McDonald's Corporation (NYSE:MCD) is set to report FQ2 2014 earnings before the market opens on Tuesday, July 22nd. McDonald’s has been a slow and steady stock for many years and has been a member of the Dow Jones Industrial Average since 1985. In recent years increased concern over obesity and related health issues have acted as a headwind catalyzing McDonald’s rebranding of itself, adding more healthy menu options including popular salads, yogurts, and oatmeal items. Here’s what investors are expecting from McDonald’s on Tuesday.

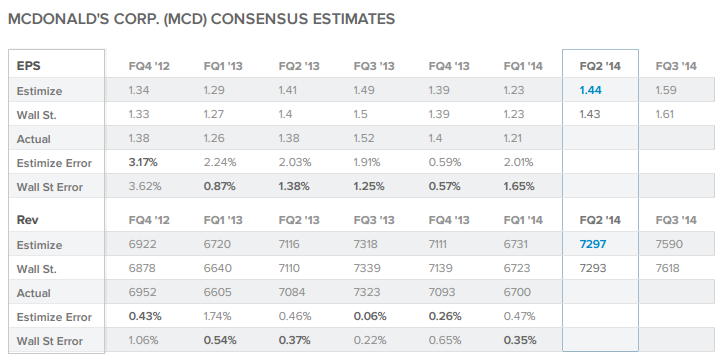

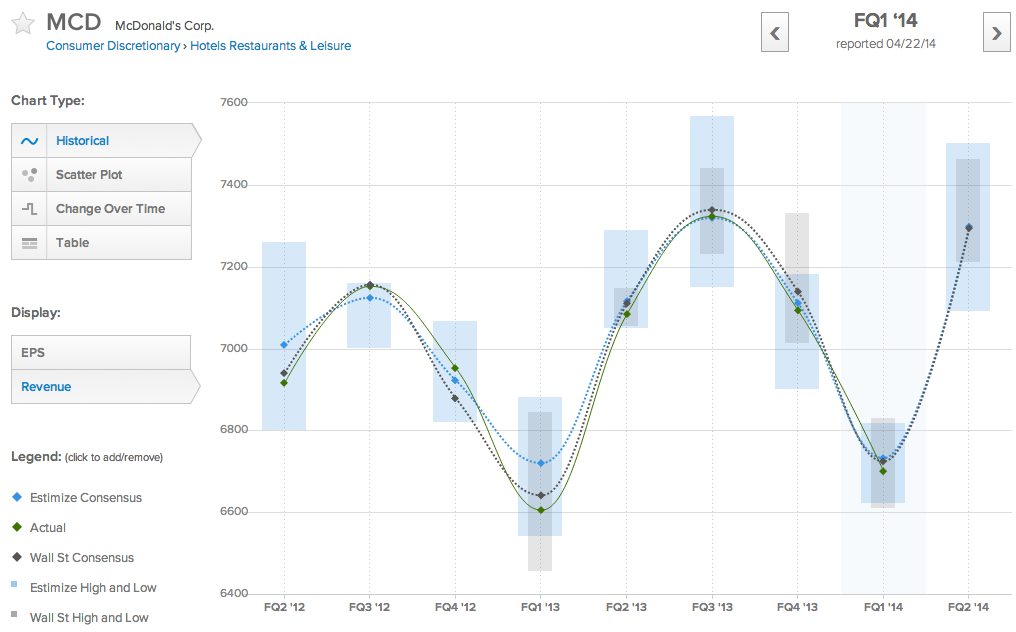

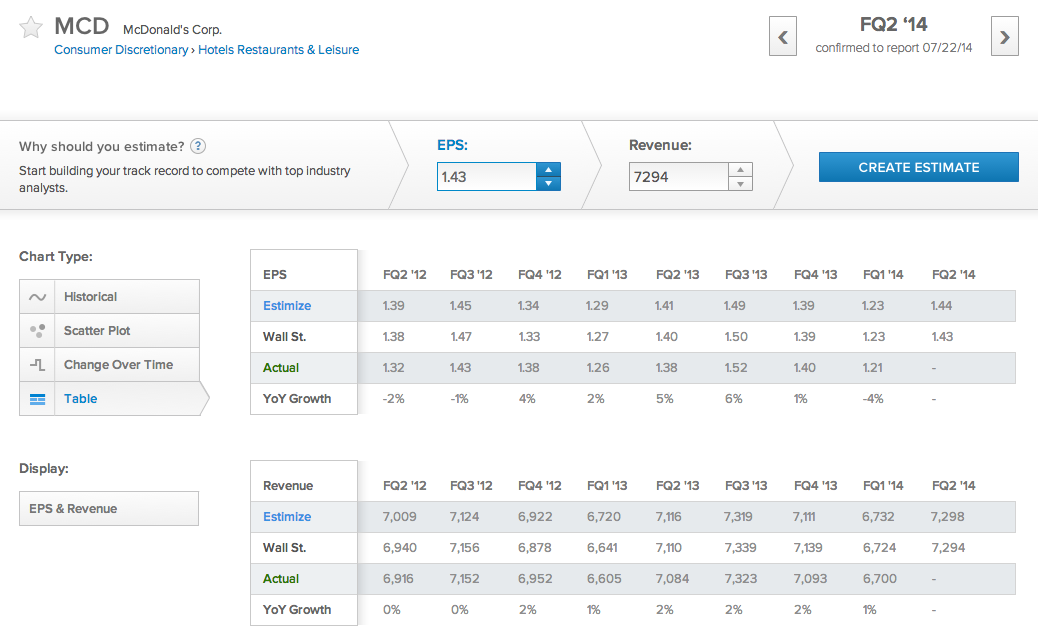

This quarter 27 contributing analysts on Estimize.com have come to a consensus earnings expectation of $1.44 EPS and $7.297B in revenue compared to a consensus of $1.43 EPS and $7.293B from Wall Street. This quarter contrbuting analysts on the Estimize.com platform expect McDonad’s to beat the Wall Street consensus by 1c per share and come in $4M ahead of revenue estimates.

Competition came gunning for McDonald’s last quarter and the golden arches missed earnings estimates from both Wall Street and the Estimize community. Notably and perhaps unexpectedly, Taco Bell (NYSE:YUM) declared a war on breakfast, rolling out a new menu featuring breakfast burritos and waffle tacos. McDonald’s still holds about a 30% share of the breakfast segment and will look defend its AM dominance this quarter.

