KEY DATA RELEASES TODAY (GMT) :

1100 GBP CBI Realized Sales exp 31 v 61

1330 USD Unemployment Claims exp 301K v 307K

1500 USD Pending Home Sales m/m exp 0.6% v 0.8%

OVERNIGHT:

Generally a lacklustre Asian session following last night’s FOMC statement which was undermined by positive USD sentiment resulting in a drift lower in G10 FX, a renewed decline in oil prices weighed and the Federal Reserve stating that it would remain “patient “on any rate increases failing to give risk sentiment a lift, as a result the USD looks poised to resume its grind higher.

The FOMC came out essentially as expected, with EUR/USD fairly subdued compared to past meetings. With crude oil and risk getting hit (Greek stocks down materially with 2 yr Greek yields up almost 3%) it makes sense to see EUR/USD and EUR/JPY down at current levels. Orderflows suggest more or less range bound action with bids down to 1.1200 and offers up to 1.1350/1.14

The NY session post-FOMC pushed risk sentiment lower, and USD/JPY (once again) traded back to the 117.20/30 support levels. Once again specs were caught off guard, with USD/JPY spiking back to a high of 118.10 after a flurry of reported real money buying coupled with short covering. Liquidity continues to own a significant premium in the JPY space, according to DTCC, there are lots of USD/JPY calls between 118.00-118.50 to expire towards the middle of the next week. Long gamma player’s supply cap USD/JPY 118.50/119.00 zone, expect momentum lower to accelerate below 117.00

GBP/USD traded to a high of 1.5220 overnight following the FOMC, before ultimately grinding down to a low of 1.5132 going into the NY close. Carney had a speech in Dublin overnight which could be interpreted as doveish for the UK as Carney highlighted the flagging Eurozone economy which is the largest trading partner with the UK. In addition to the deteriorating Eurozone, the next largest risk to the UK economy is the general election which is slowly approaching. The risk to GBP/USD is to the downside and shorts are favoured from better levels.

AUD/USD completely unwounded the post CPI move higher, currently challenging the yearly lows at 0.7850. USD/CAD printed new year to date highs as the oil decline continues to weigh on the CAD

Looking ahead US initial jobless claims will be on watch during the New York session

PRICE ACTION OVERVIEW:

EUR: 1.1450’s resistance eyed as 1.1220 supports near term

GBP: 1.5100 support area to target offers towards 1.53

JPY: Seven day 119 – 117 range, upside break targets 2014 highs

CAD: 1.26 next resistance, 1.2350 support for next leg higher

AUD: 0.80 rejects sharply for new lows, trend channel support .7750 eyed

KEY TRADES:

| FX Pair | Short Term | Position/Date | Entry Level | Target | Stop | Comments |

| EUR/USD | Neutral | Await new signal | ||||

| GBP/USD | Neutral | Short Jan 30 | 1.5125 | OPEN | 1.5275 | Intraday Signal |

| USD/JPY | Neutral | Long Jan 16 | 116.91 | OPEN | 116.91 | Intraday Signal |

| USD/CAD | Bullish | Await new signal | ||||

| AUD/USD | Bearish | Short Jan 29 | .7878 | OPEN | .7878 | Intraday Signal |

ANALYSIS:

EUR/USD Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks) Bearish

- While 1.1220’s support expect a test of 1.1460’s descending trendline resistance. Break of 1.1220;s suggests immediate continuation of down trend and a retest of Sunday’s lows

- Order Flow indicators; OBV continues ticking from recent lows, Linear Regression and Psychology bullish.

- Monitor price action at 1.1460 retest from below to set short positions to target 1.10

GBP/USD: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks) Bearish

- 1.5250 horizontal and trendline resistance eyed, support moves up to 1.5050.

- Order Flow indicators; OBV continues consolidating above recent lows, Linear Regression and Psychology pierce midpoints from below

- Shorts in play, see key trades for details

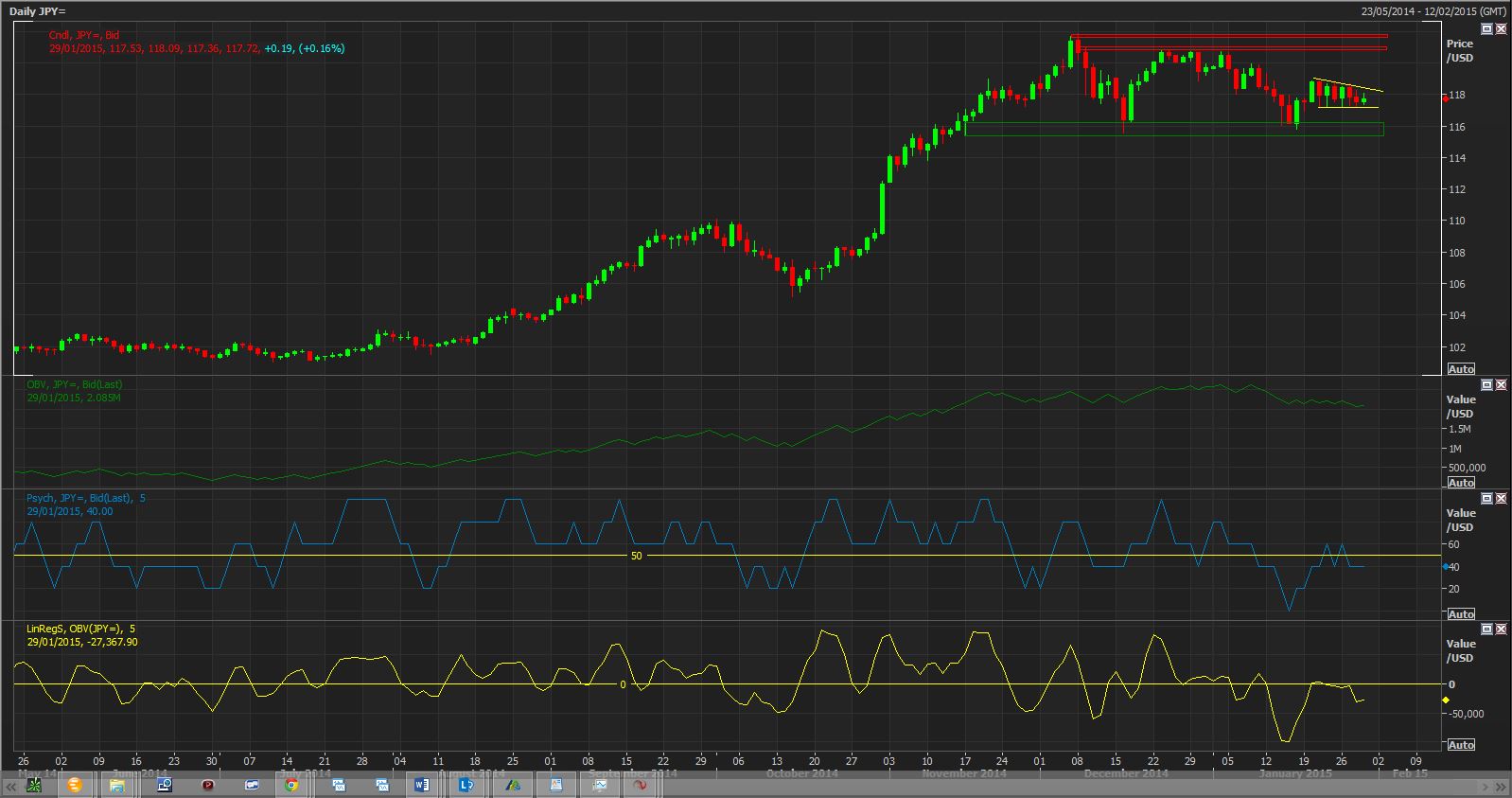

USD/JPY: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks) Bullish

- Seventh day of 117 -119 range, topside break initially targets 120 ahead of 2014 highs. Failure at 117 opens retest/break of key medium term bullish support at 116/115.50

- Order Flow indicators; OBV continue consolidating below recent highs, Linear Regression and Psychology rotating at midpoints reflecting range trade in price

- Risk free longs in play, please see key trades for details

USD/CAD: Short Term (1-3 Days): Bullish - Medium Term (1-3 Weeks) Bullish

- 1.25 resistance broken 1.26 now eyed, 1.2350 near term support, broad bullish trend remains intact above 1.2050

- Daily Order Flow indicators; OBV new highs, Linear Regression to test midpoint from above, Psychology bullish but pulling back

- Monitoring price action to reset long positions around 1.2350

AUD/USD: Short Term (1-3 Days): Bearish - Medium Term (1-3 Weeks) Bearish

- 0.80 rejected whith sharp reversal now targeting .7750 projected channel support

- Order Flow indicators; OBV back at lows, Linear Regression and Psychology stalling at midpoints

- Risk free shorts in play, see key trades for details