It was a week where oil prices rebounded from their 6-year lows and natural gas rallied too. On the news front, Schlumberger Ltd. (NYSE:SLB - Analyst Report) kicked off the earnings season with a healthy beat.

Overall, it was a bullish week for the sector. West Texas Intermediate (WTI) crude futures snapped a seven-week losing streak and inched up 0.7% to close at $48.69 per barrel, while natural gas prices gained 6.1% to $3.13 per million Btu (MMBtu). (See the last ‘Oil & Gas Stock Roundup’ here: Chevron Strikes Oil in GoM, BP Loses Appeal on Gulf Spill Fines.)

Oil prices finally halted their weekly losses and ended higher on Friday after Paris-based International Energy Agency (IEA) said that the ongoing crude rout would ultimately curb the supply growth from producers outside the OPEC cartel. This, according to the energy-monitoring body of 28 industrialized countries, will spur black gold’s recovery in the second half of 2015.

Natural gas fared even better on expectations of cranked up heating demand with forecasts of cooler weather across the key U.S. markets during the late-Jan early-Feb period.

Recap of the Week’s Most Important Stories

1. The world’s largest oil field services provider Schlumberger Ltd. reported adjusted fourth-quarter 2014 earnings of $1.50 per share (excluding special items), beating the Zacks Consensus Estimate of $1.47. Full-year 2014 earnings from continuing operations were $5.57 a share, which were ahead of the Zacks Consensus Estimate of $5.55 and up from $4.75 earned last year.

The quarter’s bottom line increased by a penny from the prior-year quarter. The results were boosted by the company’s strong international exposure, focus on execution and its integration capabilities. However, the steep fall in the oil price, and the unrest in Libya and Iraq adversely impacted the results. (See More: Schlumberger Beats Q4 & Full-Year Earnings, Revenues Miss.)

2. Integrated energy major Royal Dutch Shell plc (NYSE:RDS.A- Analyst Report) announced that it will not move ahead with the Al Karaana petrochemicals project and will suspend further works on it. The company added that the project has become commercially unfeasible with evaluations indicating high capital costs. The current weakness in the energy sector further supports this view.

The project, a joint venture of Shell and Qatar Petroleum, was started in Dec 2011 with the signing of a Heads of Agreement (“HOA”) between the two. The companies had contemplated the construction a new world-scale petrochemical facility in the Ras Laffan Industrial City, north of Qatar. Shell has a 20% stake in the project while Qatar Petroleum holds the remaining. (See More: Shell Shuts Al Karaana Project due to High Capital Costs.)

3. Independent oil and gas company Range Resources. (NYSE:RRC - Analyst Report) revised its capital budget and production growth outlook for 2015. The company lowered its capital spending budget to $870 million from the previous $1.3 billion to cope with the relentless fall in oil prices. Also, the company now targets 20% year-over-year production growth for 2015 instead of 20–25% projected earlier.

For 2014, Range Resources expects total production growth of about 24% with estimated output of 1.16 billion cubic feet equivalent (Bcfe) per day. Fourth-quarter production volumes are projected at about 1.27 Bcfe per day, with 31% liquids. Range also announced a multi-year contract to sell ethane of 5,000 barrels per day, representing half of its existing committed transportation volume, through the ATEX pipeline. (See More: Range Resources Cuts 2015 Budget & Production Guidance.)

4. Exxon Mobil (NYSE:XOM - Analyst Report) affiliate Exxon Mobil PNG Ltd. has inked an agreement with the government of Papua New Guinea (“PNG”) to provide about 20 million cubic feet per day of domestic natural gas for two decades. Exxon Mobil PNG Ltd. operates the PNG LNG Project.

The agreement is in line with the government’s strategy to increase the capacity and consistency of the country’s power supply. It also facilitates a long-term supply of natural gas to sustain Port Moresby’s urgent power generation requirements. The residual gas supply will be used to feed a new state-owned gas-fired power generation unit anticipated to be situated near the LNG Plant outside of Port Moresby. (See More: Exxon Mobil Progresses with PNG LNG Field Development.)

5. Oil refiner and marketer Western Refining Inc. (Western Refining Inc (NYSE:WNR- Analyst Report) declared that it has added 31 retail stores in southern Arizona. With this, the total number of retail units in the region has increased to 261.

Western Refining has entered into a lease agreement for the stores. The company added that previously the units were operated by Reay's Ranch, which primarily owns and manages retail locations. Western Refining will now sell various kinds of fuel from the stores under its own brand. (See More: Western Refining Includes 31 Units to its Retail Chain.)

Price Performance

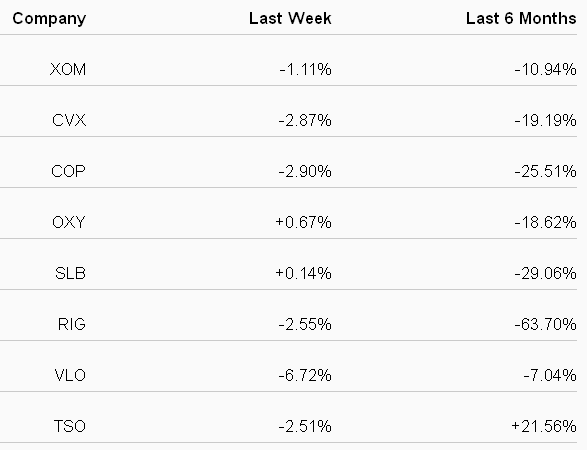

The following table shows the price movement of the major oil and gas players over the past week and during the last 6 months.

Over the course of last week, most of the market heavy weights witnessed losses with the major sufferer being Valero Energy (NYSE:VLO) - Analyst Report). The downstream operator fell 6.7% during the period with the elimination of the so-called ‘Brent-WTI spread, a measure of refinery profitability.

Over the last 6 months, Tesoro (NYSE:TSO) – another refiner – has been the major gainer on the bourses with its shares advancing 21.6%. Investors have rewarded the company for its continued focus on shareholder returns. On the other hand, offshore driller Transocean (NYSE:RIG- Analyst Report) was the laggard, as it witnessed a 63.7% price decline over the same time frame on the back of rig oversupply that has led the industry into a cyclical downturn.

What’s Next in the Energy World?

Apart from the usual releases in this week – the U.S. government data on oil and natural gas – market participants will be closely tracking a series of crucial economic reports, including those on CPI, industrial production and housing.