Another fortnight, another drop in dairy prices. The reality for the Kiwi dollar is beginning to look bleak as billions are wiped off the export receipts column of the current account ledger. Can a recession be avoided? And how deep will the RBNZ cut rates?

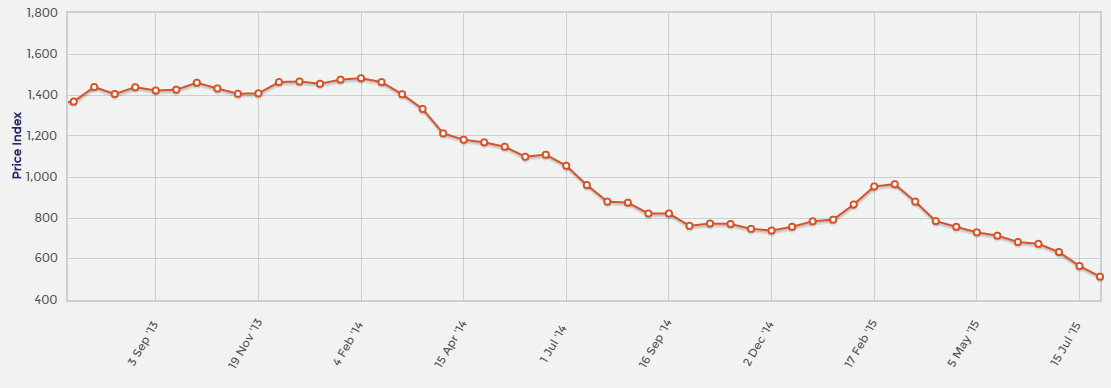

The latest news out of New Zealand in the last 24 hours will not help RBNZ Governor Graeme Wheeler sleep at night. Firstly the Global Dairy Trade held its fortnightly auction, which returned another blow to the New Zealand economy. The result of -9.3% comes on the back of a fall of -10.7% two weeks ago and markets the 10th straight negative result. The dairy index has fallen from a peak of 1,482 in February 2014 to the current level of 514, a fall of 65.3%. At the peak, dairy accounted for 30% of New Zealand’s exports, so it’s easy to see how such a devastating price collapse will affect the economy.

Source: Global Dairy Trade

The second piece of news out for New Zealand was the unemployment rate which ticked up to 5.9% from 5.8%. This rate is has now lifted from a low of 5.4% back in November 2014. Digging deeper into the employment stats and the RBNZ may find a little solace. The participation rate fell from 69.5% to 69.3%, but this was largely due to immigration increasing at a faster pace than employment. This is merely a bright spot in an otherwise gloomy read.

Last week we saw a very worrying stat in the form of business confidence. The ANZ Business Confidence survey took a sharp dive from -2.3 to -15.3. The last time it was this low was back in April 2009 which is an ominous sign. It may take some time before we see these immediate indicators filter into the lagging ones like GDP, but when they do it could get ugly for the NZ dollar.

The RBNZ is expecting further cuts to come, and the market agrees, but there has been some debate on how big the cuts will be. Governor Wheeler has said large declines in interest rates predicted by some could only occur if the economy moves into recession. This was before the latest figures and if they continue on their track, a recession will no doubt be lurking in the shadows and stalking Governor Wheeler. It may take a quarter or two, but growth cannot be sustained given the tumbling dairy prices and then we will see the deep cuts the market is predicting.

The New Zealand economy has suffered several shocks in the last 24 hours and importantly it was the large export sector than once again bore the brunt. It may take some time, but New Zealand will likely slip into recession and the RBNZ will be force to cut interest rates sharply.