After a one-day pause, the S&P 500 returned to rally mode. The index opened at its 0.20% intraday low, vaulted upward and then drifted to its 1.81% mid-afternoon high. It closed ninety minutes later with a trimmed gain of 1.23%. The popular financial press touted strong pre-market earnings (most notably from Caterpillar and 3M) as the rally trigger and blamed the afternoon fade on renewed Ebola worries (a doctor being tested in NY).

Looking ahead ... will Amazon's post-close earnings disappointment trigger a market struggle at tomorrow's open? Stay tuned!

The yield on the 10-year Note closed at 2.29%, up 4 bps from yesterday's close. The weekly average for the 30-year fixed mortgage was announced today at 3.92%, the lowest rate since early June of last year.

Here is a 15-minute chart of the past five sessions.

Volume on today's advance was relatively unremarkable -- slightly lower than on yesterday's advance.

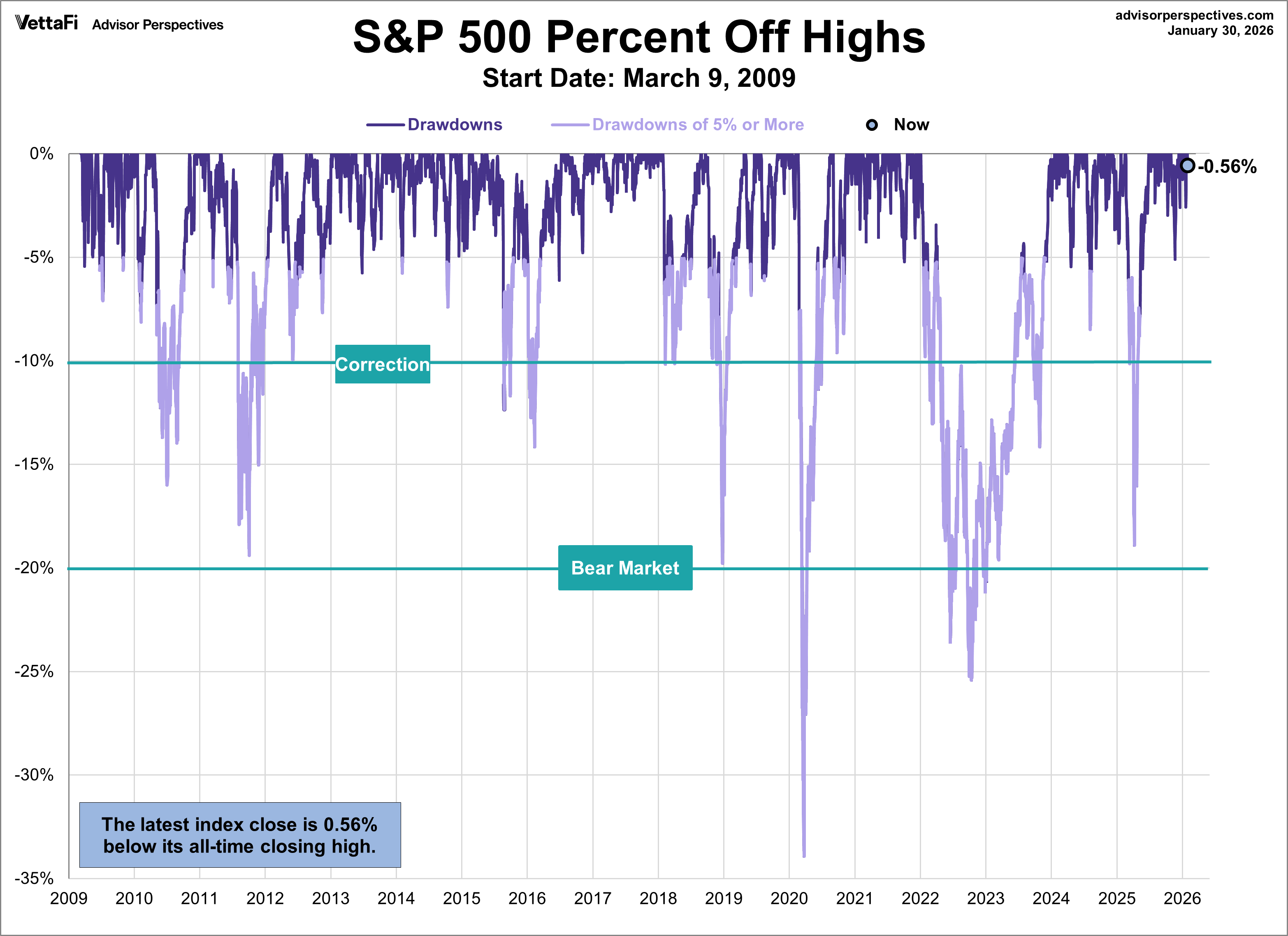

A Perspective on Drawdowns

How close were we to an "official" correction, generally defined as a 10% drawdown from a high (based on daily closes)? The chart below incorporates a percent-off-high calculation to illustrate the drawdowns greater than 5% since the trough in 2009.

