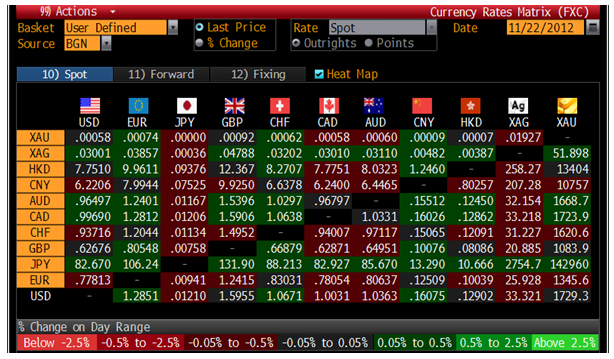

- Today’s AM fix was USD 1,729.75, EUR 1,344.23, and GBP 1,084.35 per ounce.

- Yesterday’s AM fix was USD 1,726.75, EUR 1,350.71, and GBP 1,085.05 per ounce.

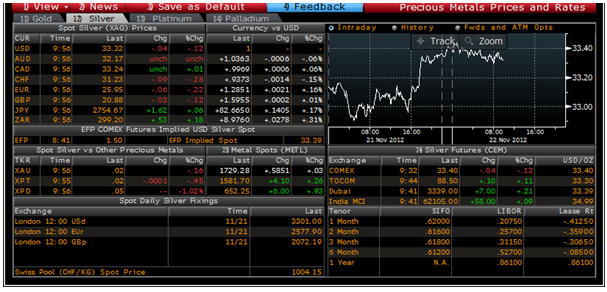

- Gold inched up $1.50 or 0.09% in New York yesterday and closed at $1,729.20. Silver surged to a high of $33.378 and finished with a gain of 0.51%. Gold is now some 1% higher for the week and silver nearly 3% higher for the week and higher weekly closes will be bullish from a technical perspective.

- Gold priced in Japanese yen rose to a nine-month high this morning at 143,262 yen/oz and is on track for its biggest weekly rise since February, up 2.8% according to Reuters.

- The yen came under heavy pressure from growing speculation that the Bank of Japan would aggressively ease monetary policy in the coming months.

- Gold trading is quiet with the US markets closed for the Thanksgiving holiday today and the early close tomorrow.

Given the degree of uncertainty in the world -- from the Middle East to Greece and the Eurozone debt crisis to the US fiscal cliff -- most traders will be reluctant to take sizeable positions long or short and lacklustre, directionless trading may continue.

However, any of these risks could lead to a sudden spurt of safe-haven buying that leads to gold eking out gains this shortened week.

The Austrian central bank keeps most of its 280 metric tons of gold reserves in the United Kingdom, Vice Governor Wolfgang Duchatczek was quoted as saying in the finance committee of the country’s parliament today, according to Bloomberg.

Answering lawmakers’ questions, Duchatczek said 80%, or 224.4 metric tons of the metal was stored in the U.K., 17% or 48.7 metric tons in Austria and 3% in Switzerland, according to a summary of a closed-door committee meeting provided by the parliament.

The reserve has been unchanged since 2007, Duchatczek was quoted as saying. The central bank has earned 300 million euros ($385 million) over the last ten years by lending the gold, he said.

Goldman Sachs is bullish on silver in 2013 and believe it will rise in price.

Silver is seeing strong investment demand due to high inflationary pressures, monetary easing and low interest rates, Goldman Sachs said in a note on silver stocks.

High silver prices in recent years have led to increased supply from mine production and old silver scrap.

Goldman noted that world silver supply grew by just 2.2% in 2012, driven by a 3% gain in mined production and a 1% increase in scrap supply.

Gold is poised to rise above $2,000/oz next year according to Merrill Lynch Wealth Management.

They are wary of industrial metals and say that the lack of clarity on demand outlook and policies in China dim prospects for industrial metals.

NEWSWIRE

(Bloomberg) -- German Household Heating Oil Stockpiles Rise to 59.5% in October

German household heating oil tanks were 59.5 percent full last month, compared with 58.4 percent in September, according to data from Ipsos Loyalty GmbH.

Commercial inventories were at 41.6 percent in October, down from 43.8 the previous month, the data showed. Germany is Europe’s largest market for heating oil.

(Bloomberg) -- Gold Futures in Shanghai Rise; Silver Futures Reach 6-Week High

June contract gains as much as 0.5% to 353.26 yuan/gram on the Shanghai Futures Exchange. Contract trades at 353.05 yuan at 9:02 a.m. Singapore time, climbing for the third time in four days. Jan-delivery silver advances as much as 1.4% to 6,938 yuan/kg, most expensive since Oct. 12. Cash bullion of 99.99% purity increases 0.4% to 347 yuan/gram on the Shanghai Gold Exchange; vols. were 3,541 kg yesterday vs. 4,227 kg on Nov. 20

(PTI) -- Reliance Money targets Rs 2 trillion gold market with new plan targeting an estimated Rs two lakh crore unorganised (rpt) unorganised gold market in the country, Reliance Money today launched a new daily gold accumulation plan under which customers can invest as low as Rs 1,000 per month. Under the plan, named Reliance My Gold Plan, the customer can invest a minimum of Rs 1,000 per month and the company would use the money for purchase of gold on a daily basis and the total accumulate funds can be redeemed for gold coins or jewellery at the end of the investment tenure.

The plan was launched here today in association with the World Gold Council as its marketing partner.

(Bloomberg) -- Reliance Money, World Gold Council Start Gold Investment Plan

The plan allows for a minimum investment of 1,000 rupees, says Vikrant Gugnani, chief executive of broking and distribution business at Reliance Capital Ltd.

Investors can opt for investment period of 1 to 15 yrs, Compulsory delivery of physical gold, no transaction tax.