With the official creditors on their way back shortly to Athens, there is a sense that a repeat of the 2015 crisis can be avoided. There is a collective sigh of relief. The generic 2-year yield was pushing around 10% in the last couple of weeks and now is at 8.16%, the new low for the month. The generic 10-year yield reached 8.1% at the end of last week and is now 7.22%, also new lows for February.

To be sure, Greece is not getting another tranche of aid, but it doesn't really need it until closer to July when a large debt servicing bill comes due. Still, there appears to be a window of opportunity, and several European finance ministers want to shift the focus from budget cuts to structural reforms. The tax system, pensions, and the labor market are the focus of such efforts.

However, reports suggest that if the pressure on Greece is somewhat lower, it may intensify on Italy. As early as today, the EC may press Italy harder, and perhaps even threaten action if it does not implement measures to reduce its debt. Italy's debt-to-GDP ratio reached 132.8% last year and is set to rise to 133.3% this year if everything goes according to plan. Ironically, there may be concerns Italy's debt is not sustainable, but the EC argues against the IMF that Greece's debt (~180% of GDP) is sustainable.

Earlier this month, Italy promised measures to reduce its structural deficit by 0.2% of GDP. The measures are to be implemented by the end of April. The soon-to-be-issued warning is a reminder of Italy's commitment. Italy's structural deficit appears to be moving in the wrong direction. It was 1.0% (of GDP) in 2015 and rose to 1.6% last year. It is set to rise to 2.0% this year and 2.5% next year.

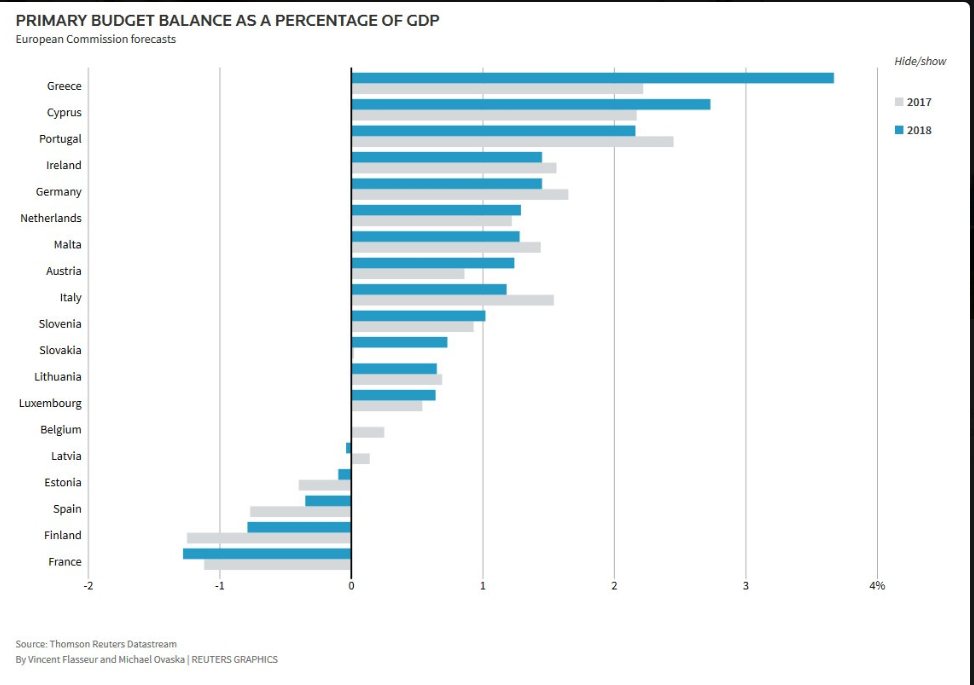

The Great Graphic below was compiled by Thomson Reuters. It shows the projections of primary budget balances for EMU members according to the EC. This is a different measure than the structural deficit. The primary balance is the budget balance excluding debt servicing costs.

There are four countries that seem problematic but do not appear to be the subject of much pressure. France sticks out like a sore thumb. It is the only eurozone member where a larger primary budget deficit in 2018 than this year is forecast. Note Finland, Spain, and Estonia also continue to record primary deficits. There may be several reasons why Spain is growing faster than Italy. Often, PM Rajoy's labor reforms and earlier efforts to address banking system problems are cited. Spain's primary budget deficit this year is in a modest deficit, while Italy is expected to report among the largest primary surpluses among EMU members this year.