I have often stated, “If you can’t beat ’em, join ’em.” In doing so I’ve had to quiet more times than not the “trader” in me. Why? Because the trader has emotions and emotions can interrupt the decision processes, by hesitating. Computers, on the other hand, don’t hesitate. They have their marching orders and execute them. As “traders” we need to understand that there are a myriad of algorithms in operation firing off orders at all times conceivably in all traded markets. Add to that the myriad of strategies that are at play via the myriad of algorithms in operation firing off orders at all times conceivably in all traded markets. Get the picture? To be successful in trading you really can’t care about the “who, what, where, when or why.” Remember it’s only a number. And many relevant numbers are being processed simultaneously and disseminated to massive amounts of servers across the globe operating algorithms written by MIT graduates. The amount of $’s flying around the world in need of a temporary resting place is substantial. And at the moment, the sheer volumes bring opportunities some will say come every 4 years as the battle for political control in the U.S. continues in a perpetual state of transition. Having the right mindset has become critical to succeeding. Getting caught up in all the hubris taking place within the current election cycle is important to pay attention to, but don’t fall into that abyss.

I don’t have an opinion of the markets that I choose to trade. For the most part, I’ve stopped thinking about the necessity to understand what fair value for the underlying should or shouldn’t be. I think of “cents” instead of the “dollars” and the probability and random variable theory as measured by volatility.

As I’ve previously discussed, anticipating versus participating becomes heavily favored towards participating. Opportunities are abundant across a wide variety of tradeable markets and are likely to remain in their various forms of “transition” through the balance of 2016. It isn’t easy to just step into a market that you haven’t traded before based purely on computer generated signals. But when trading in tune with the volatile price swings, the rewards are extremely encouraging. While there are “traders” in all of us the concept of “removing the human factor” can’t be total. The input will always be traceable back to a human being. Therefore, I’ve had to embrace the 21st century and abandon the reality of the trading floor and accept the realities of a virtual trading floor, which is, for the most part anonymous.

I am resolved in accepting the direction that my trading has taken by shifting from primarily trading options to primarily trading futures. Since I’ve kept close tabs on the “economic pecking order” and with, interest rates sitting at the top from which everything else flows into and out of, I’ve been able to get comfortable trading futures. Currently in “pecking order” this includes futures on bonds, US$/EUR, (6E), precious metals, and stock indices. I’m looking to re-engage trading within the forex markets as well.

The discussion will continue...

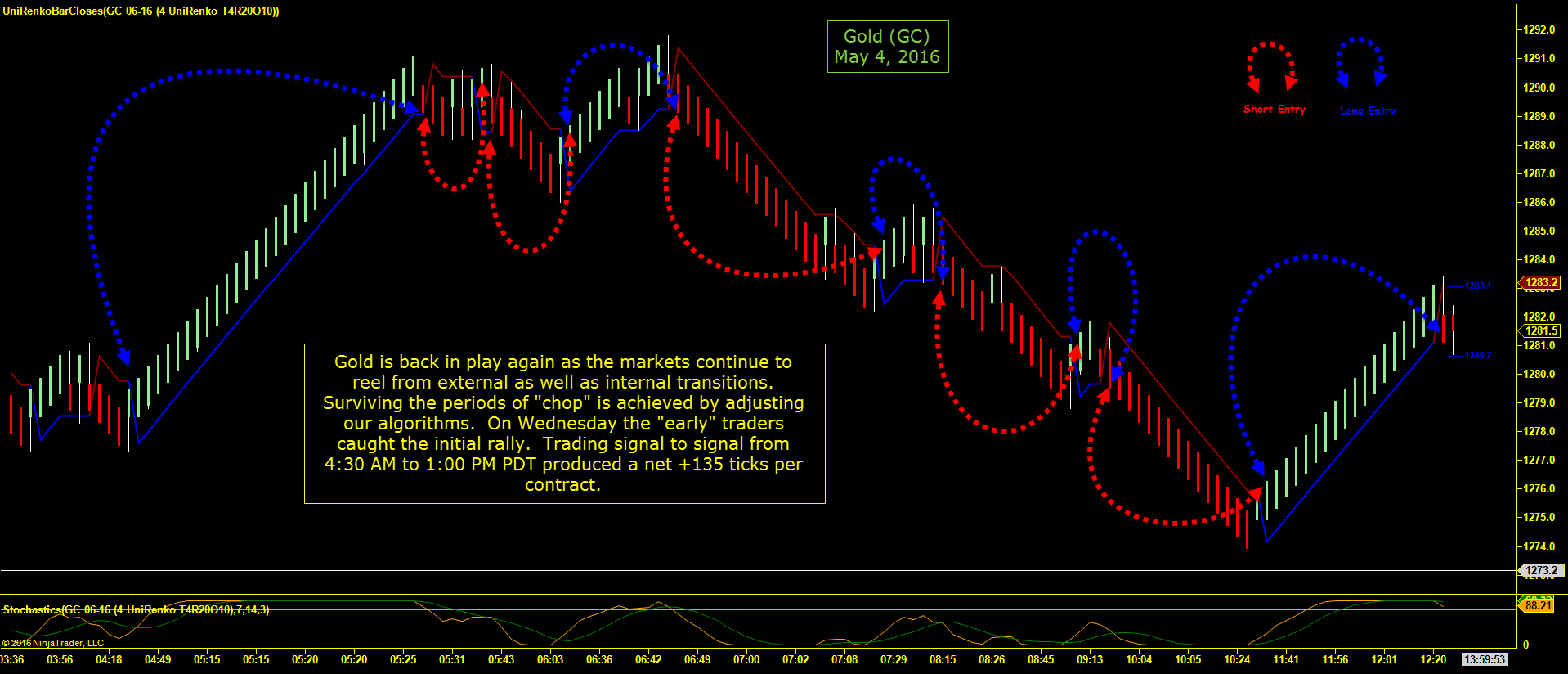

Gold has come back into play over the past week or so as global markets move in tandem with the US $ against the euro and the yen. With volatility getting kicked up several notches the opportunities for “runners” of 20 to 50 ticks is occurring with more regularity. I would anticipate that this will remain the case as the US dollar is pulled into the global transitions happening within China, Japan, and the European Union.

Check out the chart for today’s trades and discussion.