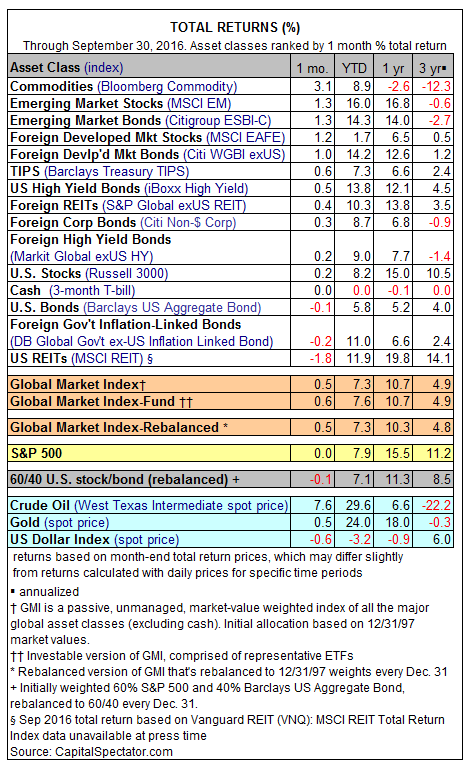

Broadly defined commodities led the way higher in September for the major asset classes. The Bloomberg Commodity Index climbed 3.1% last month, posting its first increase since June for the monthly comparison.

Overall, September was kind to most markets. The only losers: US investment-grade bonds, foreign inflation-linked government bonds, and US real estate investment trusts (REITs). Last month’s 1.8% loss for REITs left the asset class dead last among the major asset classes for the second month in a row.

For the year-to-date column, all the major asset classes are posting gains when measured in total-return terms. The big winner: emerging-market stocks. The MSCI Emerging Market Index is ahead 16% so far this year through last month’s close.

Meantime, the upside bias in September lifted the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI’s 0.5% total return marks the ninth consecutive monthly gain so far in 2016. Year-to-date, GMI is up a respectable 7.3%.