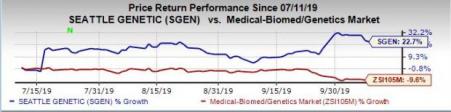

Shares of Seattle Genetics, Inc. (NASDAQ:SGEN) have rallied 22.7% against the industry’s decline of 9.6%.

The company's sole marketed drug, Adcetris, is approved for relapsed Hodgkin lymphoma and relapsed systemic anaplastic large cell lymphoma (sALCL) in the United States, the EU and Japan. The drug generated sales of $294 million in the first half of 2019, reflecting a year-over-year surge of 35%.

Improved sales of the drug were owing to its recent label expansions for frontline CD30-expressing PTCL and frontline HL, addressing a higher patient population.

Apart from Adcetris, the company has multiple antibody-drug conjugate (ADC) candidates in its pipeline, which are making good progress. These include enfortumab vedotin, tucatinib, tisotumab vedotin, ladiratuzumab vedotin and SEA-BCMA.

Last month, Seattle Genetics along with Japanese partner Astellas Pharma announced encouraging initial results from the phase I EV-103 study on enfortumab vedotin. The candidate is being evaluated in combination with Merck's (NYSE:MRK) PD-1/L1 inhibitor, Keytruda (pembrolizumab), for addressing previously untreated patients with locally advanced/metastatic urothelial cancer, who are not eligible for cisplatin-based chemotherapy.

The platinum-free combination of enfortumab vedotin plus Keytruda met the outcome measures for safety and demonstrated encouraging clinical activity in the first-line setting. Shares of Seattle Genetics rose significantly back then.

We remind investors that, last month, the company along with Astellas announced that the FDA accepted the biologics license application (BLA) for enfortumab vedotin under a priority review. The company is seeking approval of the candidate for the treatment of patients with advanced/metastatic urothelial cancer, who had received treatment with both a checkpoint inhibitor (PD-1/PD-L1) and platinum-based chemotherapy. A decision from the regulatory body is expected on Mar 15, 2020.

Also, in September, the company presented initial data from the single-arm phase II MOUNTAINEER study on its investigational agent, tucatinib.

The study evaluated tucatinib in combination with Roche's (OTC:RHHBY) Herceptin (trastuzumab) for treating patients with HER2-positive RAS wild-type metastatic colorectal cancer, who have already received treatment with first and second-line standard-of-care therapies. The combo regime was well tolerated and demonstrated an encouraging antitumor activity.

Currently, Seattle Genetics has no approved product in its portfolio other than Adcetris. The drug constitutes the majority of the company's top line. However, Seattle Genetics' dependence on a single drug is a concern. Thus, any regulatory setback for Adcetris could hurt sales significantly.

Seattle Genetics, Inc. Price

Zacks Rank & Stock to Consider

Seattle Genetics currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is Exact Sciences Corporation (NASDAQ:EXAS) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Exact Sciences’ loss per share estimates have narrowed 5.4% for 2019 and 10.1% for 2020 over the past 60 days. The stock has soared 44.3% year to date.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Seattle Genetics, Inc. (SGEN): Free Stock Analysis Report

Exact Sciences Corporation (EXAS): Free Stock Analysis Report

Original post

Zacks Investment Research