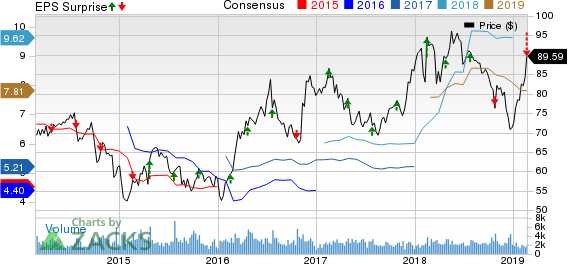

Reliance Steel & Aluminum Co. (NYSE:RS) posted profit of $85.6 million or $1.22 per share in the fourth quarter of 2018, down roughly 72% from $301.4 million or $4.09 in the year-ago quarter. The bottom line in the reported quarter was hurt by a hefty LIFO inventory expense.

Barring one-time items, adjusted earnings were $1.08 per share for the reported quarter, which fell from $1.22 in the prior-year quarter. The figure also missed the Zacks Consensus Estimate of $1.71.

Reliance Steel recorded net sales of $2,814 million, up around 18% year over year. It beat the Zacks Consensus Estimate of $2,765.3 million. The company witnessed a healthy demand environment and stable metal pricing conditions during the quarter.

FY18 Results

For 2018, profits were $633.7 million or $8.75 per share, up around 3% from $613.4 million or $8.34 recorded in 2017.

Net sales for the year went up around 19% year over year to record $11,534.5 million on the back of favorable pricing and healthy demand.

Volumes and Pricing

Overall sales volume went down 1.6% year over year to around 1.43 million tons in the reported quarter. Average prices per ton sold for the quarter rose around 20% year over year to $1,965.

Financials

Reliance Steel ended 2018 with cash and cash equivalents of $128.2 million, down roughly 17% year over year. Long-term debt was $2,138.5 million, up 18% year over year. Cash flow from operations was $431.3 million for the fourth quarter and $664.6 million for 2018.

The company repurchased 6.1 million shares worth record $484.9 million in 2018. As of Dec 31, 2018, it had roughly 7.03 million shares available for repurchase under its share repurchase program.

Reliance Steel also raised its quarterly dividend by 10% to 55 cents per share.

Outlook

Moving ahead, Reliance Steel is optimistic about business conditions for the first quarter of 2019. It expects demand to be healthy in the first quarter and projects tons sold to be up 6-8% sequentially in the quarter.

The company also expects price hikes for many of its products based on current demand levels, impact of ongoing trade actions and raw material costs. However, it expects average selling price per ton for the first quarter to be flat-to-down 1% compared with fourth-quarter tally. Per the company, the expected price hikes will not be effective for the full quarter and its average selling price trended downward during each month of fourth-quarter 2018.

Additionally, the company expects adjusted earnings per share in the band of $2.35 to $2.45 for the first quarter based on an expected LIFO income and benefits of lower number of total shares outstanding due to share buybacks in 2018.

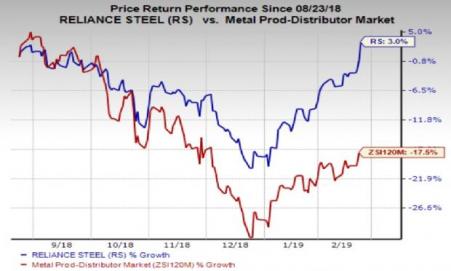

Price Performance

Reliance Steel’s shares gained 3% in the past six months, outperforming the industry’s 17.5% decline.

Zacks Rank & Stocks to Consider

Reliance Steel currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks worth considering in the basic materials space include Kirkland Lake Gold Ltd. (TO:KL) , Israel Chemicals Ltd. (NYSE:ICL) and The Mosaic Company (NYSE:MOS) .

Kirkland Lake Gold has an expected earnings growth rate of 20.9% for the current year and carries a Zacks Rank #1 (Strong Buy). Its shares have surged 131% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Israel Chemicals has an expected earnings growth rate of 10.8% for the current year and carries a Zacks Rank #2 (Buy). The company’s shares have rallied around 25% over the past year.

Mosaic has an expected earnings growth rate of 23.4% for the current year and carries a Zacks Rank #2. Its shares have gained 15% in the past year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Israel Chemicals Shs (ICL): Free Stock Analysis Report

The Mosaic Company (MOS): Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS): Free Stock Analysis Report

Kirkland Lake Gold Ltd. (KL): Free Stock Analysis Report

Original post

Zacks Investment Research