Everyone who believes risk has disappeared has fallen for the con.

Judging by this year's version of Santa Claus's reliable year-end stock market rally, risk has vanished, not just in stocks but in bonds, junk bonds, housing, commercial real estate, collectible art—just about the entire spectrum of tradable assets (with precious metals and agricultural commodities among the few receiving coals rather than rallies).

One of the maxims of this site is: risk cannot be made to disappear, it can only be cloaked, hedged or offloaded onto others. In other words, when the magician makes the white rabbit disappear, the physical rabbit does not in fact vanish; it is merely transported out of sight of the enthralled audience.

And so it is with risk in markets. Risk is now viewed as something that can be reliably sold as a more or less guaranteed source of easy profits. In the present-day perception that risk has been eradicated from the markets, it makes little sense to hedge against risk; hedging is a waste of capital when there's no risk in sight.

This suggests risk is either being cloaked and/or offloaded onto punters who aren't aware that risk is piling up in their portfolios. If risk is being masked, every participant is exposed to risk that is being hidden behind policies (the Fed has our back," etc.), statistics (everything's coming up roses everywhere) and the diminishing premium for hedges. If risk is being offloaded onto unsuspecting participants, then we must look to the poker table for guidance:

if you can't identify the marks, you're the mark. In other words, if we can't identify the chumps who have unknowingly accepted all the accumulated risk, then we're the chumps.

The successful con artist knows the marks want to believe the impossible, and so in essence they are begging to be conned. We all want to believe risk has vanished, because all the anxiety, uncertainty and the high cost of hedging all go away once risk has disappeared.

Everyone who believes risk has disappeared has fallen for the con. The tears of joy being shed as Santa Claus delivers his usual year-end rally may well become tears of shock, mourning and grief once the illusion that risk has been swept away is itself swept away.

To illustrate how risk is currently perceived, here is a chart of the VXX short-term volatility futures index: notice a trend here? How about a relentless two-year decline?

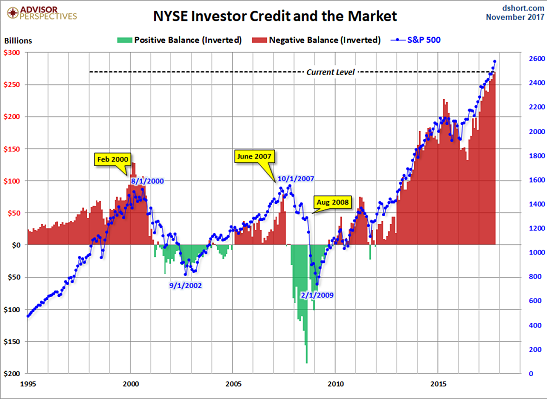

In the meantime, party hearty and borrow to the hilt (via margin) to buy more of all those risk-free assets in an apparently risk-free market:

A Look at NYSE Margin Debt and the Market (Advisor Perspectives)