Fed rethink

It’s been a solid start to the year for the US economy. Economic growth is running around 2%, the housing market has staged a stunning recovery, and the jobs market remains in good shape. In addition, inflationary pressures have started to cool off, albeit at a relatively slow pace.

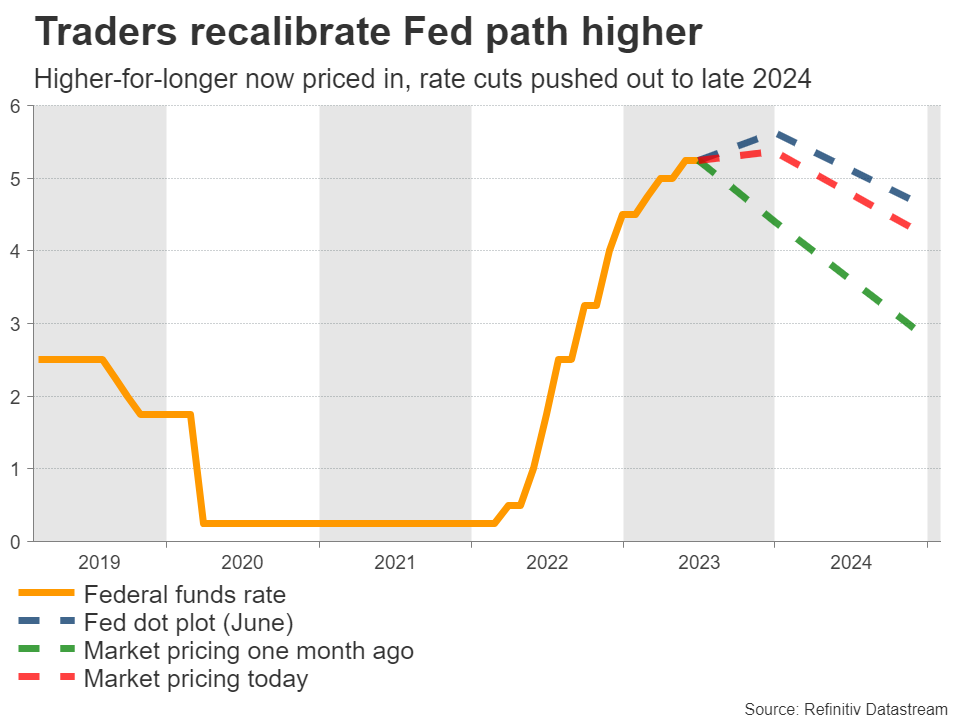

With the economy so resilient, investors have priced in a higher-for-longer scenario for interest rates. Market pricing suggests the Fed will raise rates once again by September, with a second rate hike beyond that seen as a coin toss. Most importantly, the timing of any rate cuts has been pushed out into the second half of 2024.

In other words, recession concerns have melted away and traders increasingly believe inflation might prove to be persistent, forcing the Fed to keep policy tighter for a longer period. The striking part is that the dollar could not capitalize on this narrative shift and has instead languished for most of June, as the central-bank-infused strength in the euro and sterling clipped its wings.

Slowdown in nonfarm payrolls?

Turning to this week’s events, the ball will get rolling on Wednesday with the ADP jobs data, ahead of the minutes of the latest FOMC meeting. We’ve heard from Chairman Powell multiple times lately, so the minutes are unlikely to contain any revelations. Then on Thursday, the ISM services survey will be released, before all eyes turn to the official employment report on Friday.

Nonfarm payrolls are forecast at 225k in June, less than the previous month but still a healthy number overall, consistent with continued tightening in the labor market. The unemployment rate is projected to decline back to 3.6%, while wage growth is anticipated to cool slightly in yearly terms to reach 3.6% as well.

As for any risks, most early indicators point to some softness in June. Business surveys revealed the weakest employment growth so far this year, something reaffirmed by the ISM manufacturing index. Meanwhile, initial jobless claims rose during the month, although not much.

The ADP report and the ISM non-manufacturing index will provide further clues as the week progresses, but with the indicators we have seen so far, there is some scope for a slight disappointment in the employment data.

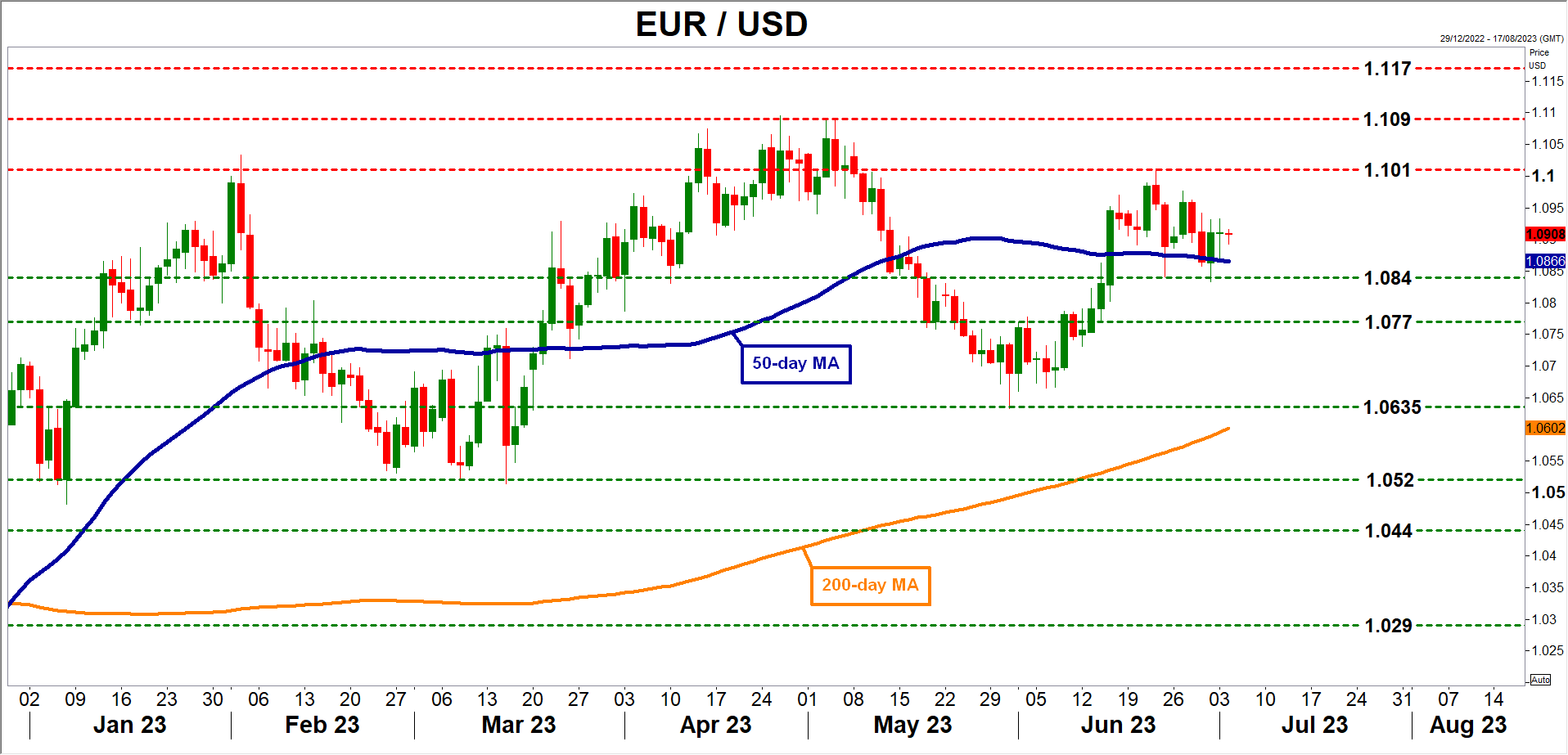

If indeed nonfarm payrolls come in slightly below projections, the dollar could absorb some damage. Looking at the euro/dollar chart, the first major barrier on the upside might be the recent high near 1.1010.

On the flipside, a surprisingly strong employment report - particularly on the wage front - could breathe some life back into the dollar as traders price in higher odds of another rate increase beyond September. In this scenario, euro/dollar could edge lower, perhaps to retest the 1.0840 region.

What’s next?

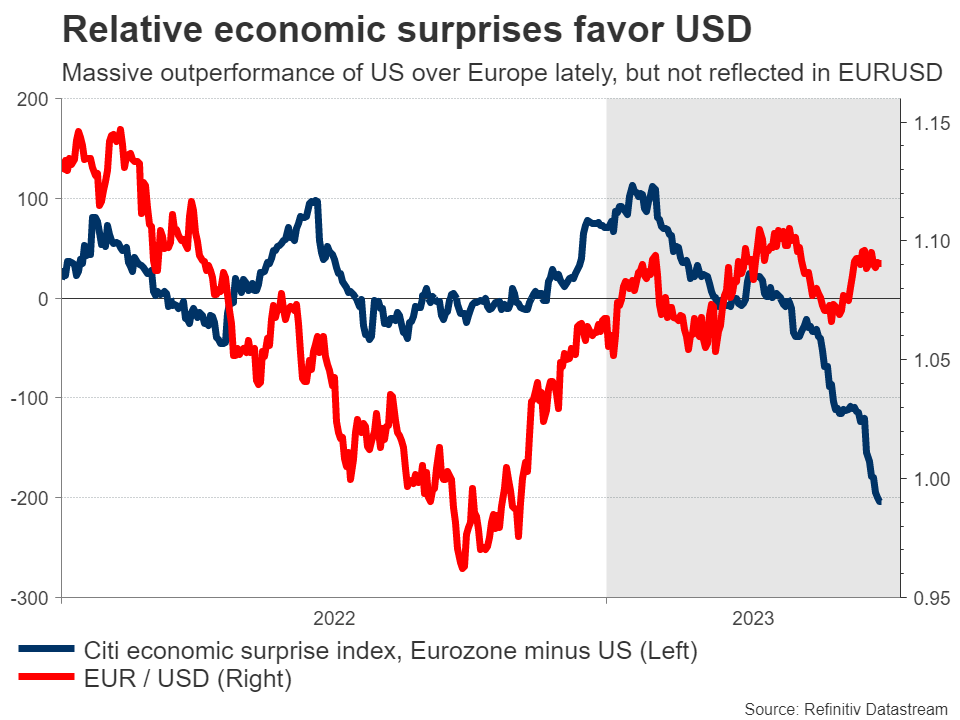

Looking beyond this week, the outlook for the dollar seems quite favorable. It boils down to relative economic performance, as the US economy is far superior to the Eurozone’s, and this gap could widen further amid warnings from business surveys that the European economy is headed downhill.

Another element that can help the dollar recover is risk appetite. With stock markets staging a furious rally lately, demand for safe haven instruments has suffered a major blow. If this euphoria calms down and there’s a correction in riskier assets later this year, the dollar could finally attract some defensive flows.

In short, the US economy seems like the cleanest shirt in a dirty laundry basket globally. That might allow the dollar to shine as other economies lose steam, particularly if risk aversion returns to global markets.