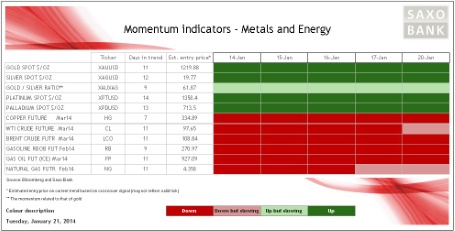

A sharp and exceptional split in short-term momentum between the energy and precious metal sectors is continuing into a second week. The four metals, led by platinum, are all among the top five performers this month while the energy sector holds on to negative momentum. Some signs of a break-up are now starting to emerge, with the recent recovery in both WTI crude and natural gas having the potential of a return to positive strength — but not yet.

Platinum is a distinct metal in terms of expectations for the year ahead, with the positive outlook driven by robust demand and worries over the reliability of supply. This has been highlighted over the past two days after the biggest mining union in South Africa called for strike action over pay on January 23. The platinum belt in South Africa is home to the world's three biggest platinum mining companies, and the area's output accounts for 70 per cent of global production (Bloomberg).

Gold and silver got an extra boost on the back of the rally in platinum. However, after rallying more than 3 per cent so far this January, key levels of resistance at 1,270 USD/oz and 20.65 USD/oz respectively are now blocking the path to further gains. Hedge Funds increased both long and short positions during the week of January 14, which highlights the general level of confusion as to where do we go from here. Further upside for now seems limited as we approach the next Federal Open Market Committee meeting on January 29, as it will return the focus to tapering while the slow but steady rise of the dollar also creates some headwind.

Brent and especially WTI crude oil are showing negative momentum, which has so far resulted in negative returns of 3 and 4 per cent respectively so far this January. Both are still expected to be rangebound as increased supply has the potential to be met by increased demand as the economic recovery, especially among OECD countries, takes hold. The International Energy Agency (IEA) has raised its forecast for global demand in 2014 and this is primarily being driven by the first pick-up in demand from OECD nations since 2010. Worries about the outlook for China after another surge in money market rates and weaker-than-expected economic data could have a negative impact on the country's expected rise in demand. This, together with a continual rise in US crude oil production should keep oil prices rangebound for the foreseeable future. WTI crude is expected to run out of steam between USD 94.87/barrel and USD 96/barrel, and this could prevent positive momentum at this stage.