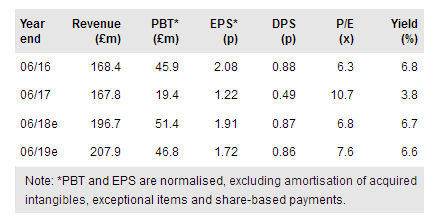

Notwithstanding a reclassification of both Uitkomst and Phoenix as ‘discontinued operations’ in FY17, PAF’s net profits of £17.9m were within 3% of our estimate, while the proposed dividend was exactly in line. Notable variances compared with our prior expectations included the tax charge, which was materially lower and approximately balanced an equal and opposite deterioration in ‘other income’. All told, the group produced 173koz of gold during the period at a cash cost of US$986/oz.

FY17 a transition year

FY17 represented a transition year for Pan African Resources Plc (LON:PAFR) at a time when the rand demonstrated unusual strength against both the US dollar and sterling. Non-core assets, such as Uitkomst and Phoenix have been sold, while Evander underwent a major refurbishment that occasioned a two month suspension of mining and processing. Now, however, the spate of DMR Section 54 stoppage notices that has afflicted the industry over the course of the past two years shows signs of abating at the same time that Pan African is developing its next major project, Elikhulu (which is now fully funded and permitted), and putting in place an active strategy to manage the periodic low grade mining cycle at Evander. At the same time, it has completed a feasibility study on a sub-vertical shaft at Barberton’s Fairview mine and is progressing one on Evander Mines’ 7 Shaft No. 3 Decline and 2010 Pay Channel, which is expected to be concluded in the first quarter of CY18.

To read the entire report Please click on the pdf File Below: