Roper Technologies, Inc. (NYSE:ROP) yesterday announced that it agreed to acquire Exton, PA-based iPipeline. The transaction has been valued at $1.625 billion and will be settled in cash.

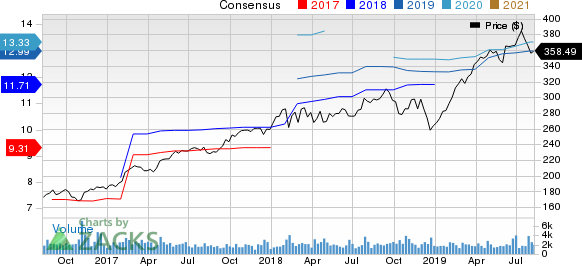

It is worth mentioning here that the company’s share price grew roughly 2.83% yesterday, closing the trading session at $358.49.

iPipeline is a provider of cloud-based software solutions to customers in the financial services and life insurance industry. The company’s services are used by roughly 1,350 financial institutions and distributors as well as 150 insurance carriers and 0.5 million agents.

Details of the Buyout

Notably, Roper intends on financing the all-cash buyout with funds raised from revolving credit facility and available cash. iPipeline’s brands and name will remain the same, post the completion of the buyout and will run under the leadership of CEO Larry Berran.

Roper believes that iPipeline’s efficient management team, solid customer base and customer retention policies will be beneficial. The buyout will help generate revenues of $200 million and free cash flow (after-tax) of $70 million in 2020. Also, cash accretion is predicted immediately from this buyout along with organic revenue growth in a high-single digit.

Subject to the receipt of regulatory approvals and fulfilment of closing conditions, Roper anticipates closing the transaction in the third quarter of 2019.

Strengthening Portfolio Through Buyouts

We believe that the above-mentioned transaction is consistent with the company’s policy of acquiring meaningful businesses to gain access to new customers, regions and product lines. In April 2019, Roper acquired Foundry, a specialist in providing software technologies. This buyout is predicted to generate revenues of $75 million in the first year of the completion.

It is worth mentioning here that acquired assets boosted Roper’s revenues by 2% in the second quarter of 2019.

Zacks Rank, Estimates and Price Performance of Roper

The company, with approximately $36.3-billion market capitalization, currently carries a Zacks Rank #2 (Buy).

In the past 30 days, earnings estimates for Roper have been improved. The Zacks Consensus Estimate for earnings is pegged at $12.99 for 2019 and $13.33 for 2020, suggesting growth of 0.4% and 1% from the respective 30-day-ago figures.

Roper Technologies, Inc. Price and Consensus

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE): Free Stock Analysis Report

Graham Corporation (GHM): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Original post