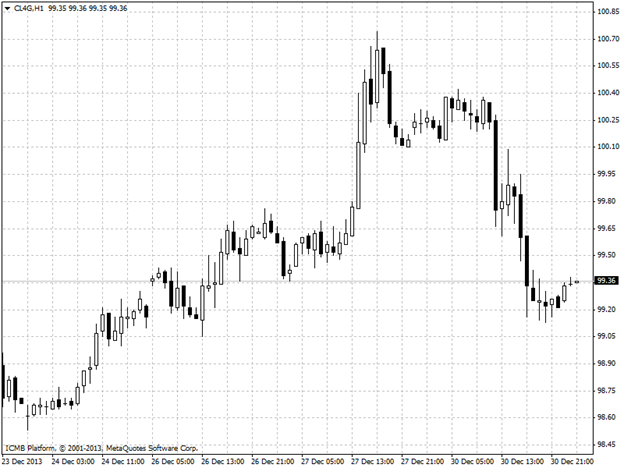

CL

Crude Oil slipped below $100 a barrel on speculation prices raised more than justified last week and with U.S. inventories near a record high for this time of the year. Futures dropped the most in two weeks, paring the biggest monthly gain since July, after rising six of the previous seven sessions to a two-month high of $100.32 on Dec. 27. Energy Information Administration data showed stockpiles at the second-highest level for mid-December in more than 30 years of data. Brent dropped as Libya resumed production in a field. “The market was really rallying last week and now we are coming down to earth,” said Phil Flynn, senior market analyst at the Price Futures Group in Chicago. “The market got ahead of itself. U.S. inventories are still at a pretty high level.

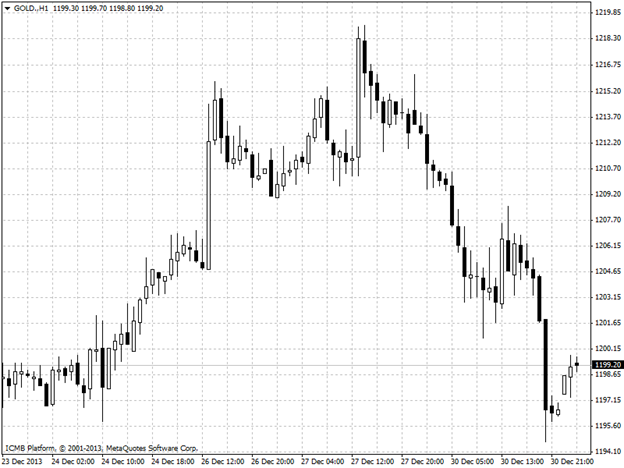

GOLD

Gold prices dropped on Monday after investors shrugged off soft U.S. housing figures and sold on concerns years of support from the Federal Reserve via monetary stimulus tools will be winding down in 2014. The National Association of Realtors reported earlier that its pending home sales index increased by a seasonally adjusted 0.2% in November, far shy of market expectations for a 1.0% gain. Pending home sales for October were revised to a 1.2% decline from a previously reported drop of 0.6%. The disappointing data sent the greenback falling, wiping out gains locked in when the Federal Reserve announced it would trim USD10 billion from its USD85 billion in monthly bond-buying purchases beginning in January. The Fed has said it may taper the program even more should data show that economic recovery is gaining steam while adding soft patches could prompt the U.S. central bank to hike up monthly bond purchases to ensure price and labor-market stability. Still, gold futures suffered on sentiments that Fed bond purchases, which support gold by bolstering its image as a hedge to a weaker dollar, will scale back sooner rather than later, ending a multi-year rally fueled by monetary support.