased by 2.3% globally.

- Media spending to elect another presidential candidate increased 30% compared to 2012.

- Automobile miles driven globally increased by 10% this year.

The common theme is that GDP, debt, sales, expenses, gasoline consumption, economic activity and much more increased exponentially. Our world is based on exponential economic growth, exponential increases in spending, exponential increases in population, exponential increases in the extraction of crude oil, and exponential increases in the use of natural resources. This is not sustainable.

Consider the example of exponential growth in the US national debt for over 45 years. Like the man falling from the top of the Empire State Building said as he passed the 45th floor, “so far, so good.” But massive, unpayable, uncontrollable debt, like a fall from a 100+ story building, is very likely to end in a crash.

Exponential increases eventually exceed the system’s ability to support the demand for resources and energy. To further illustrate this point, consider these extreme examples:

World population exceeds 7 billion people. Exponential growth means that world population will eventually exceed 50 billion or 100 billion people. Can the world feed and support 50 or 100 billion people?

Current US national debt exceeds $18 Trillion and is growing 9 to 10% per year. Exponential growth indicates national debt will reach $100 Trillion and eventually $1,000 Trillion. Really?

One penny deposited in a saving account that earned 6% interest compounded annually would be worth, after 2,000 years of exponential growth, over $4 Trillion Trillion Trillion Trillion. Exponential growth produced a number of dollars with 48 zeros after 2,000 years. The calculation is correct and clearly shows there are limits to exponential growth.

Exponential growth can persist for a considerable time, but not forever. Eventually the system resets, natural resources are depleted, climate transitions into a cold cycle, energy supplies are depleted, drought reduces food production, war devastates the population and economy, or whatever. Exponential growth will cease when the system runs out of resources and/or energy.

WHAT TO EXPECT

Systems will reset and change when exponential growth at current or reduced rates becomes impossible. The transition is likely to be difficult, dangerous, and the ensuing trauma will not fade quietly into the night.

Exponentially increasing debt supported by nothing more than exponentially increasing promises will end in national and/or global disaster.

When the reset comes, and it may be years away, would you rather hold assets that are based on debt, trust in a possibly insolvent counter-party, and denominated in the currency of an increasingly insolvent government and central bank . . . . or physical gold and silver?

Do you trust real silver and gold, or unbacked paper assets based on the promises of self-serving politicians and central bankers?

These should be easy questions to answer when you realize that exponentially increasing debt, expenses, and commodity prices all point to inevitable and serious financial and social trauma.

However, gold and silver, since they are real money, will increase in value as other debt-based paper assets crash and burn in the inevitable reset.

Read: Chris Martenson If We’re Going To Borrow Against The Future