I often find myself repeating this message but the more I do, the more it seems to sink in. The noise is getting louder out there and it could be quite harmful. Why is that? Because the future is so uncertain, and when we have the media, pundits, experts, analysts all claiming they can predict the next market move - well, I just have to turn down the volume. The markets will ALWAYS tell us the next move.

These reminders are always important but more so at this very moment, because so much is coming that could seemingly derail this market. I won't ever try and predict or anticipate what will happen with markets, I'll leave that to the market timers who are like broken clocks (they are right twice a day).

But where most are struggling is length of this bull market and not being hit hard when it ends. Again, another market timing call. The devastating financial crisis is still fresh in everyone's head and if you had the courage to add down there in 2009 or just stayed with your trades you are probably far better off or at worst near even. Yet, with all of the reasons/excuses surrounding this massive 5+ year bull run there is nobody who wants to be left holding the bag if/when the market takes a nosedive. Remember 2007? We hit all time highs at a time of great vulnerability, but very few saw the warning signs. Fixes and corrections were made to the banking/lending system to seriously challenge whether that sort of crisis would repeat, but you never really know. A story for another day.

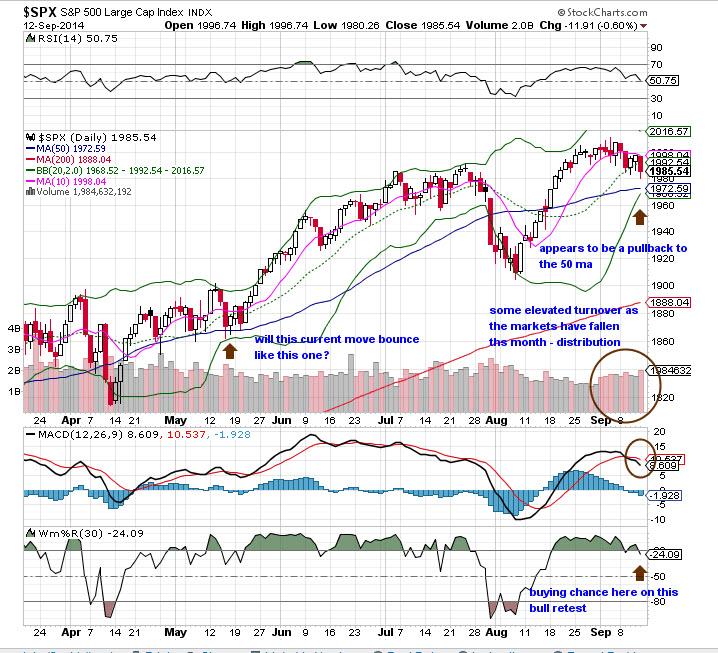

So, currently we have a market that exceeded some extreme levels in price action, 'hung around' for a bit and after a fantastic August and is correcting in price and time. That's not a bad situation and likely gives some a chance to get set up for a big end of year run (see chart below). Heck, if you didn't know it the SPX 500 is still up solid for 2014. With the talk of all the 'events' upcoming - the Fed meeting, Alibaba IPO and this or that, we have an economy that is growing modestly with little inflation, productivity is strong, consumer sales are starting to flicker some life and banks have started to lead again.

Housing is still a drag on the economy. But after a tremendous month, isn't the market entitled to a rest? Does a down week or month mean we 'stick a fork in it'? Of course that's not the case.

As for sentiment, worries still abound on the geopolitical crises across the globe, but unless you are using that as a selling excuse, there is not much to be done (which is interesting, because every time the market had come down of late following some news overseas it quickly rebounded - that seems to have changed now, when news hits the market doesn't blink). After reaching some pretty negative extremes a month ago the sentiment has become much more sanguine. The market structure is still healthy though a bit wobbly after a few distribution days. We'll have to see how things shake out the rest of the month but for now players are showing some caution - and when that 'wall of worry' is up there is no better condition to go higher.