Earlier this week I laid out very specifically what the key break points were. One item I wrote in particular was:

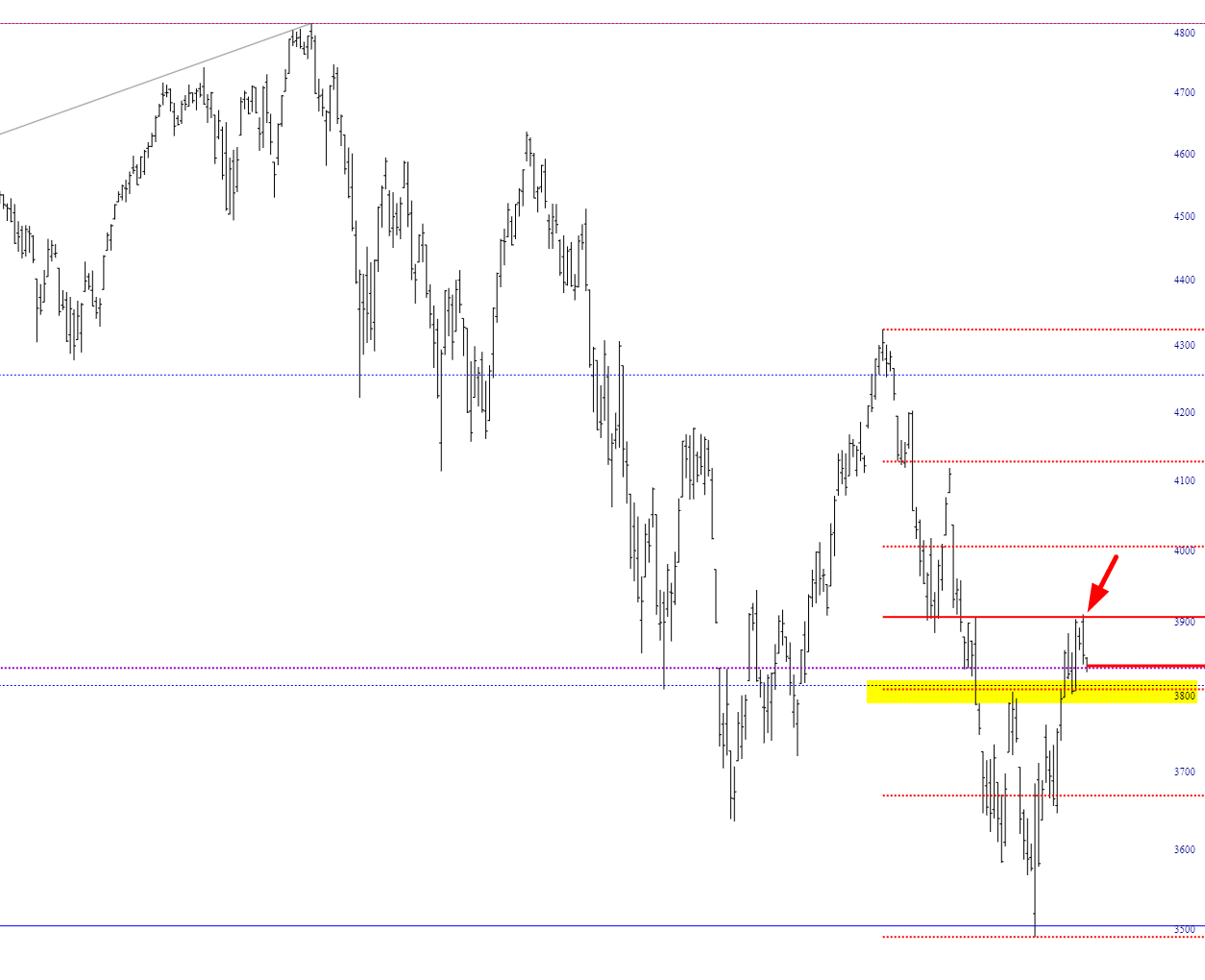

The S&P 500 has been amazingly Fibonacci-friendly this year. There are actually three Retracements drawn below, which for me is incredibly cluttered, but I’ve made an exception. As the arrow shows, the did a perfect 50% retracement of the August 15-October 13 plunge. If we push past that, the bulls are just going to keep winning. On the other hand, there are THREE Fibonacci retracements that would fail if we get below 3800, so that would be a massive victory for the bears if we can get below that Big Round Number before this week is over.

