Asian markets this morning are responding to the FOMC decision and interest rate guidance from Janet Yellen late yesterday. Asian markets are taking their clues from Wall Street with both the Nikkei 225 and the Australian exchange trading on a high note. With traders reacting positively to the Federal Reserve’s monetary policy announcement, US markets moved mostly higher over the course of the trading day on Wednesday. The strength on Wall Street came on the heels of the announcement from the Fed, which was largely in line with expectations. As was widely expected, the Fed announced its decision to reduce the pace of its asset purchases by another $10 billion to $35 billion per month. Regarding the outlook for interest rates, the Fed’s projections showed a slight uptick in expectations for rates at the end of next year, although mid-2015 remains the target for the first rate hike. U.S. stocks climbed lifting the S&P 500 to a record finish. Meanwhile, European stocks were narrowly mixed on Wednesday as markets paused for the latest interest rate announcement from the U.S. Federal Reserve. The Federal Reserve Bank slashed its forecast for U.S. economic growth to a range of between 2.1 percent and 2.3 percent from an earlier forecast of around 2.9 percent, but expressed confidence the recovery was largely on track.

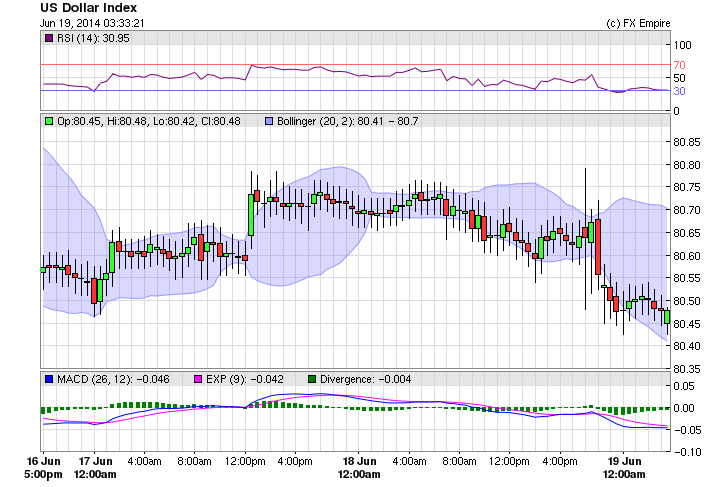

As Wall Street climbed the US Dollar eased to trade at 70.50 and remains in the red this morning at 80.48. Gold on the other hand climbed a bit and is trading at 1277.50. The euro gained to trade at 1.3592 this morning and the pound remains flat at 1.6993 as it tries to break the psychological 1.70 price level. The Bank of England policy makers said an interest-rate increase this year may be more likely than investors anticipate as the debate on the timing of the first policy tightening in seven years heats up. The euro traded on a positive note around 0.4 percent yesterday on the back of weakness in the DX. Further, upbeat global market sentiments in later part of the trade supported an upside in the currency.

The Japanese yen appreciated around 0.23 percent yesterday on the back of weak market sentiments in early part of the trade which led to rise in demand for the low yielding currency. The USD/JPY is trading at 101.92 and against the euro the pair is at 138.53 both remaining flat in the morning session.

The Aussie and the kiwi rallied immediately after the Fed announcements with the AUD trading above 94 and the NZD breaking the 0.87 price level. This morning the pair gave back a bit of those gains as investors booked profits. The Aussie is trading at 0.9398 and the New Zealand dollar is at 0.8714 after NZD GDP numbers printed a bit lower than forecast. Markets are expected to trade on a quiet note today with violence in Iraq being the most important factor.