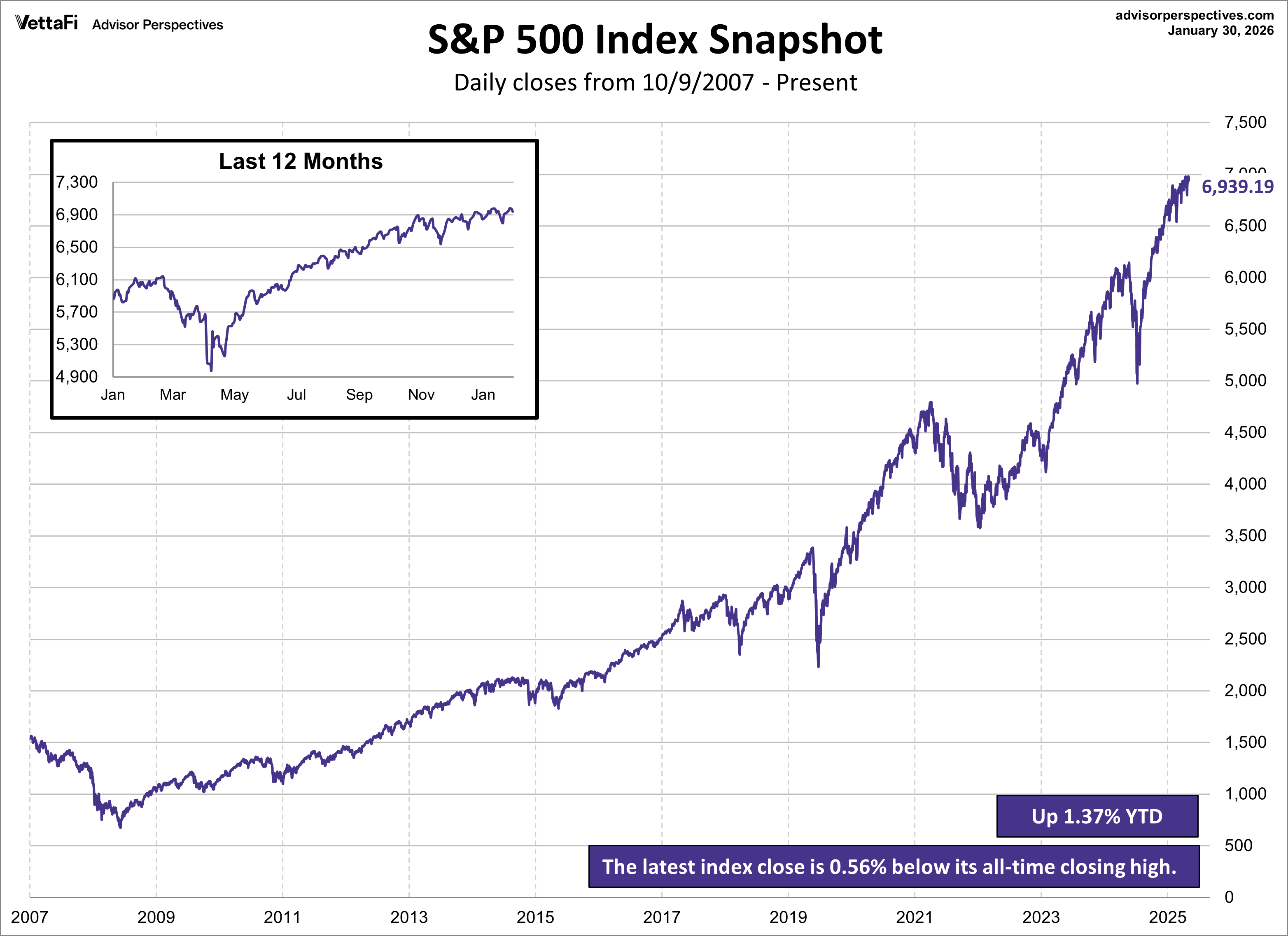

For a longer-term perspective, here is a pair of charts based on daily closes starting with the all-time high prior to the Great Recession.