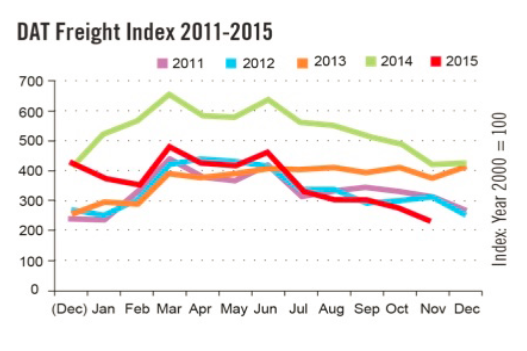

A chart of the DAT freight index posted on CCJ Indicators shows a huge, ongoing collapse in trucking shipments.

"Spot freight falls 15 percent: The amount of freight available on the spot market fell 15 percent in November from October, DAT reported last week. That dip is in line with seasonal trends, the online loadboard said. Year over year, however, freight volume fell 45 percent from November 2014. Van freight fell 2.9 percent from October, flatbed 39 percent and reefer 9.1 percent, DAT says."

Also note that in August, September, October, and November, shipping volumes were down compared to the same month in 2011, 2012, 2013, and 2014 except for the single instance of September 2015 vs. September 2012.

Not to worry!

“We expect conditions to improve as we move through the year as the market further prepares for tight truck capacity when the HOS, ELD, and speed governor rules are implemented over the next two years,” says FTR’s Jonathan Starks. “The main risk right now is the weakness in manufacturing and the high inventory levels. The inventory situation needs to be corrected before we are likely to get a sizable burst of manufacturing activity. Look for that to happen early in 2016.”

Sizable Burst of Unwarranted Optimism

Starks foresees a "sizable burst of manufacturing activity." He provided no reasons for expecting that burst of activity.

I suppose inventories will magically shrink or consumers will go on a record buying spree despite rising interest rates, a slowing global economy, unaffordable home prices, high and rising rent prices, and rapidly rising medical costs, the latter two rising much faster than paychecks.

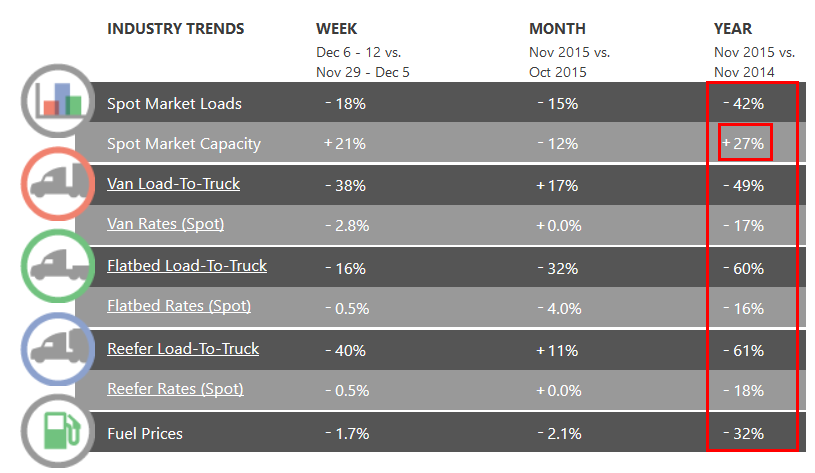

DAT Trendlines

In the above chart, courtesy of DAT Trendlines, the only thing up vs. a year ago is capacity to ship. That spells trouble in my book.

Finally, inventories are a very serious problem, not something that can be wished away.