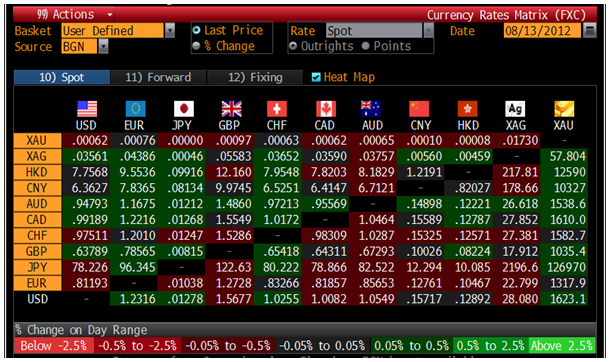

Today's AM fix was USD 1,622.25, EUR 1,317.30, and GBP 1,035.33 per ounce.

Friday’s AM fix was USD 1,608.50, EUR 1,310.92 and GBP 1,030.69 per ounce.

Gold rose $2.70 or 0.17% in New York on Friday and closed at $1,620.40/oz. Silver fell and then recovered to $28.32, but finished on Friday in New York with a loss of just 0.4%.

For the week, gold rose 1.1% and silver rose 1.2%.

Gold inched up again on Monday, continuing the climb for its 7th session as world economies falter – increasing the likelihood of further central bank policy action – which may again prove futile.

The yellow metal will become sought out by investors as an inflation hedge when quantitative easing is pursued again and huge amounts of money are again dumped into the financial system in what seems like an increasingly vain attempt to stimulate growth.

In line with China’s poor data on Friday, Japanese data earlier today showed that their economy slowed greater than expected in 2Q.

Gold and silver markets have been extremely subdued of late with Bloomberg terminals abandoned in favour of the marvellous spectacle that was the London Olympics. Many traders, decision makers and institutional participants were off on holidays and or enjoying watching the Olympics.

The precious metals have been strangely becalmed despite significant volatility being seen in stock markets. Economic data has been poor and largely gold positive and this could result in a bout of buying with the return of important market participants.

The distracting spectacle of the Olympics may have led to market complacency and the cocktail of macro risks and geopolitical risks such as the eurozone debt crisis and events in Syria and Iran could lead to the Olympic calm giving way to a volatile and stormy Fall.

It is important to note that markets were also unusually calm during the two weeks of the Chinese Olympics in 2008. The 2008 Summer Olympic Games took place slightly later in August than the London Olympics – starting August 8 and ending August 24.

Only days after the ending of the Chinese Olympics came massive market volatility in September and then seven months of market turmoil.

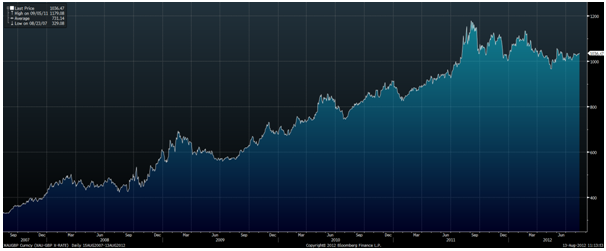

Similarly to this Olympic year, in Olympic year 2008, gold traded sideways to down in a period of consolidation prior to further gains. Gold bottomed in September 2008 in euro and sterling terms.

Another brief bout of dollar strength saw gold bottom in November 2008 in dollar terms.

Besides the eurozone crisis (and the significant risk of the German Constitutional Court deciding on September 12th to reject the recently cobbled together alphabet soup response to the crisis (ESM etc etc) and significant instability in the Middle East, there is also the not inconsequential risk from the US Presidential campaign and the upcoming "fiscal cliff."

These factors should see gold well supported again in the coming months.

NEWSWIRE

(Bloomberg) -- Syria Government Relaxes Tax on Pure Gold Imports, State TV Says

Syrian President Bashar Al-Assad announced measures facilitating imports of pure gold, Syrian state-run television said.

All custom duties and storage, insurance and administrative costs levied on gold imports will be replaced by a single fee of $100 per one kilogram, the channel said citing a presidential decree today.

Pure gold imports no longer require a special permit and travelers are allowed to bring the metal with them into the country, it said.

(Bloomberg) -- Economist Dennis Gartman Says He’s Buying Gold Priced in Pounds

Economist Dennis Gartman is adding to his gold position by buying the metal priced in British pounds, he wrote today in his daily Gartman Letter.

(Bloomberg) -- Gold Traders Trim Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators decreased their net-long position in New York gold futures in the week ended August 7, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 115,500 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 10,564 contracts, or 8 percent, from a week earlier.

Gold futures rose this week, gaining 0.8 percent to $1,622.80 a troy ounce at today's close.

Miners, producers, jewelers and other commercial users were net-short 146,418 contracts, down 9,594 contracts, or 6 percent, from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

(Bloomberg) -- Silver Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York silver futures in the week ended Aug. 7, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 13,680 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 644 contracts, or 5 percent, from a week earlier.

Silver futures rose this week, gaining 0.9 percent to $28.06 a troy ounce at today's close.

Miners, producers, jewelers and other commercial users were net-short 21,852 contracts, an increase of 490 contracts, or 2 percent, from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

(ABC) -- UBS buys stake in Silver Lake Resources

Swiss bank banker UBS has bought a 5 per cent share in Kalgoorlie-based gold producer Silver Lake Resources.

At the Diggers and Dealers conference in Kalgoorlie, Silverlake announced it intends to buy fellow Goldfields miner Integra Mining for $426 million. The new entity would produce about 200,000 ounces of gold a year.

(Bloomberg) -- Gold ETP Holdings Climb to Record 2,417.32 Metric Tons

Gold holdings in exchange-traded products backed by the metal rose 4.82 metric tons to a record 2,417.32 tons, data tracked by Bloomberg showed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Olympic Calm Before Coming Financial Storm

Published 08/14/2012, 01:46 AM

Updated 07/09/2023, 06:31 AM

Olympic Calm Before Coming Financial Storm

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.