Friday night’s NFP report missed headline expectations, strengthening the stance of Fed doves uninterested in a September interest rate hike.

USD Average Hourly Earnings m/m: 0.1% v 0.2% expected.

USD Non-Farm Employment Change: 151K v 180K expected.

USD Unemployment Rate: 4.9% v 4.8% expected.

(The August 5 release was also revised up to 275K from 255K.)

A close miss, but a miss none the less. And in an environment where hawks were looking for a stellar number, I don’t think this is going to be good enough for a September hike.

I can’t seem to find it behind a paywall now, but I read a NYT piece during my morning commute that said something like ‘while the NFP number missed it’s headline expectation, it was close enough to allow US traders to head to the Hamptons for the Labor Day weekend.

Wouldn’t that be nice…

Normally I’m all about identifying opportunity heading into a news release and then using the re-pricing that follows to collect home run type trades. In Friday’s blog however, we identified the fact that there would most definitely be action aplenty surrounding the release and had this to say about taking a trade into it:

“Tonight’s release is going to have major implications to both the long and short side. This isn’t the type of release that has a clearly overstated bias that is set up for disappointment in one direction. For me here, trying to pick a direction with the risks on both sides of the market as they are, just isn’t worth it.”

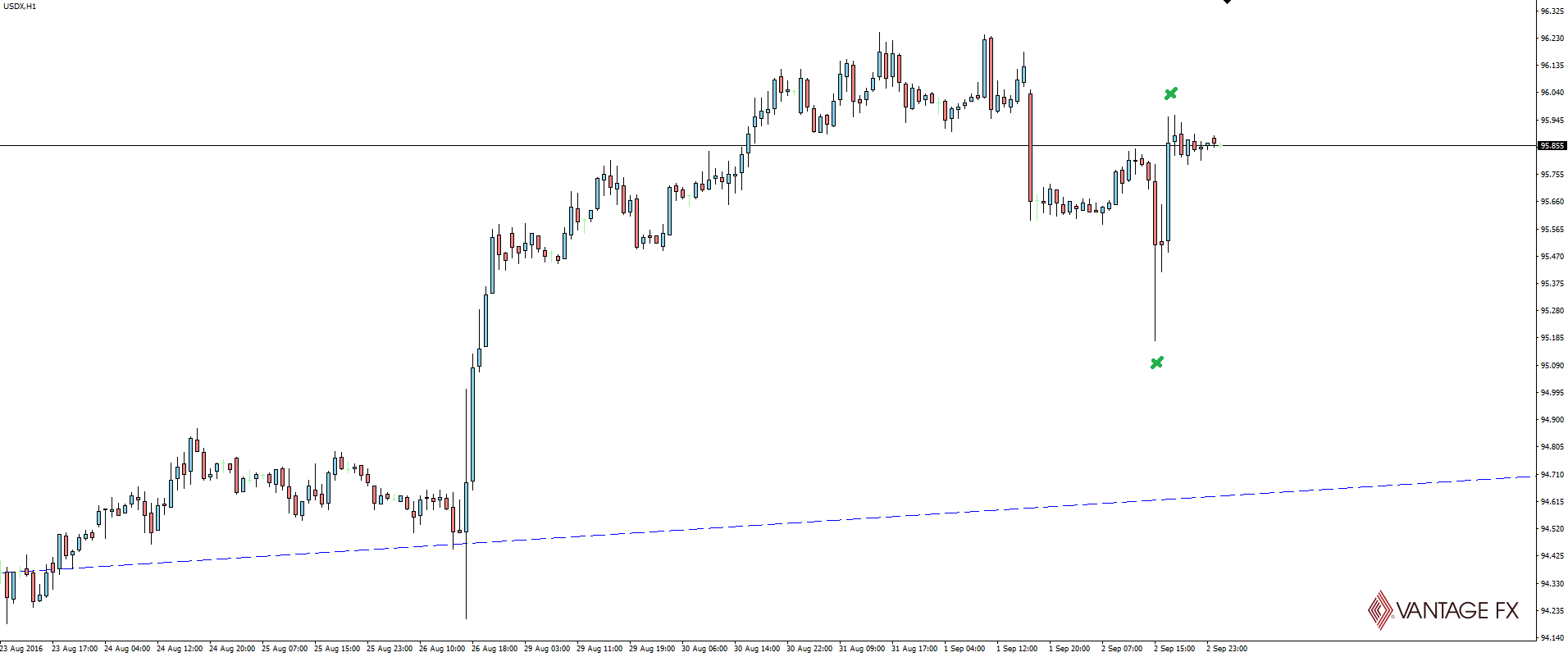

US Dollar Index Hourly:

Look at that spike!