Although McDonald’s is under siege in the breakfast wars, it’s throwing punches back too by offering promotions on coffee in an attempt to wrestle the morning crowd away from coffee shops like Dunkin’ Donuts (NASDAQ:DNKN) and Starbucks (NASDAQ:SBUX).

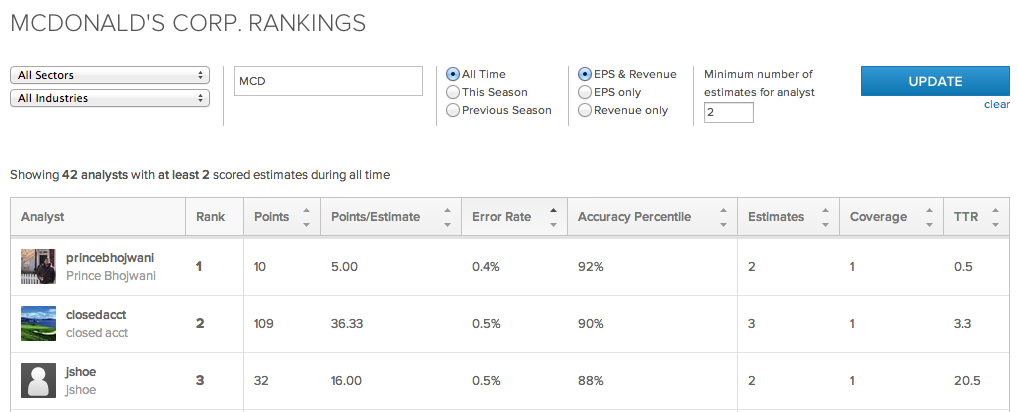

Estimize.com ranks and allows the sorting of analysts by accuracy, the analyst with the lowest error rate on McDonald’s is an information technology professional who goes by the username princebhojwani. Over 2 previously scored estimates on McDonald’s princebhojwani has averaged an impressively low error rate of 0.4%. Estimize is completely open and free for anyone to contribute, and the base of contributing analysts on the platform includes hedge fund analysts, asset managers, independent research shops, non professional investors, and students.

The Estimize consensus was more accurate than the Wall Street consensus 65% of the time last quarter on the coverage of nearly 1000 stocks. A combination of algorithms ensures that the data is not only clean and free from people attempting to game the system, but also weighs past performance and many other factors to gauge future accuracy.

Contributing analysts on the Estimize.com platform are forecasting that on Monday McDonald’s will report earnings a penny ahead of Wall Street’s EPS forecast and beat the Street’s revenue consensus by $4 million (