The cycle of accumulation and distribution defines cause (building) within a broader mark down phase for copper. The flow of leverage and sentiment continues to describe a message of change. The majority, a group that believes central planners' policies manage the global economy (not the invisible hand) as directed or follows only price, will likely ignore or miss this message. This leaves the minority of independent thinkers tightening risk management and preparing for change.

A 25 basis point (bp) interest rate cut, the third reduction in six months that follows 100 bp reduction in the reserve requirement and unexpected revaluation of the yuan, extends a coordinated effort to spur global economic growth.

While coordinated 'stimulus' supports a countertrend rally of commodities foreshadowed by negative concentration discussed months ago, it won't reverse global capital flows regardless of the hype. Eventually, today's largely short covering move will peter out. Copper, an economically-sensitive commodity, should lead a cyclical downturn in the global economy.

Insights follows interplay of price, leverage, time, and sentiment (click for further discussion of reviews) to help recognize the transition from cause (building) to mark up or mark down for subscribers.

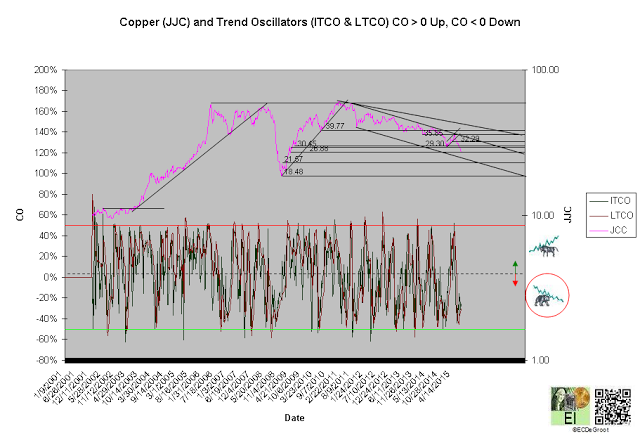

Trend

Negative trend oscillators define a down impulse and decline from 32.39 to 26.86 since the second week of June (chart 1). The bears control the trend until this impulse is reversed. Copper has yet to reach oversold (OS).

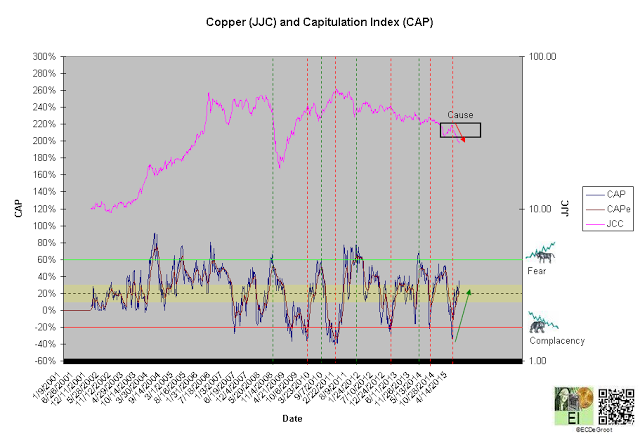

DI and CAP fell as low as -80% and -32% during mid May. These readings, indications of extreme distribution (bearish setups) and sentiment (complacency), significantly increased the probability of change of impulse (see leverage). A bearish crossover confirmed the change during the second week of June.

A weekly close below 29.60 broke the ice and transitioned the trend from cause to mark down. A weekly close above 29.60 therefore jumps the creek and returns the trend to cause. A close below 26.80 confirms continuation (of mark down).

Chart 1

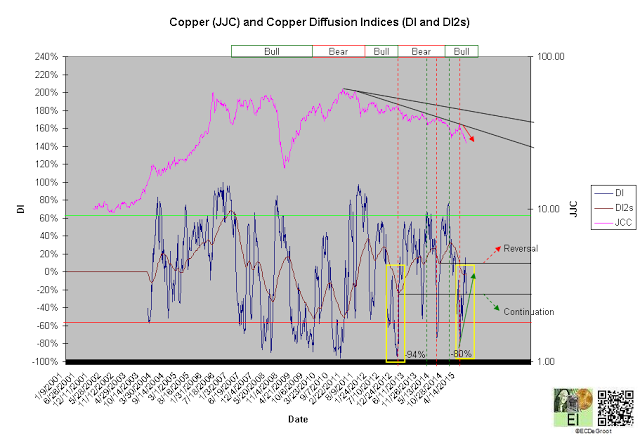

Leverage

The flow of leverage defines bull phase, a negative flow of leverage, since December 2014 (chart 2) A DI2 close above its September 2014 low reverses the phase. A DI2 close below its March 2013 low confirms continuation.

A diffusion index (DI) of -22% maintains a bearish bias within a declining trend; this is bearish as DI most often rises as price declines. A capitulation index (CAP) of 36% within a trend of growing fear supports DI's bearish message until it climbs above 50% (chart 2A). These trends, the flow of leverage and sentiment from distribution to accumulation and complacency to fear, support the bears that shorted June's bearish crossover (see trend).

The tendency for setups (bullish and bearish) to cluster could generate additional shorting opportunities into September. The yellow boxes highlight this tendency (chart 2).

Chart 2

Chart 2A

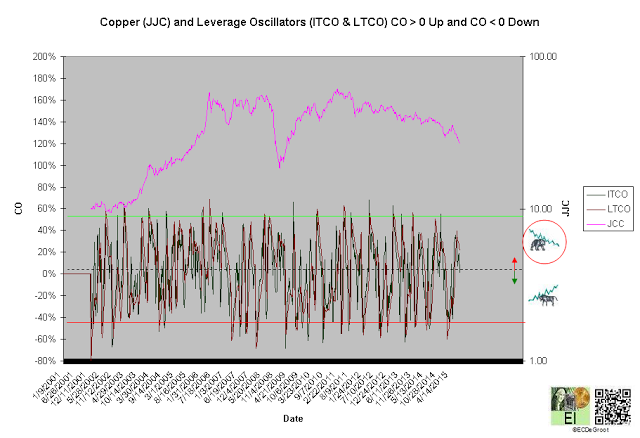

Positive leverage oscillators define an up impulse that opposes the bull phase and supports the bear trend (chart 3).

Chart 3

Time/Cycle

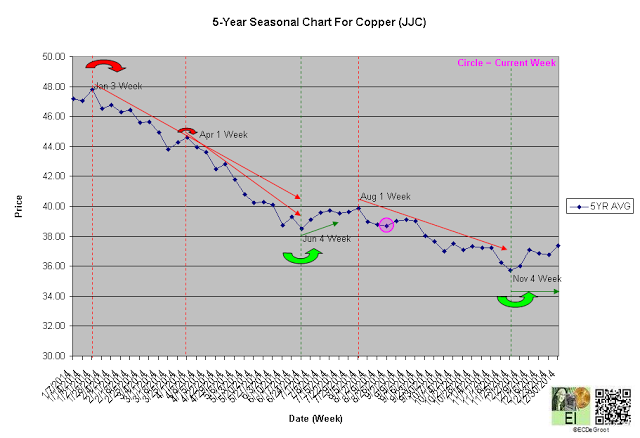

The 5-year seasonal cycle defines weakness until the fourth week of November - the fall transition (chart 4). Cause building, churn or sideways chop, could generate additional bearish setups or clusters (see leverage) necessary to fuel a more organized decline into the fall transition.

Chart 4