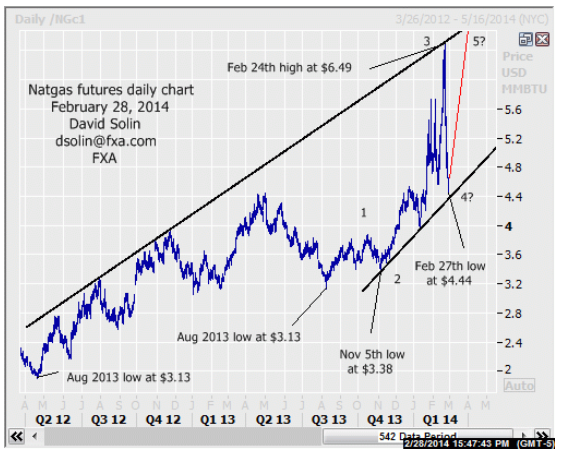

Volatile trade in natgas futures over the last week, surging to reach a high on Feb 24th high at $6.49 (a level not seen since Dec 2008, and also a test of the rising resistance line since Jul 2012) and before quickly reversing lower to reach $4.44 on Feb 7th (also the bullish trendline from Nov and 62% retracement from the Aug 2013 low at $3.13). With the upside pattern from the Aug low at $3.13 not yet "complete" (recent pullback seen as wave 4 in the rally from the Aug low), there is scope for gains back to the $6.49 high and even above ahead (within wave 5). At this point there is no confirmation of such a low "pattern-wise" so the confidence is not extremely high, while a clear break/close below that $4.34/44 support area would argue that a more important top is in place. Nearby resistance is seen at $5.44/49 (50% from the $6.49 high).

Strategy/position:

With some potential for gains back to that Feb 24th high at $6.49, it is recommented to stay long and buy here (currently at $4.61). Though, the confidence is not yet extremely high, a clear break/close below that $4.34/44 would abort. So from a risk/reward standpoint, appears a good opportunity, stopping on a close $.10 below that trendline from Nov. But will also want to get much more aggressive with stops on gains and especially a quick move back to the $6.49 high, as further upside may be limited (see longer term below).

Long term outlook:

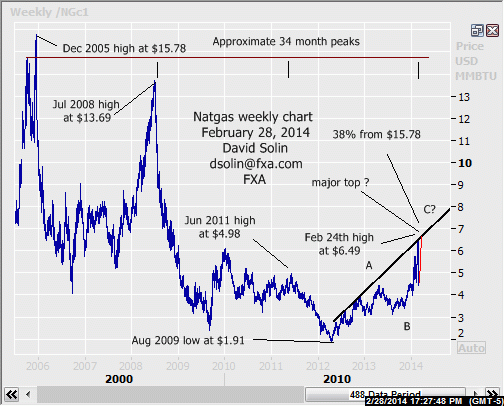

As discussed above, there is potential for another upleg back to the Feb 24th high at $6.49 and even above. But such a move may be quick, limited and before completing a more major top (and versus the start of a significant, new upleg). Note another move higher would be seen as the final upleg in the rally from last Aug (see shorter term above) and potentially the final upleg in the whole rally from the Aug 2009 low at $1.91 (A-B-C). Also, longer term cycle peaks have regularly occurred approximately every 34 months (see weekly chart/2nd chart below), with another top seen around this time. And finally, longer term resistance remains near that $6.49 high, with further long term resistance just above at $7.10/25 (38% retracement from the Dec 2005 high at $15.78), with adding to the risk that gains back to the $6.49 high and even above, may be limited.

Strategy/position:

Though there is potential for a quick move back to the $6.49 high, such upside would be seen limited and potentially completing a more major top. So instead of switching the bias to the bullish side, would be looking to switch to the bearish side on such a move higher ahead.

Current:

Nearer term : long Feb 28th at $4.61 for gains back to the $6.49 high (may be another quick move up).

Longer term : looking to short into a retest (and break) above the $6.49 high.