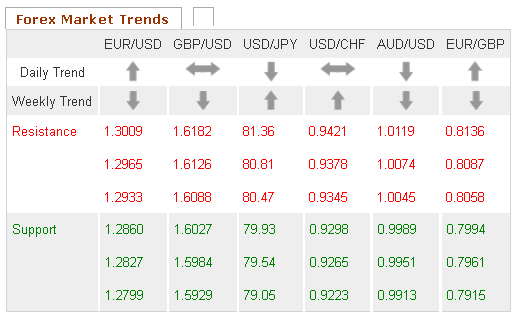

Following multiple failures by Greek politicians to form a new government, investors are now concerned about what impact a possible new election will have on Greece's status in the eurozone. The news weighed down on riskier currencies, particularly the euro, throughout Friday's trading session. The EUR/USD dropped to a fresh 3 ½ month low at 1.2903 before staging a slight correction to close out the week at 1.2917. Turning to this week, eurozone news is once again forecasted to dictate the direction the market takes. Any additional negative announcements out of Greece could drive the euro even lower against its main currency rivals.

Economic News

US Consumer Sentiment Gives Dollar A Boost vs. JPY

News that consumer sentiment in the US reached a more than four-year high gave the dollar a slight boost against several of its main rivals on Friday, including the Japanese yen. The USD/JPY was up close to 30 pips for the day, but was unable to break the psychologically significant 80.00 resistance level. Additionally, risk aversion in the marketplace helped the safe-haven dollar make substantial gains against the British pound throughout Friday's session. The GBP/USD fell over 75 pips over the course of the day to close out the week at 1.6067.

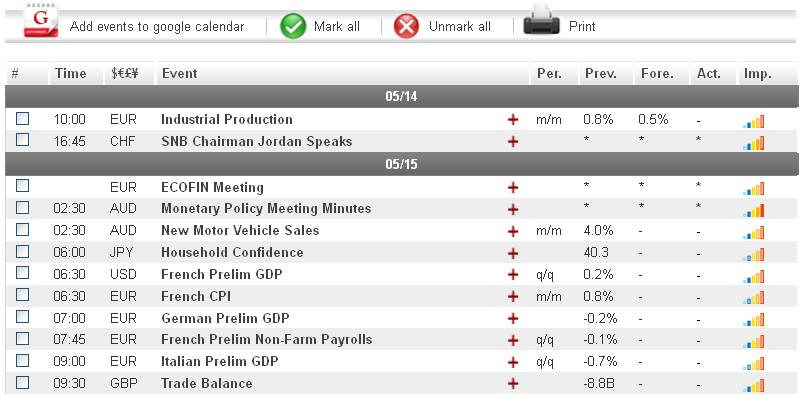

Turning to this week, a batch of potentially significant data out of the US is forecasted to generate volatility in the marketplace. Traders will want to pay attention to Tuesday's Retail Sales and Core Retail Sales reports. With both forecasted to come in below last month's figures, the dollar may take losses against the yen as a result. Additionally, Wednesday's FOMC Meeting Minutes could provide investors with clues as to any steps the Fed is considering taking to generate momentum in the US economic recovery. Any indication that a new round of quantitative easing is on its way could lead to heavy dollar losses against its safe-haven rivals.

Euro Continues To Fall Amid Greece Worries

The prospect of fresh elections in Greece combined with news that a leading US bank suffered a $2 billion loss due to a poor trading strategy, caused investors to shun riskier assets to close out last week's trading session. The euro took heavy losses as a result of the news, falling to a 3 ½ month low against the US dollar during early morning trading. That being said, the common currency was able to stage a recovery against the British pound, after dropping as low as 0.7995 during Asian trading. The EUR/GBP eventually closed out the week at 0.8037.

Turning to this week, traders will want to focus their attention on any announcements out of the eurozone. With the prospect of Greece exiting the eurozone turning more and more into a real possibility, the markets could see significant movement in the coming days. Traders will also want to note the results of several US economic indicators, scheduled to be released throughout the week. Should any of the news point to a further slowdown in the US economic recovery, investors may continue to shift their funds to safe-haven assets which could negatively impact the euro.

Aussie Resumes Bearishness Following Brief Gains

The Australian dollar saw brief gains during European trading on Friday before resuming its bearish trend against the safe-haven US dollar and Japanese yen. The AUD/USD was up over 50 pips in mid-day trading, reaching as high as 1.0076 before erasing its gains during the second half of the day. The pair eventually closed out the week at 1.0019. Against the yen, the AUD traded as high as 80.55 before staging a downward correction to finish Friday's session at 80.08.

This week, AUD movement is likely to come as a result of news out of the eurozone. In addition to the political uncertainty in Greece, analysts are also concerned about how the current crisis is going to affect already fragile economies in countries like Spain and Italy. Any signs that economic and political turmoil will spread to other countries in the region could result in heavy losses for riskier currencies like the aussie.

Negative International News Leads To Drop For Crude Oil

The price of crude oil fell once again on Friday as the combination of negative news out of the US, eurozone and China caused investors to abandon riskier assets. Following a brief spike during mid-day trading in which crude reached as high as $97.15 a barrel, the commodity resumed its bearish trend, eventually dropping to $95.60 to close out the week.

This week, crude traders will want to pay attention to a batch of US news, specifically Tuesday's retail sales reports and Wednesday's FOMC Meeting Minutes. Should any of the news point to a further slow-down in the US economic recovery, oil could continue falling as a result. In addition, any more political turmoil in the eurozone may lead to risk aversion in the marketplace in which case commodities like oil could drop further.

Technical News

EUR/USDThe weekly chart's Williams Percent Range has dropped into oversold territory, indicating that this pair could see upward movement in the coming days. This theory is supported by a bullish cross on the daily chart's Slow Stochastic. Opening long positions may be a wise choice for this pair.

GBP/USD

The Bollinger Bands on the daily chart are narrowing, indicating that this pair could see a major shift in price in the near future. That being said, most other long-term technical indicators are not providing clear signs as to what direction the shift will be. Taking a wait-and-see approach may be the best choice for this pair.

USD/JPY

A bullish cross on the weekly chart's Slow Stochastic points to a possible upward correction in the coming days. This theory is supported by a bullish cross on the daily chart's MACD/OsMA. This may be a good time for traders to open long positions.

USD/CHF

The Relative Strength Index on the daily chart is approaching the overbought zone, indicating that this pair could see downward movement in the near future. Additionally, the Williams Percent Range on the weekly chart has crossed above the -20 line. Traders may want to go short in their positions ahead of a possible bearish correction.

The Wild Card

USD/NOKA bearish cross on the daily chart's Slow Stochastic indicates that this pair could see downward movement in the near future. Furthermore, the Williams Percent Range on the same chart is in overbought territory. This may be a good time for forex traders to open short positions ahead of a possible downward breach.