That’s price action from a confused market and completely justifies the caution shown.

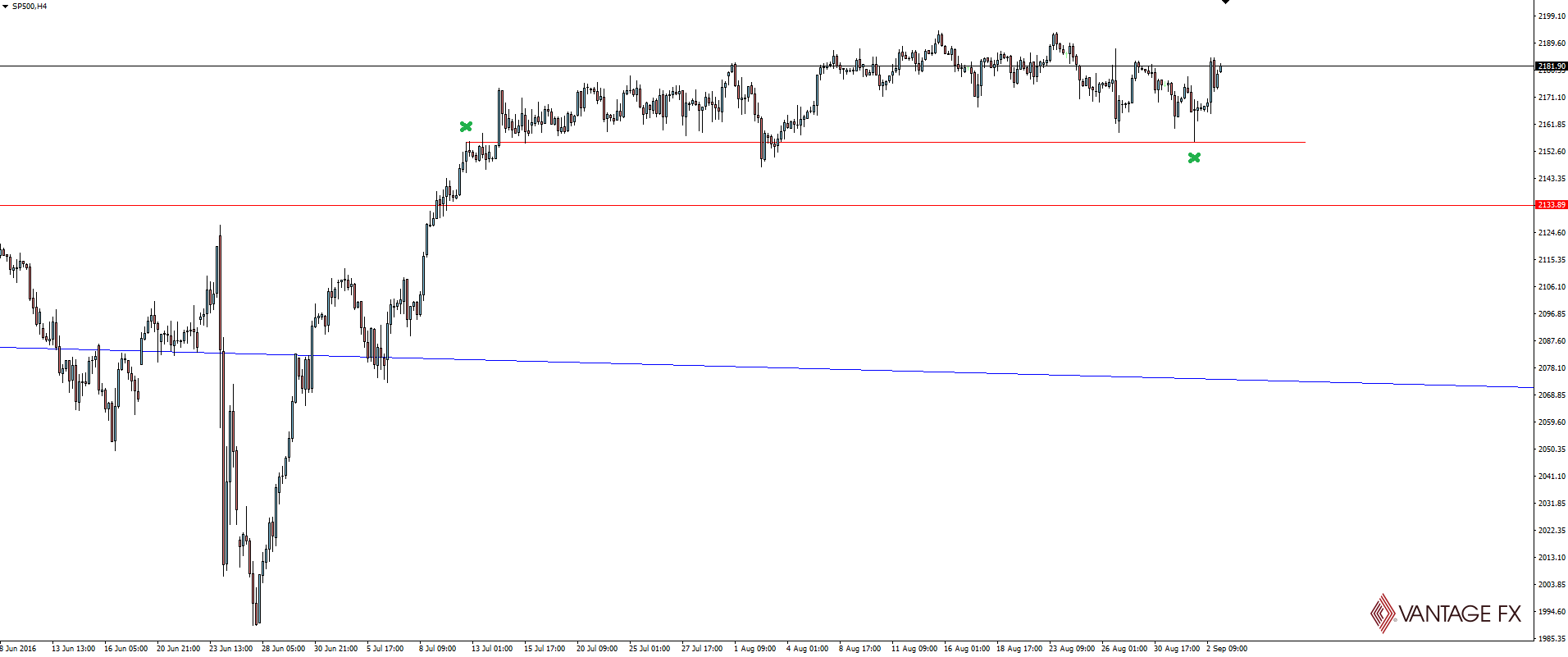

S&P 500 4 Hourly:

I also had to include this S&P 500 chart for the indices traders that love the way their markets respect levels.

So clean!

Today’s trading will be dominated by G20 meetings and the Labor Day holiday in the United States and Canada. US holidays that fall on a Monday always seem to have a flow on effect to Asian trade that starts the week, so be aware of the likely liquidity issues and lack of momentum behind moves.

If you’re in the US or Canada, enjoy your day off and see you back here tomorrow!

On the Calendar Monday:

ALL G20 Meetings

JPY BOJ Gov Kuroda Speaks

GBP Services PMI

CAD Bank Holiday: Labor Day

USD Bank Holiday: Labor Day

“Labor Day in the United States is a public holiday celebrated on the first Monday in September. It honors the American labor movement and the contributions that workers have made to the strength, prosperity, and well-being of the country. It is the Monday of the long weekend known as Labor Day Weekend and it is considered the unofficial end of summer. The holiday is also a federal holiday.”

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.