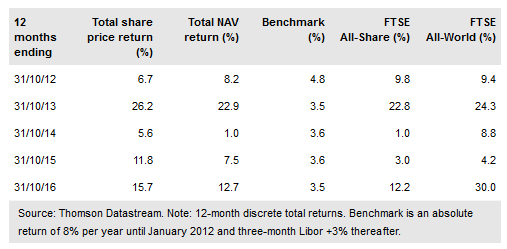

Seneca Global Income Growth (LON:SIGT) aims to generate income and long-term capital growth from a range of asset classes. Investments are made for the long term using a strategic asset allocation to equities (60%: 35% UK and 25% overseas, with modest US exposure), fixed income (15%) and specialist assets (25%, including property and infrastructure assets, where yields can be in the 5-8% range). Around one-third of the fund is invested in UK mid-caps, where over time returns tend to be higher than for large-caps, and where the market is generally less efficient, providing opportunities for stock picking. There is no exposure to safe-haven government bonds, which the managers consider unattractively valued, and SIGT has lower FX exposure than its peers. Following a change in investment mandate in 2012, SIGT’s NAV total return has meaningfully outperformed the FTSE All-Share index, with significantly lower volatility.

Investment strategy: Diverse streams of income

SIGT employs a ‘Multi-Asset Value Investing’ approach that aims to meet the trust’s objectives of generating income and long-term capital growth, (which includes significant investments in specialist assets). Tactical asset allocation is employed within a strategic asset allocation framework to enhance potential investment returns. SIGT invests directly in UK equities, while the majority of investments in other asset classes are in dedicated funds. Gearing of up to 25% of net assets is permitted. At 31 October, net gearing was 9.6%.

To read the entire report Please click on the pdf File Below