Here was the situation at the time:

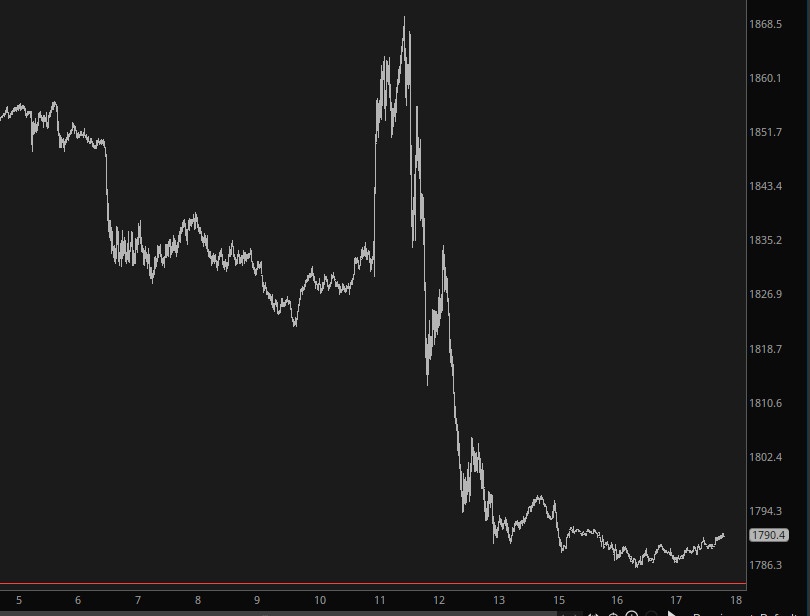

Well, never did I dream things would go as splendidly as they did on Wednesday.

- The red arrow perfectly marked the top;

- We cut through the supporting trendline that I pointed out in the premium post;

- We blasted through both of the Fibonacci retracement levels

All assets fell across the board, and the Dow respected their descending trendline beautifully.

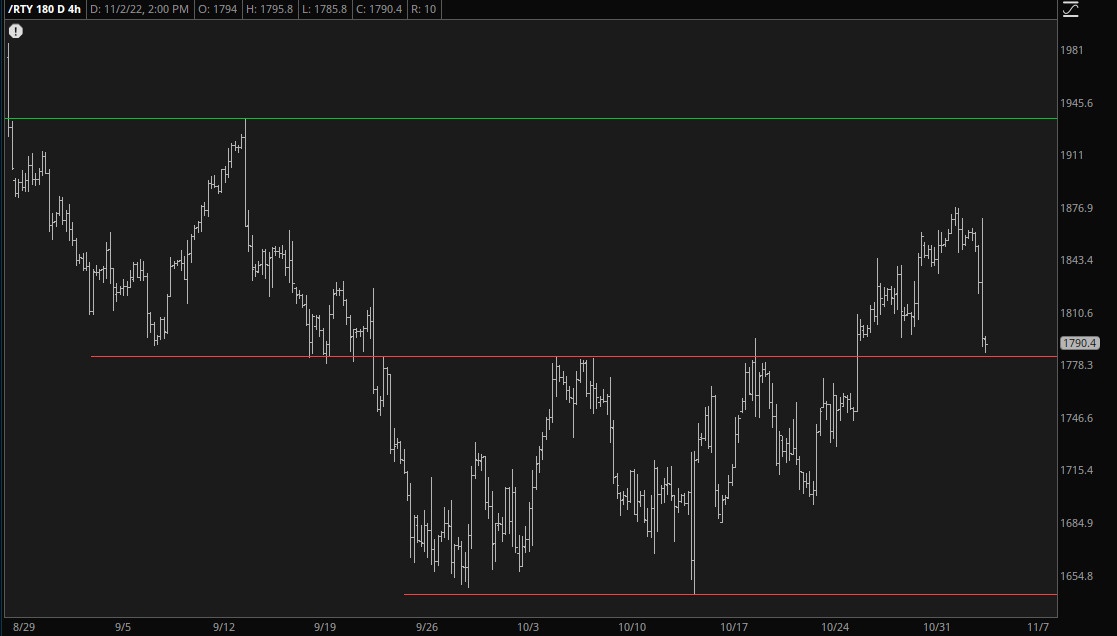

Now, as I look at the small cap futures (RTY), they are skimming just above a red horizontal.

The aforementioned line is critical, because it constitutes the breakout for the small cap. Until this breaks, the only thing accomplished by Wednesday’s swoon is that the bulls successfully tested the breakout from the bullish base. What I’d prefer to see, as I’m sure you can guess, is a breach of this level, either today or Friday. That will nuke this pattern.

Wednesday was a tremendous gift, and I hope we have to give very little of it back. The biggest ally the bears have right now is that Bear Force One launches in the early hours of Friday morning.