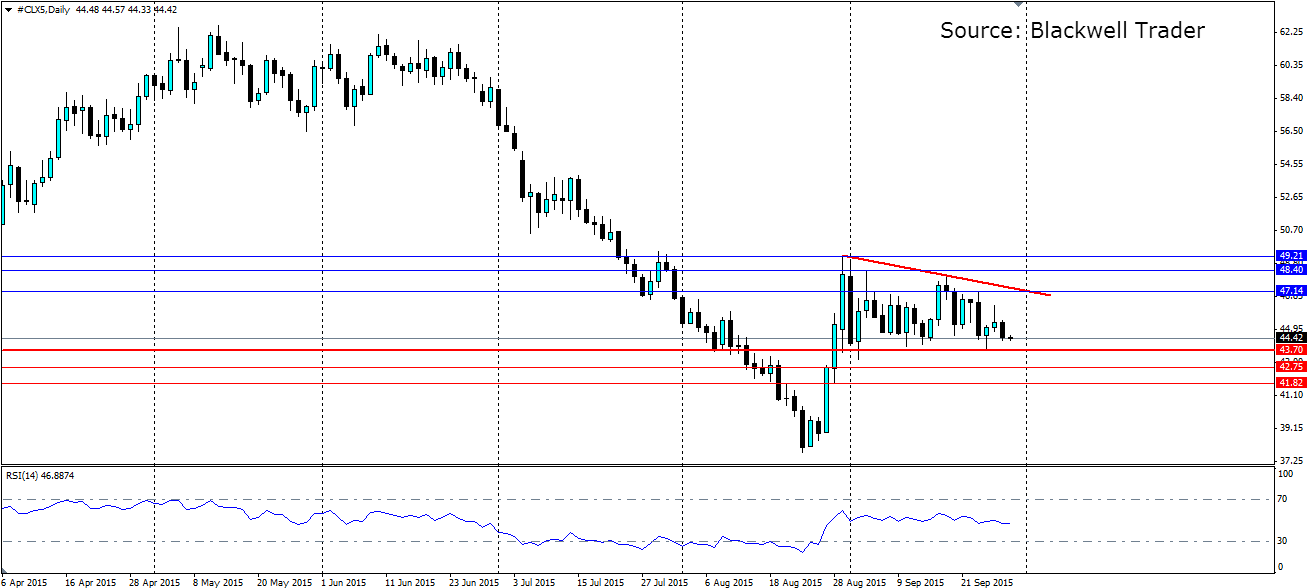

Oil has been respecting the current range for the past month, although the highs are getting lower. In recent days it has been pushed back to the bottom of the range where the bulls will be lined up to defend the support level.

Oil has found solid support along the bottom of the range around the $43.70 a barrel level, with several rejections higher off it. The range extends as high as $49.30 a barrel, however each subsequent high has been getting lower. The weakness is coming on the back of the usual supply and demand concerns.

On the demand side, China continues to provide the bulk of the concern. Growth in the second largest nation has been downgraded by several economic watchers over the last two weeks with the latest coming out of Japan. The Japan Centre for Economic Research estimates that Q2 GDP in China slumped to as low as 4.8%, well below the official figure of 7%.

On the Supply side, the glut in reserves still persists and is expected to do so for some time to come. Last week saw a draw in reserves of almost 2 million barrels, which is a little bit of a surprise. However, US production is showing no signs of slowing despite predictions earlier in the year suggesting it would. The rig count is down, however, efficiencies have been made which has kept production relatively stable, with a reduced cost base. This should help many of the US producers to weather the storm, but also means a lower long term price.

Another factor to consider is the upcoming refineries stand down this month and next. Refiners schedule maintenance for September and October as they transition to winter-grade fuel from summer-grade fuels. As refineries demand less crude and while production continues, stockpiles will grow which will put pressure on prices. U.S. refineries enter planned seasonal as the federal government requires different mixtures in the summer and winter to minimize environmental damage.

From a technical perspective, the range is clear. The tops are getting lower which indicates a consolidation that the bears are winning. There is no urgency when it comes to the squeeze, so the range could be respected for several more weeks to come.

RSI is sitting in a very neutral position, with a slight bearish bias on it. This leaves the door open for a downside breakout, should the support fail. The likely scenario, however, is a continuation of the current range, so a move back up towards the resistance at $47.14 could be seen in the next few days. Look for further support beyond the $43.70 mark to be found at 42.75 and 41.82 while resistance will be found at 47.14, 48.40 and 49.21 with the top of the range acting as dynamic resistance.