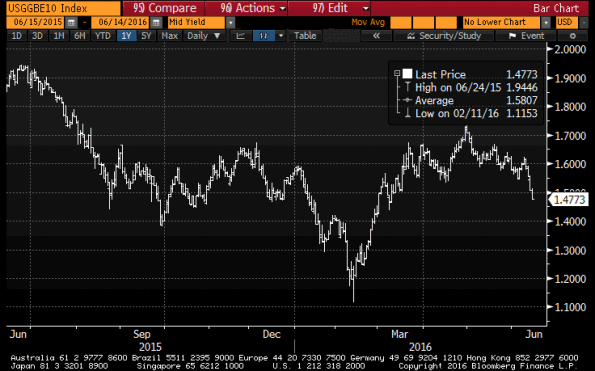

Some days – well, on days like yesterday, and for the last few before – it seems like there are far too many TIPS. Although energy has slipped only mildly, and (let’s not forget!) core and median inflation are both over 2% and rising, yesterday 10-year breakeven inflation fell to only 1.48%, the lowest level since early March (see chart, source Bloomberg).

The panicky-feeling downtrade is exacerbated by the thin risk budgets on the Street in inflation trading. From an investment standpoint, with inflation over the next few years highly likely to exceed the current breakeven rate (unless energy prices go to zero, or median inflation and wages abruptly reverse their multi-year accelerations), investors who buy TIPS in preference to nominal Treasuries (which is the bet you’re putting on in a breakeven trade, but works from a long-only perspective as well) are likely to outperform unless US inflation comes in below, say, 1.25% for the seven years starting in three years. And even if inflation does come in below that, the underperformance will be slight in comparison to the potential outperformance if inflation rises from its current level. TIPS don’t continue to underperform worse and worse in deflationary outcomes; their principal amounts are guaranteed in nominal terms.

But that doesn’t help at times like these. We have to remember, core inflation has been below 3% for twenty years. There are people in college today who have never seen core inflation with a 3-handle, and a generation of investors who have never had to factor the possibility of higher inflation into their calculations. (See chart, source Bloomberg).

If that seems incredible, then consider that it may be even more incredible to ignore inflation-linked bonds at these levels even if you think inflation will stay low! Core inflation has not been lower than 1.9% compounded, over a ten-year period, since the 1960s. Even trailing 10-year headline inflation, which is currently 1.73% only since Crude Oil is -35% over the last ten years (remember all of the smack talk about how the Fed should stop focusing on core inflation since energy was no longer mean-reverting?), hasn’t been as low at 1.5% for an entire decade since 1964, and hasn’t been below 1.25% since 1942.

But prices at any moment are about supply and demand, and there are about $1.27trillion in TIPS outstanding right now while investors struggle to remember what 3% inflation felt like.

I am here to tell, though, that there is a terrible shortage of TIPS.

So we know the supply number. About $1.25 trillion, and only $310bln is over 10 years in maturity. Not all of that is float, mind you – many of these bonds are held as long-term hedges by investors who know better. We don’t have to add corporate inflation-linked bonds (ILBs), municipal ILBs, or infrastructure-backed ILBs, because the aggregate outstanding of those markets is rounding error.

How about demand? Let’s tick off some of the inflation exposures that exist institutionally, which admittedly completely ignores demand by individual investors (who are also inflation-exposed by nature).

- Total US endowment and foundation assets: ~$1 trillion as of 2013 (latest I have handy)

- Endowments and foundations’ liabilities are almost wholly inflation-sensitive

- Total US pension fund assets: ~$16 trillion

- Most pension funds in the US don’t have COLAs, but they still have large exposures to inflation if they still have employees earning benefits

- Insurance companies: exposure to inflation in 125mm workers’ compensation policies covering $6 trillion in wages, and very long-dated to boot

- Post-employment medical (OPEB) benefits liabilities: $567bln as of 2014, for US states alone (that is, ignoring corporate OPEBs)

- OPEB exposures are completely “real” exposures, as I illustrated some years ago in a paper for a Society of Actuaries Monograph.

I will stop counting here. I didn’t have to look very hard to get inflation-linked liabilities that are a multiple of available ILB supply – and a very large multiple of long-dated ILB float. I am sure someone will complain that I left something out, or have old data, or something…but this isn’t an accounting class: I am just pointing out orders of magnitude. And, by an order of magnitude, there are not enough TIPS to go around if investors decide that inflation is a salient risk.

But if there is already such an imbalance, then why don’t TIPS trade as if there is a shortage? For the answer, we go back to the chart above. The people managing these liabilities (and you may be one!) haven’t had to worry about inflation exposure for a very long time. To the extent that savvy institutional investors buy TIPS, they dislike them because the nominal and real returns are awful. Therefore, they seek to replace these bonds with other real assets which may provide some protection if inflation rises. Among these are commodities – which are also loathed at present – as well as illiquid assets like real estate or private equity.

I have had insurance company risk managers say to me, “we cannot own enough TIPS to matter if inflation rises to a level that would concern us, because the return if inflation does not rise is so horrible. And, in fact, our hedge ratio would probably be above 100%.” I am not sure that is a great excuse to do nothing at all (and we try to help them square that circle) but I present the comment to give some notion of the mindset.

The mindset will change. It will not change overnight, probably, but when inflation exceeds 3% and then starts the assault on 4%, it will change. And then, abruptly, it will all too obvious that a trillion in TIPS doesn’t go as far as you think.

Editor's Note: Michael Ashton’s new book What’s Wrong With Money? The Biggest Bubble of All has been published by Wiley and is available from booksellers in hardback and e-book formats. You can also find it here. The book concerns the functions and weaknesses of money, the likely trajectory for inflation, and how investors can invest in an ‘inflation-aware’ way.